The U.S. short-term rental (STR) and vacation rental market will grow steadily by 2025.

The projected annual growth rate reflects a stabilization phase after the recent highs and lows. Increased property listings and market expansion mark this significant U.S. vacation rental industry growth.

With changing travel patterns, economic shifts, and technological advancements, the industry is finding balance and offering plenty of opportunities for stakeholders.

Below, we examine the current state of the STR market and provide insights into key metrics, challenges, and future possibilities.

What Are Short-Term Rentals and How Do They Work?

Short-term rentals (STRs) are accommodations rented out for temporary stays, typically lasting from a single night to several weeks. They are an alternative to hotels and give travelers access to more personalized spaces like homes, apartments, or rooms.

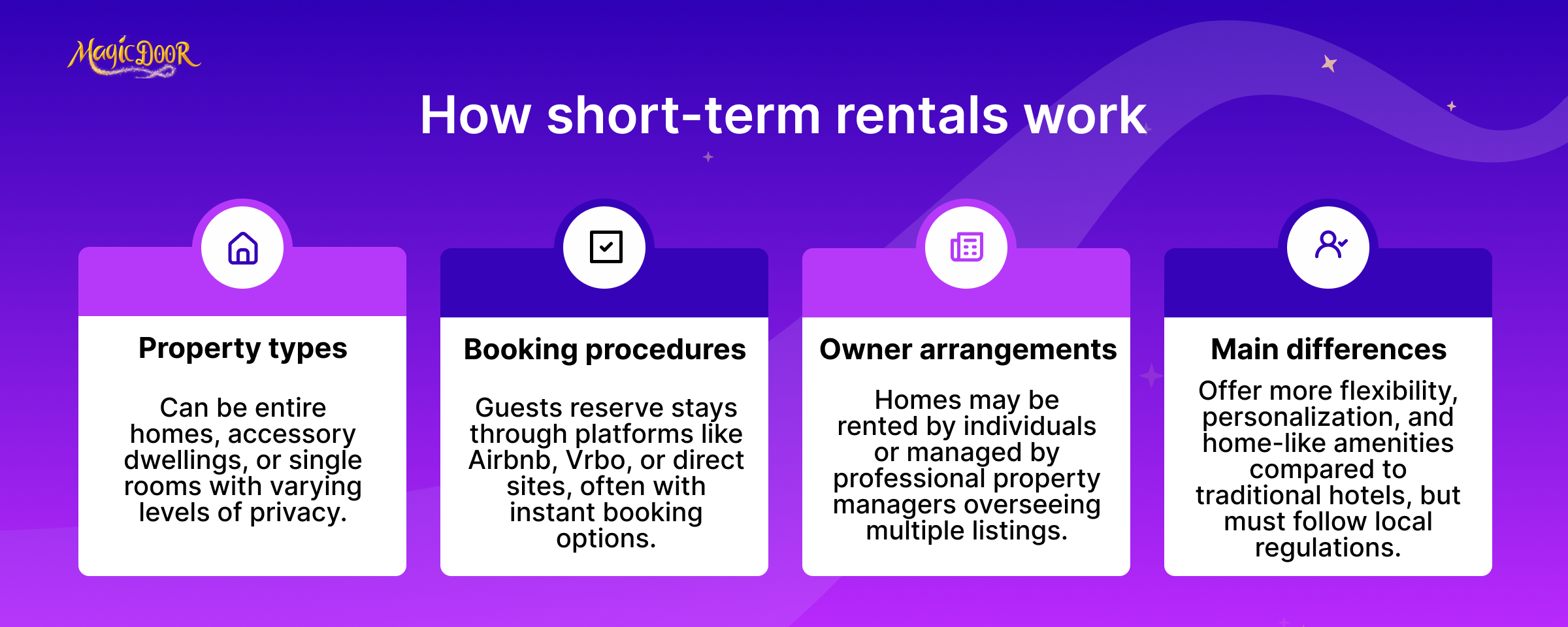

Here’s a general breakdown of how STRs operate:

STRs can range from entire homes to smaller spaces like accessory dwellings or individual rooms. The home market segment dominates the global accommodation market due to its large revenue share and cost-effective options compared to traditional hotels.

For example:

- Entire homes: These are fully private rentals where guests can access the entire property.

- Accessory dwellings: Detached units such as backyard cottages or guest houses.

- Single rooms: A room within a primary residence, often with shared amenities like a kitchen or living area.

Booking procedures: Travelers book short-term rentals through online platforms like Airbnb, Vrbo, or direct property management websites. Some listings support “instant booking,” which simplifies the reservation process.

Owner arrangements: STRs can be run by homeowners who occasionally rent out properties or by investors who manage multiple vacation rental units. The vacation rental business emphasizes the importance of accommodations and amenities in enhancing the travel experience and converting first-time guests into repeat customers. Depending on the model, owners might hire property managers to handle guest communication, maintenance, and bookings.

Several aspects distinguish STRs from traditional accommodation options:

- Flexibility: Guests find STRs appealing for their variety of locations and home-like amenities, such as full kitchens and laundry facilities.

- Personalization: Many listings offer unique characteristics, like cozy neighborhood vibes or spaces tailored to specific guest preferences.

- Regulations: Local laws govern how STRs operate, and rules vary by jurisdiction. Common requirements include licensing, tax registration, and rental day limits.

For guests, STRs create an opportunity to experience a “home away from home.”

Owners, meanwhile, benefit from additional income while maintaining flexibility in how they use their property. To enjoy a smooth experience, both parties must stay informed on local regulations and plan accordingly.

Market Growth and Performance

- The short-term rental industry in the U.S. is projected to reach $138.1 billion in 2025, up from $124.6 billion in 2024, expanding at a CAGR of 10.9% through 2037. This growth is attributed to heightened demand for unique lodging experiences, particularly among travelers seeking localized and personalized stays. The projected market volume indicates significant anticipated growth, highlighting the industry’s expected monetary value in future years.

- Demand for STRs is forecasted to grow by 6.8% in 2025, building on the rebound from 2024. This increase reflects eased inflation pressures, rising consumer confidence, and more substantial real incomes, boosting travel budgets. The average revenue per user is expected to rise, reflecting overall revenue trends within the industry.

- Occupancy rates, which had declined since their 2021 peak, are expected to rise slightly in 2025, stabilizing at approximately 54.9% by year-end. This marks a recovery toward pre-pandemic levels as supply growth slows and demand continues its upward trajectory.

- Average Daily Rates (ADR): ADRs will rise by 2.1% in 2025. This growth aligns with inflation adjustments and the introduction of premium listings, driving pricing power.

- Revenue per Available Rental (RevPAR): 2.9%, reflecting improved market equilibrium. The vacation rental revenue is anticipated to grow annually, providing insights into the market’s financial performance and highlighting the economic viability of vacation rental investments.

Current Market Trends in Short-Term Rentals

Growth Patterns in the US STR Market

The US short-term rental (STR) market has displayed dynamic shifts over recent years, shaped by evolving traveler preferences, economic changes, and regulatory landscapes.

While there has been notable progress, the growth trajectories have highlighted emerging opportunities and challenges for rental property managers and owners.

- Market value: The US short-term vacation rental market was estimated at $68.64 billion in 2024 and is projected to grow at an annual rate of 7.4% through 2030, reaching approximately $102.86 billion.

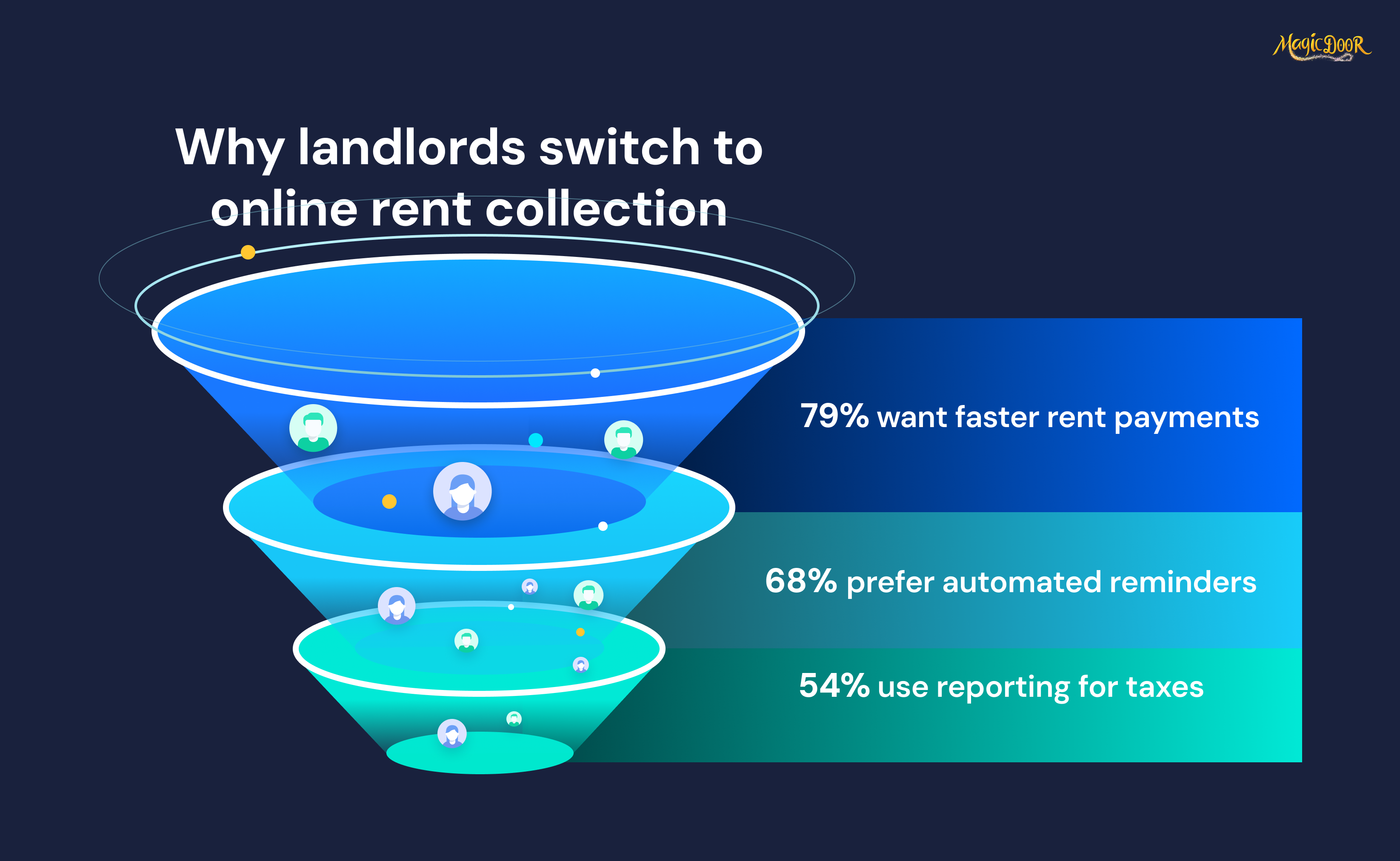

- Platform-based dominance: Online booking platforms dominate the market, accounting for over 95% of rentals booked. The ease of use, detailed property information, and secure payment options continue to attract modern travelers.

- Consumer demand: Increased preferences for unique stays and work-friendly properties have driven interest in this market. Many travelers now appreciate accommodations featuring flexible spaces, privacy, and amenities such as high-speed internet. The vacation rentals segment plays a significant role within the broader vacation rental industry, contributing to user growth, revenue generation, and overall market share.

- Remote work influence: The growth of remote and blended work (“bleisure”) has expanded the scope of STRs, making them appealing beyond traditional vacationers. Professionals seeking comfortable environments for both work and leisure have contributed to this growing trend.

- Diverse accommodations: With options ranging from urban apartments to idyllic cottages near coastal areas, STRs cater to travelers seeking both convenience and immersive local experiences.

- Host incentives: For property owners, these rentals provide a means of income diversification. Some use their earnings to offset housing costs or invest further in vacation rental businesses.

The vacation rental market size is segmented based on accommodation types and regional outlooks. Urban and coastal destinations reflect differing growth patterns:

- Urban rentals: Cities like New York and San Francisco maintain year-round demand, particularly from business travelers. Stringent local regulations, however, present operational complexities for hosts.

- Coastal properties: Destinations like Malibu and Myrtle Beach see spikes in summer bookings, reflecting seasonal trends and guest preferences for waterfront amenities.

While growth remains consistent, several market challenges merit attention:

- Housing shortages: Limited housing supply in some regions has led certain properties to shift from short-term rentals to long-term leasing.

- Inflation and costs: Rising labor expenses and maintenance fees impact STR operators’ profit margins. Hosts, particularly in high-demand areas, may face additional pressures to ensure affordability while maintaining quality.

- Bookings and pricing: Consumer behavior indicates a shift toward last-minute bookings. Guests capitalize on competitive rates as hosts adjust their pricing strategies close to arrival dates.

Seasonal Booking Trends & Demand Fluctuations

Short-term rentals (STRs) experience noticeable shifts in demand throughout the year, reflecting diverse guest preferences and external factors like weather, holidays, and local events.

Recognizing and responding to these trends is essential for optimizing occupancy and revenue for property managers and vacation rental owners.

Key demand drivers by season include:

- Summer peaks: Many families and travelers plan vacations during the warmer months. Beachside locations such as Myrtle Beach and the Hamptons often see the highest demand, with bookings surging for accommodations featuring outdoor amenities like decks or private pools.

- Fall getaways: Cooler destinations, such as mountainous regions, attract visitors seeking scenic foliage experiences. This shoulder season can be ideal for properties emphasizing cozy atmospheres, proximity to hiking trails, or niche local events.

- Winter preferences: From December through February, travelers frequently visit ski towns and other winter-focused destinations. At the same time, warmer urban locations like Miami often draw non-skiers who are escaping colder climates.

- Spring breaks: Families and college students are in charge of bookings during this period. Demand diversifies as travelers seek vibrant city stays, beachfront homes, or tranquil resorts in scenic regions.

Online sales are projected to account for 77% of total revenue by 2023, highlighting the increasing reliance on digital booking platforms. Trends show that many travelers prefer to find information and complete transactions online, thus driving revenue growth through online sales.

Certain destinations reflect notable seasonality:

- Urban areas: Cities maintain steadier demand year-round due to consistent business travel and urban tourism. However, large events or conferences can drive significant short-term spikes in occupancy.

- Coastal markets: Beachfront rentals experience their highest bookings in summer, often paired with increased nightly rates. Conversely, off-season discounts appeal to budget-conscious travelers in cooler months.

- Ski towns: Popular winter destinations often see a double benefit, peak demand in winter and a resurgence in late spring as snow melts, attracting hikers and other adventurers.

Broader circumstances also shape seasonal STR trends:

- Weather variability: Delays or extreme conditions (like hurricanes) can disrupt bookings in certain regions, significantly affecting short-term rental property managers in weather-prone areas.

- Holiday seasons: Christmas, Thanksgiving, and spring holidays create predictable spikes in vacation planning. Planning for these peak periods can enhance revenue while ensuring a seamless guest experience.

- Regulations affecting the market: Rules like limiting the number of rental days frequently impact seasonal availability in cities like San Francisco or New York, creating demand elsewhere.

To make the most of seasonal demand, aligning pricing, amenities, and marketing to suit guest expectations is vital:

- Dynamic pricing strategies: Adjust nightly rates to reflect high and low seasons. Properties in high-demand regions can particularly benefit from tailored pricing tools on platforms like Airbnb or Vrbo.

- Highlighting amenities: Promote season-specific features like fireplaces during winter or outdoor areas when summer heat draws visitors.

- Seamless booking options: Convenient, user-friendly reservation systems increase guest confidence, particularly when paired with flexible policies that accommodate last-minute plans.

Key States Dominating the Vacation Rental Market

- Supply growth, which surged in 2021 and 2022, has decelerated sharply due to high interest rates and elevated home prices. Supply is expected to grow more slowly than 4.7% in 2025, creating a more balanced landscape. Vacation rental property managers play a crucial role in managing significant rentals and adapting to market trends, leveraging technology, and adjusting pricing strategies to meet changing traveler behaviors.

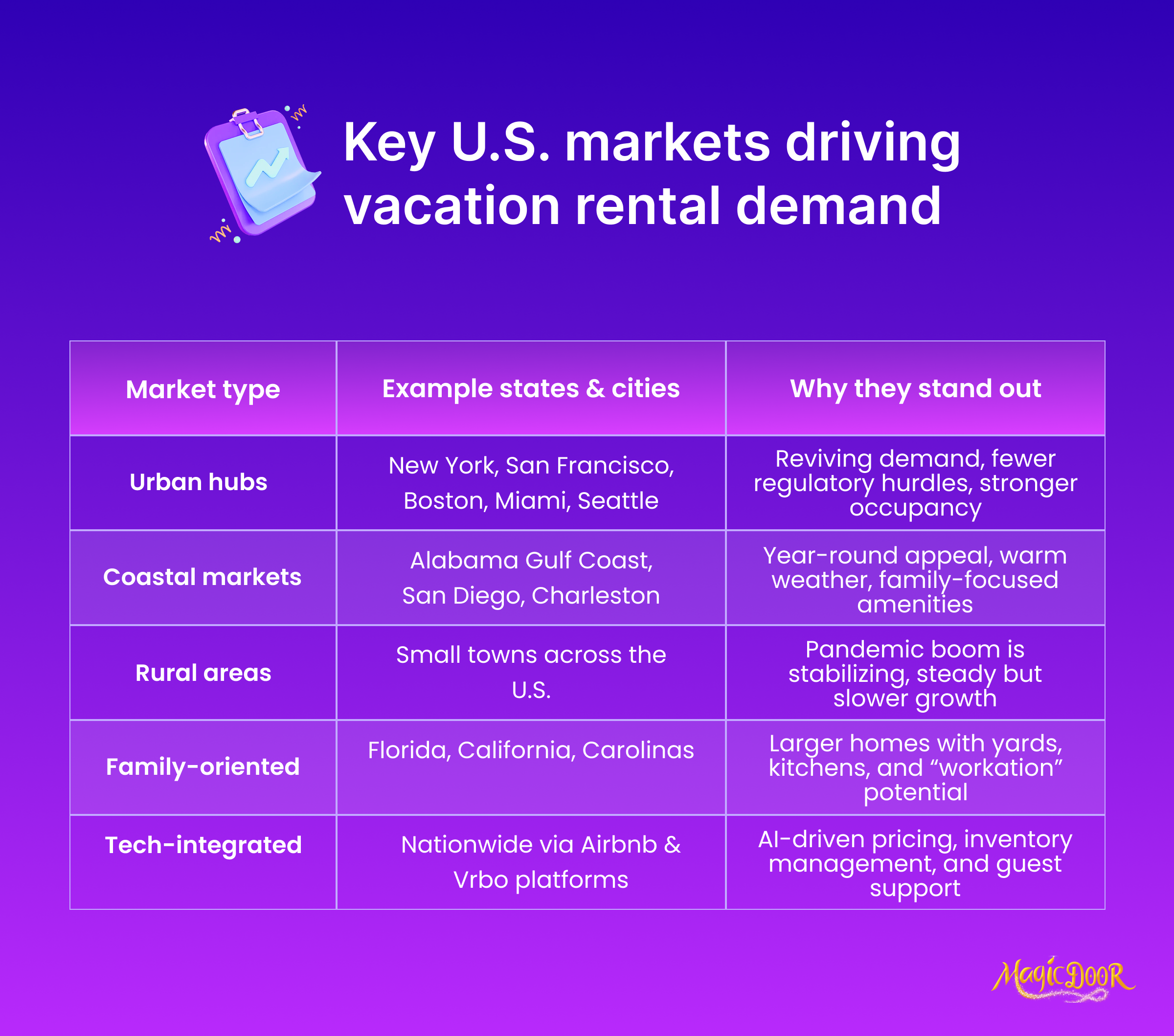

- Once constrained by regulatory challenges, urban markets like New York and San Francisco see moderated supply levels, allowing for modest occupancy gains.

- Post-pandemic travel trends favor short-term stays with personalized experiences. Guests prioritize comfort, safety, and access to local culture, pushing property owners to focus on premium hospitality.

- Remote work continues to support “workation” bookings, while family travelers are driving demand for larger homes with amenities like kitchens and private yards.

- Platforms like Airbnb and Vrbo have integrated AI tools for property management to optimize pricing, improve guest experiences, and manage inventory.

- Urban hub revival: Major cities such as Boston, Miami, and Seattle are reclaiming popularity among leisure and business travelers. Vacation rental listings in these cities are essential platforms for travelers seeking accommodation, attracting millions of visitors daily. These cities are witnessing improved occupancy rates, fewer regulatory constraints, and renewed demand.

- Rural stabilization: Rural and small-market locations that experienced a pandemic-era boom are normalizing as demand plateaus.

- Coastal destinations: The Alabama Gulf Coast, San Diego, and Charleston remain top performers due to their perennial appeal, warm climates, and family-friendly amenities.

Short-Term & Vacation Rental Challenges for 2025

- Rising interest rates burden potential investors, while inflation-induced operational costs pressure existing STR operators.

- Regulatory landscapes remain complex, particularly in densely populated urban centers where local governments strive to balance tourism benefits with housing affordability concerns.

- Increased supply, particularly in key cities, creates pricing pressure for operators, making guest experiences and value differentiation crucial.

- Factors such as climate concerns (e.g., hurricanes impacting Florida markets) and geopolitical uncertainties pose potential disruptions to travel and the STR market.

- The home market segment dominates the global accommodation market, significantly impacting revenue with its cost-effective options compared to traditional hotels.

Statistics That Matter to Property Owners and Managers

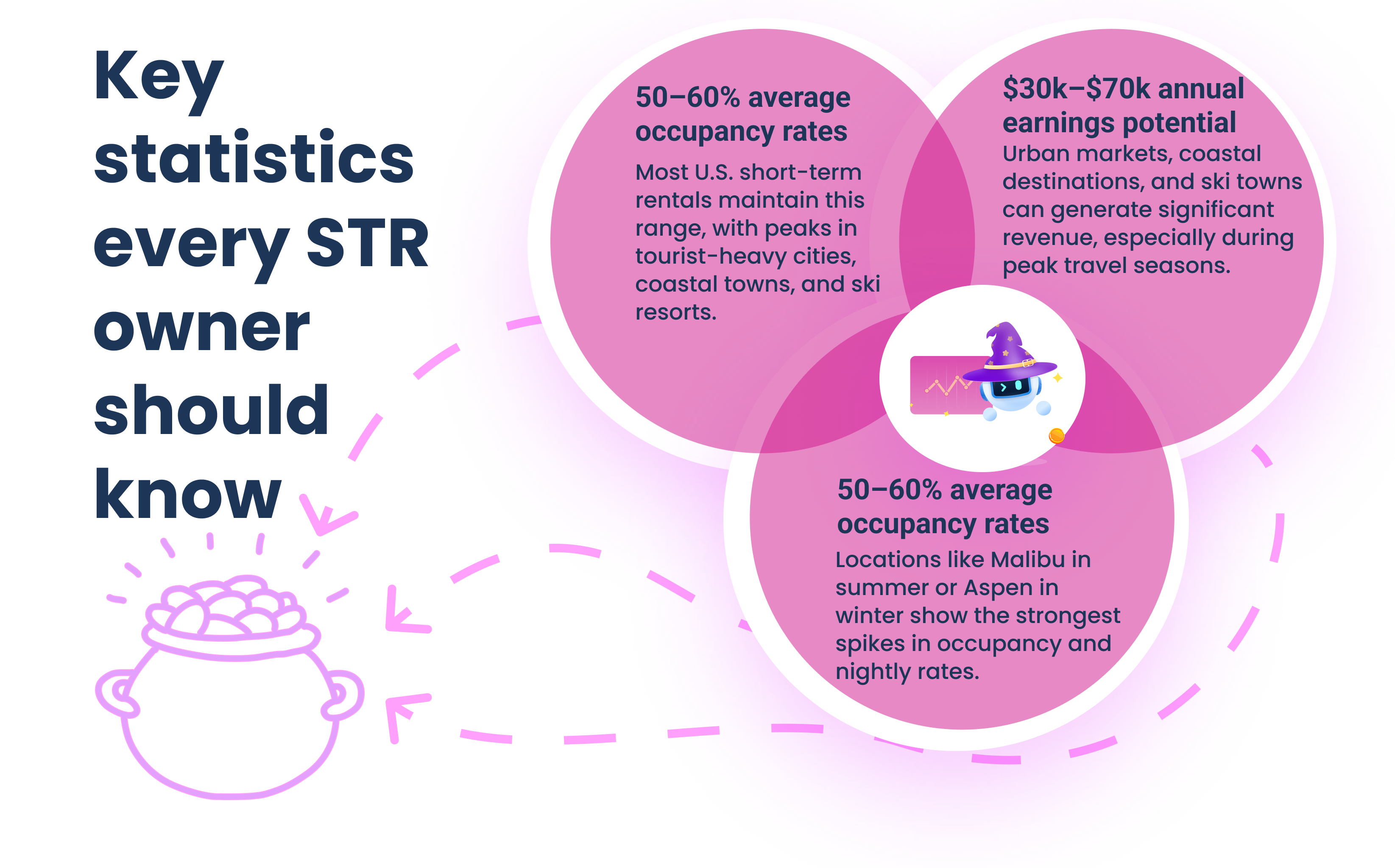

Short-term rentals (STRs) exhibit varied occupancy rates based on location, seasonality, and market demand.

On average, STR occupancy rates in the U.S. range between 50% and 60%.

Urban areas and popular tourist destinations frequently see higher occupancy percentages, especially in peak seasons. Coastal towns like Malibu report summer rates nearing 70%, while ski resorts such as Aspen feature spikes during the winter months.

Several elements can have an impact on STR occupancy rates, including:

- Location: Properties in areas with year-round attractions, like New York or Orlando, often maintain steadier bookings.

- Seasonality: Destinations with seasonal appeal, such as beach towns, show significant yearly fluctuations.

- Amenities: Listings with sought-after features like high-speed internet, pet-friendly policies, and flexible booking options often outperform less-equipped properties.

Earnings from STRs vary widely depending on geography, property type, and demand. Some estimates provide the following insights:

- Urban areas: Cities like San Francisco or Miami offer higher nightly rates, and well-maintained properties in desirable neighborhoods can earn an average annual revenue of $30,000 to $50,000.

- Coastal destinations: Beachfront homes in regions like the Gulf Coast can generate $40,000 or more in rental income during peak seasons, reflecting strong guest demand for such locales.

- Ski resorts: Winter-focused towns such as Park City or Vail report earnings close to $70,000 annually, driven by premium nightly rates during ski seasons.

- Rural getaways: Properties in rural or remote areas offer more affordable stays but still draw consistent income. For example, depending on occupancy, cabins or cottages may earn between $15,000 and $30,000 annually.

To increase earnings, STR owners should consider implementing strategies tailored to meet local demand:

- Optimize listings: High-quality images and descriptive copy create more appealing vacation rental listings. Highlight unique amenities, such as hot tubs or proximity to landmarks.

- Use pricing tools: Dynamic pricing software ensures competitive nightly rates through automated adjustments based on demand trends.

- Enhance guest experiences: Providing thoughtful touches, such as keyless entry, welcome kits, or personalized recommendations for local activities, can encourage satisfied guests to leave positive reviews, boosting future bookings.

Opportunities in the STR Market in 2025

- Using AI-powered pricing tools and guest experience platforms to stay competitive will play an important role for property managers.

- Sustainability efforts such as offering eco-friendly stays increasingly appeal to environmentally conscious travelers.

- Catering to long-term rental demands from remote workers and digital nomads presents a growing revenue stream for STR operators.

- Investors are eyeing emerging STR hotspots, including Wisconsin Dells and the Alabama Gulf Coast, where demand remains high and acquisition costs are relatively low compared to major markets.

- The projected market volume for the vacation rental industry indicates significant anticipated growth, with financial figures highlighting the industry’s expected monetary value in future years.

- Operators and investors are exploring smaller, less-saturated markets with unique value propositions, such as Savannah’s historical allure or Myrtle Beach’s family-friendly atmosphere.

Conclusion

Looking ahead, the U.S. short-term and vacation rental industry is positioned for sustainable growth. A delicate balance between supply and demand stimulates challenges and opportunities.

The industry has seen significant growth, with an increase in property listings and overall market expansion driven by changes in travel behavior and the popularity of budget-friendly travel options.

Steady economic recovery, supported by consumer confidence and tech-driven advancements, sets the stage for a robust 2025. For investors and property managers, adopting a data-driven approach, fostering innovation, and adapting to shifting travel preferences will be key to capitalizing on this dynamic market.

With stabilization in key metrics like occupancy and RevPAR, the STR market continues to be a vibrant sector offering strong income potential for both seasoned and first-time participants.