US real estate investment trusts (REITs) are central to connecting investors to income-producing real estate without the need to directly own or manage properties.

With more than $4.5 trillion in real estate assets under management, REITs provide access to diverse property types, from apartment buildings and retail centers to healthcare facilities and data centers.

For many retail investors and institutions, REITs serve as a dividend-based income vehicle and a long term capital appreciation strategy.

They allow participation in the real estate market with liquidity similar to mutual funds and exchange traded funds, while delivering shareholder dividends that reflect the cash flow of commercial REITs and mortgage REITs.

In this guide, you’ll find the latest REIT statistics, performance trends, and sector insights for 2025, covering everything from occupancy levels and dividend payouts to the growth of specialized sectors like self-storage and data centers.

What Are Real Estate Investment Trusts (REITs)?

Real Estate Investment Trusts (REITs) are companies that manage and own income-generating real estate properties. They allow individual investors to participate in the real estate market without owning physical properties.

REITs function by pooling investor capital to finance real estate and acquire assets such as office towers, apartment buildings, shopping centers, and even data centers.

These income-producing real estate holdings generate revenue primarily through rent payments or mortgage interest. That income is then distributed as shareholder dividends, making REITs a dividend-based income vehicle with predictable cash flow.

Unlike private REITs, publicly traded REITs are listed on stock exchanges, giving investors the flexibility to buy and sell shares like mutual funds or exchange-traded funds. This accessibility opens opportunities for retail investors who want exposure to real estate values without the complexity of direct ownership.

Benefits of REITs:

- Accessibility: Shares can be purchased with relatively small investments, lowering entry barriers for retail investors.

- Dividend income: Most equity REITs must distribute at least 90% of taxable income as dividends, providing steady returns.

- Diversification: REITs invest across commercial REITs, residential complexes, and other assets, helping balance an investment portfolio.

- Liquidity: Publicly traded REITs allow investors to raise capital or exit positions quickly compared to non-traded REITs.

- Tax efficiency: Although REITs are subject to corporate income tax rules, REIT legislation requires high payout ratios, which gives investors consistent REIT dividends.

REITs generally serve as an accessible bridge between traditional real estate investment and equity market capitalization, offering long-term capital appreciation alongside dividend-based income.

For many REIT investors, they act as a hedge against inflation and interest rate fluctuations while keeping portfolios diversified across multiple property types.

Types of Real Estate Investment Trusts (REITs) Investors Should Know

There are three primary categories of real estate investment trusts (REITs).

Each one serves a different investment strategy and provides exposure to unique segments of income-producing real estate.

Equity REITs hold and operate real estate assets that generate rental income. They represent the largest share of the REIT market, with publicly traded equity REITs covering sectors such as retail centers, apartment buildings, healthcare facilities, and commercial REITs like office towers and data centers.

These structures allow investors to generate income directly from property operations while benefiting from long term capital appreciation as real estate values rise.

Mortgage REITs (or mREITs) do not own physical real estate but instead finance real estate by investing in mortgages or mortgage-backed securities. They rely heavily on interest rates and capital markets performance, earning returns from the spread between borrowing costs and mortgage yields.

While often more sensitive to rate fluctuations, they provide steady shareholder dividends when managed effectively.

Hybrid REITs combine the features of equity REITs and mortgage REITs. These vehicles balance ownership of gross real estate assets with investments in loans, offering a diversified way to generate income while hedging against volatility.

Hybrid structures give investors exposure to both physical real estate companies and financial instruments like non-traded REITs or mortgage-backed securities.

For investors, understanding these types of REITs is essential when shaping an investment portfolio. Each carries different levels of risk, dividend potential, and exposure to taxable income.

Choosing between them depends on whether the goal is steady REIT dividends, growth in total assets, or diversification across multiple real estate sectors.

Key REITs Performance Highlights for 2025

- The FTSE Nareit All Equity REIT Index delivered 14% total returns in 2024, surpassing the 25-year average of ~10%, and this positive momentum is expected to extend further into 2025.

- Healthcare REITs, data center REITs, and office REITs emerged as top performers in 2024, and similar sector strengths are anticipated for the new year.

- A standout feature of REITs is that dividend yields for select sectors remained attractive. Some REITs offered double-digit payouts, and yields as high as 15.3% were reported for niche players.

- Several REITs traded at a premium to their net asset value (NAV), signaling investor confidence and strong cost-of-capital advantages heading into 2025.

Number of Properties Owned by REITs in The US

Real estate investment trusts (REITs) hold various properties across the United States, ranging from commercial spaces to residential buildings. Their expansive portfolios provide investors access to diversified real estate investments without requiring direct property ownership.

Key insights into property holdings:

- Over 535,000 properties nationwide fall under the ownership of various REITs. These include a mix of sectors such as healthcare facilities, office spaces, shopping malls, industrial warehouses, and rental housing.

- Around $4.5 trillion worth of assets are managed by publicly traded equity REITs, showcasing their significant presence in the real estate industry.

- By diversifying across different property categories, REITs reduce risk while maintaining steady income streams for their investors.

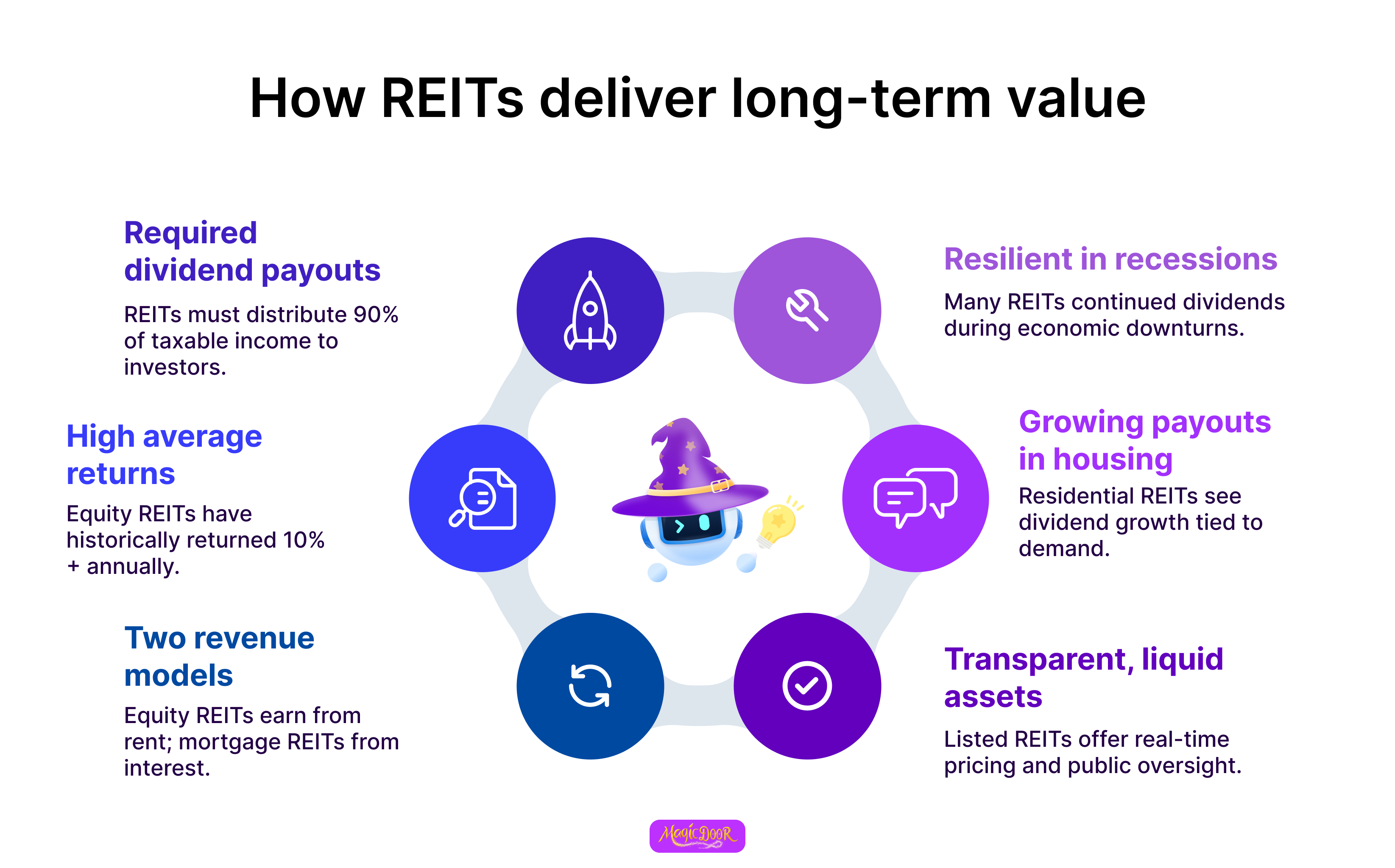

Historical Trends in Returns & Dividends

Over time, real estate investment trusts (REITs) have proven their value in providing consistent returns through dividends and stable property investments. Historical patterns bear out their reliability as an option for individuals and institutions seeking dependable income.

Here are key statistics and insights to illustrate these trends:

- REITs are legally required to distribute at least 90% of their taxable income as dividends, ensuring steady payouts for investors.

- Average annualized returns for equity REITs have historically surpassed 10%, often outperforming traditional mutual funds.

- Equity REITs generate returns through rental income and property appreciation by focusing on income-producing real estate, while mortgage REITs primarily earn from real estate mortgages or mortgage-backed securities.

- Many REITs demonstrate resilience during economic downturns, sustaining dividends even in challenging conditions.

- Among residential and apartment building investments, dividend growth has mirrored demand increases in metropolitan property sectors over decades.

- Today’s REIT market manages assets valued at over $4.5 trillion, with listed REITs providing transparency unmatched by private alternatives.

This performance history highlights why diverse investors rely on REITs, whether it’s for long-term capital appreciation or consistent income generation.

Occupancy Rates Across Property Types

Real estate investment trusts provide valuable insights into occupancy levels across various property types. These rates highlight demand trends and offer an overview of market performance.

Below are key occupancy statistics across distinct real estate sectors:

- Residential REITs consistently maintain average occupancy levels near 95%, driven by steady demand for apartments and urban housing in metropolitan areas.

- Commercial real estate properties, such as office buildings, averaged 87% occupancy in 2025 as hybrid work models continue changing tenant behavior.

- Retail centers, including shopping malls and strip centers, reported an occupancy rate of around 92%, supported by a mix of e-commerce-resistant businesses and service-oriented tenants.

- Industrial facilities, such as warehouses and distribution centers, are the most occupied property sector, with 96% occupancy. This is driven by the growing logistics and online shopping needs.

- Healthcare real estate, covering assets like senior living facilities, managed occupancy rates close to 91%, reflecting growing demand in aging demographics.

These occupancy data points reveal how efficiently REITs utilize their property assets while adapting to economic shifts. Investors often assess these metrics to identify trends and predict the stability of income-producing real estate within specific property types.

The figures also highlight how REITs balance various real estate investments to provide returns and consistently respond to varying industry demands.

REITs Sector Trends & Growth Drivers

Growth in Specialized Sectors Like Data Centers & Self-Storage

The growth of specialized sectors, such as data centers and self-storage, has fueled the rapid evolution of REITs. These niches provide reliable sources of income and cater to growing market demands.

Here are key highlights and statistics tied to their expansion:

- Data centers have seen a significant surge, driven by the growing demand for cloud-based services and digital infrastructure. Occupancy levels in this sector often approach 98%, reflecting high use rates.

- The global data center market’s value is projected to exceed $130 billion by 2025, providing a robust growth backdrop for relevant REITs.

- Self-storage facilities maintain stable occupancy rates, averaging near 94%, as individuals and businesses increase demand for flexible storage solutions.

- Over the past decade, self-storage REITs have delivered above-average annualized returns, consistently outpacing the broader REIT market.

- Witnessing explosive demand driven by artificial intelligence (AI) growth and the need for server storage.

- These sectors operate with lower maintenance costs than traditional commercial properties, contributing to dependable gross income streams.

- Listed REITs specializing in these areas provide transparency and accessibility for investors seeking stable dividends and predictable returns.

The sustained growth in data centers and self-storage enables REITs to diversify portfolios while targeting sectors less prone to economic fluctuations.

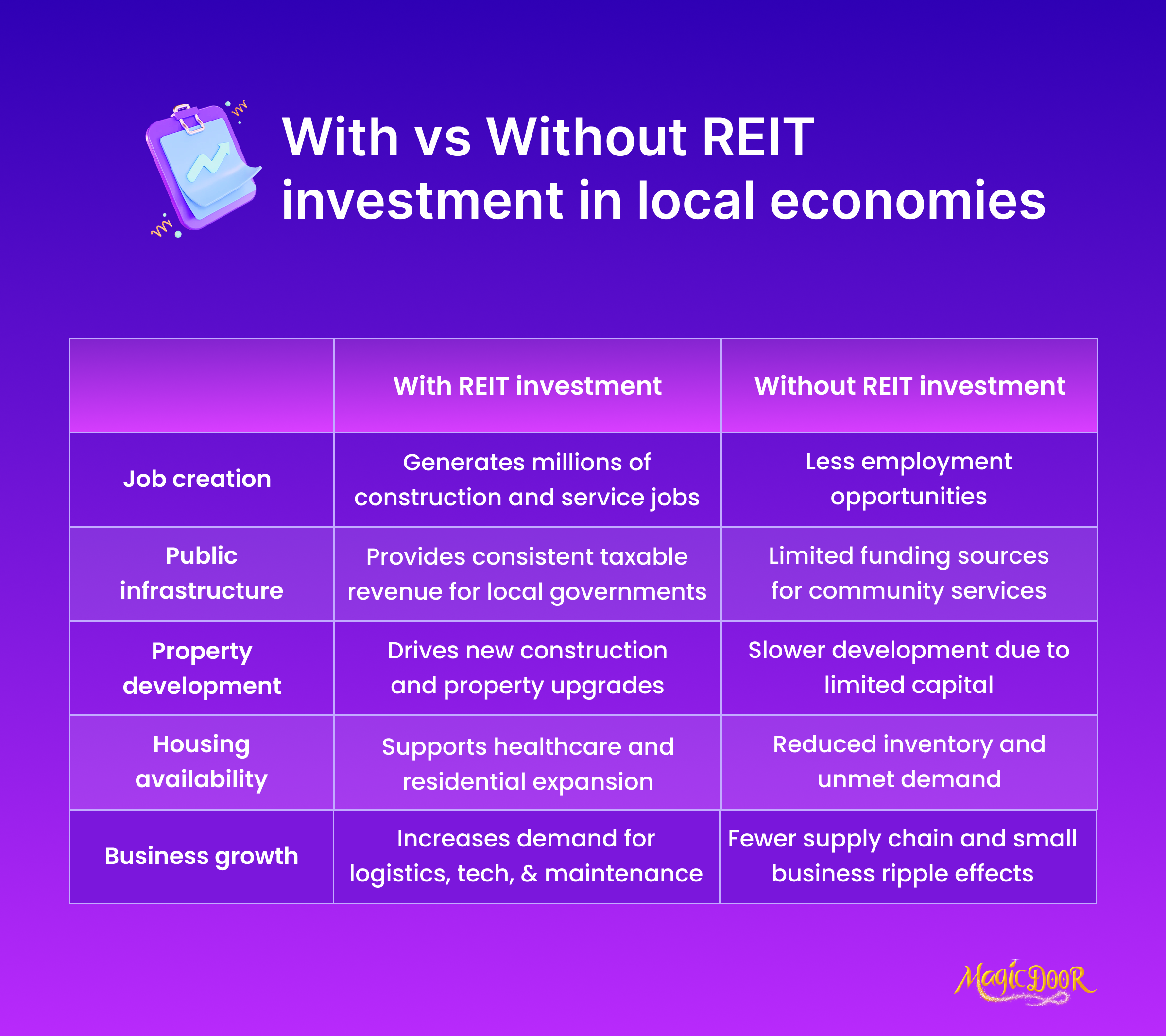

Economic Activity Generated by REIT Operations & Construction

Real estate investment trusts (REITs) contribute significantly to the economy by generating employment and driving substantial revenue streams. Their operations and development activities create ripple effects across industries.

Here are the key highlights showcasing their economic impact:

- REIT-focused construction, including new developments and renovations, supports close to 3 million jobs annually within the construction and related services sectors.

- A limited supply of facilities due to power and cooling requirements pushed up rental rates, creating attractive pricing power for REIT operators like Equinix and Digital Realty Trust.

- REITs’ operations and property management contribute over $190 billion annually to the U.S. gross domestic product (GDP).

- Boosted by e-commerce expansion, where logistics and warehousing demand remains strong.

- Commercial properties, such as office buildings and retail centers, create indirect economic activity by involving service providers, including cleaning, security, and maintenance crews.

- Investment in data centers and logistics facilities has surged, indirectly contributing to technological advancements and supply chain efficiencies.

- Taxable income generated by REITs ensures substantial revenue for federal and local governments, strengthening public infrastructure.

- Benefit from rising demand for senior housing amid an aging population. For instance, Global Medical REIT (GMRE) achieved 96% occupancy, reflecting robust fundamentals despite past tenant challenges.

- Specialist sectors like healthcare and residential REITs enhance local economies by sustaining community services and increasing housing availability.

- Across the real estate market, REIT-funded projects drive demand for materials and services, amplifying impact on employment and business opportunities.

Through their developments, REITs manage real estate properties and drive essential job creation and financial activity, making them a vital force in the real estate industry and other industries.

Regional Influence & Household Investments in REITs

Real estate investment trusts (REITs) are critical in creating regional economies and attracting household investments. Their accessibility and diverse property portfolios appeal to retail and institutional investors alike.

Here’s a closer look at their regional impact and investment patterns:

- The U.S. Sun Belt region has emerged as a top choice for REIT investments, driven by strong population growth and demand for residential and commercial real estate assets.

- West Coast REITs maintain steady success, bolstered by the expansion of the high-tech industry and premium property sectors like office buildings and data centers.

- Overcame negative market perceptions with consistent fundamentals in specific markets, notably Philadelphia and Austin. REITs diversifying into life sciences and residential spaces also gained traction.

- Northeast states see consistent activity, often led by investment in healthcare and residential REITs, improving services for local communities.

- Expanded to include new subsectors such as single-family rentals, affordable housing, and student accommodations, contributing to nearly 40% of transaction volume over the past three years.

- Around 145 million Americans are directly or indirectly involved with REIT investments, including through mutual funds or 401(k) plans.

- Annual household investment in publicly traded REITs has steadily grown, with over $3 trillion in market capitalization noted in 2025.

- Regional development funded by REITs generates ripple effects, creating jobs, spurring small business growth, and increasing property values.

- Retail investors favor REITs because they can generate consistent rental income and capital gains while maintaining liquidity through public markets.

REITs provide individual households access to historically stable real estate markets and stimulate localized economic development across the country.

Economic & Market Environment

Interest Rate Sensitivity:

- Given their capital-intensive nature, declining financing costs from potential rate cuts are positioned to support REITs.

- While long-term Treasury yields remain critical, REITs have insulated from volatility by securing 91.3% of debt as fixed-rate loans and maintaining an average interest rate of 4.1%.

- Public vs. Private Real Estate Valuation Gap:

- The pricing gap between REIT valuations and private real estate has narrowed significantly; the spread declined from 212 basis points in early 2024 to 69 basis points by Q3 2024.

- This convergence is expected to catalyze a revival of halted transactions in the broader commercial real estate (CRE) market.

Capital Raising and Strategic Moves

- REITs secured $40.8 billion in unsecured debt issuances by Q3 2024, highlighting their disciplined financial strategies.

- Notable transactions included Lineage REIT’s $5.1 billion IPO and joint ventures like Equinix’s $15 billion expansion into data centers, demonstrating portfolio expansion and innovation capabilities.

- With more substantial balance sheets and cost-of-capital advantages, REITs are poised to lead in acquisitions. Projected transaction market normalization could further boost REIT activity in 2025.

REITs Challenges & Risks

- Rising geopolitical tensions, changes in tariff policies, and potential fiscal imbalances hold downside risks for the broader CRE market.

- Persistent supply-demand imbalances in segments like the office sector and industrial properties could pressure short-term operational metrics.

- REITs remain a promising avenue for investors seeking income and diversification. They paid strong dividends in 2024 and offer inflation-protected earnings as property values and rents adjust to economic conditions.

- Institutional investors increasingly favor REITs because of their operational efficiency, sustainability focus, and innovative strategies. As a result, they are becoming core holdings in real estate portfolios.

Conclusion

Real estate investment trusts remain one of the most accessible ways to generate income from real estate while diversifying an investment portfolio.

Whether through equity REITs, mortgage REITs, or hybrid structures, they continue to balance reliable shareholder dividends with opportunities for long-term capital appreciation.

The latest REIT market statistics show resilience across property sectors, from residential apartments near full occupancy to industrial facilities supporting e-commerce demand.

With publicly traded REITs offering transparency, liquidity, and compliance under securities and exchange commission oversight, investors can align exposure to property types that best match their investment strategy.

While challenges remain, such as interest rate sensitivity and sector-specific risks, REITs paid strong dividends in 2024 and remain positioned to deliver consistent returns in 2025.

REITs continue to be a vital part of the equity market capitalization industry for investors looking to raise capital efficiently, diversify holdings, and participate in real estate values without direct ownership.

Frequently Asked Questions

How many REITs are there in the USA?

There are approximately 225 publicly traded REITs in the United States, covering various sectors, such as residential, healthcare, and retail properties.

What are the top 5 largest REITs in the US?

The largest REITs by market capitalization include Prologis, American Tower, Crown Castle, Equinix, and Public Storage.

Which country has the most REITs?

The United States leads with the highest number of REITs globally, due to its established real estate market and favorable legislation.

Why REITs are not popular with investors?

Some investors may shy away from REITs due to their tax-advantaged structure, which often results in high dividend payouts and limited capital appreciation compared to other equities.

What is the US largest office REIT?

Boston Properties is considered the largest office REIT in the US, focusing on high-quality office buildings in major metropolitan areas.