Mortgage data plays a central role in understanding the real estate market, influencing both homebuyers and property owners nationwide.

Mortgage statistics for 2025 reveal a market defined by elevated interest rates, resilient demand, and changing borrowing patterns. Knowing where rates, origination trends, and delinquency numbers stand can guide smarter financial decisions for property management.

This guide examines current U.S. mortgage statistics, including total outstanding debt, average mortgage rates, and lending trends.

You’ll also find insights into housing prices, affordability challenges, and the shifting dynamics between prime and subprime borrowers. Whether you’re tracking market performance for investment purposes or planning a purchase, the following data provides a clear picture of the mortgage landscape in 2025.

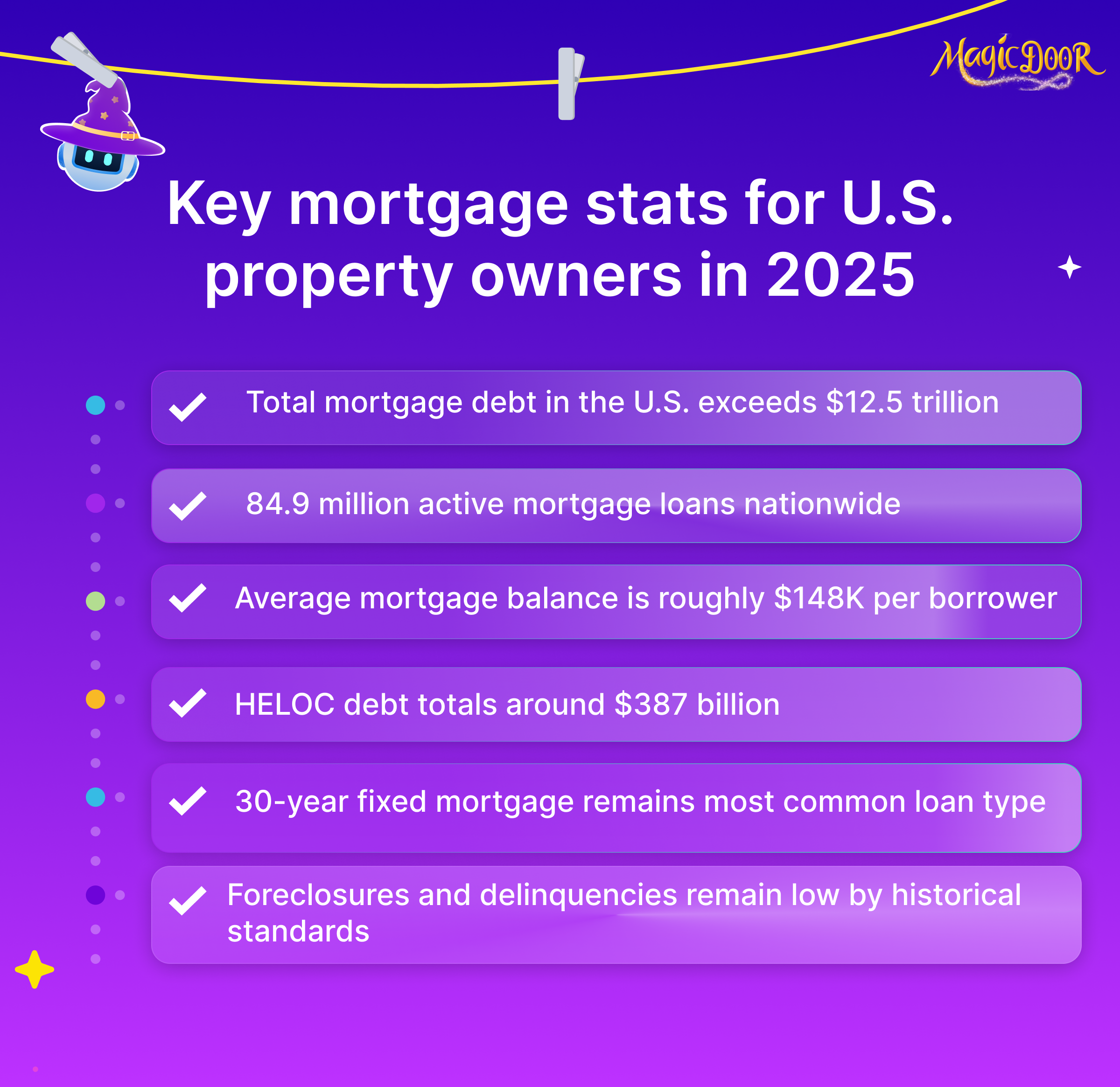

Key Mortgage Data for 2025

At the beginning of 2025, total U.S. mortgage debt stands at $12.59 trillion, spread across roughly 84.94 million active loans. The average loan value is $148,222 per borrower, according to national mortgage data provided by industry dashboards and lenders.

The 30-year fixed mortgage remains the dominant choice for a family buying a home, offering stable monthly payments even as borrowing costs stay high. While the Federal Reserve Bank may introduce slight rate cuts later in the year, overall mortgage rates are expected to remain elevated.

Key figures and trends:

- Total U.S. mortgage debt: $12.59 trillion across 84.94 million loans

- Average loan amount: $148,222 per borrower

- Average mortgage rate (2025 forecast): 6.0%–6.5%

- HELOC debt: $387 billion, averaging $29,407 per account

- Serious delinquency rate (90+ days overdue): 0.71%

- Foreclosures in 2024: 132,880 new filings

- Refinancing trend: Down since 2021 due to higher rates

Mortgage performance remains stable, with delinquency and foreclosure rates still far below the height of the 2008 financial crisis. Lenders continue to approve mortgages for qualified borrowers who meet minimum requirements, but navigating loan terms, rate locks, and payment schedules has become more complex in this higher-rate environment.

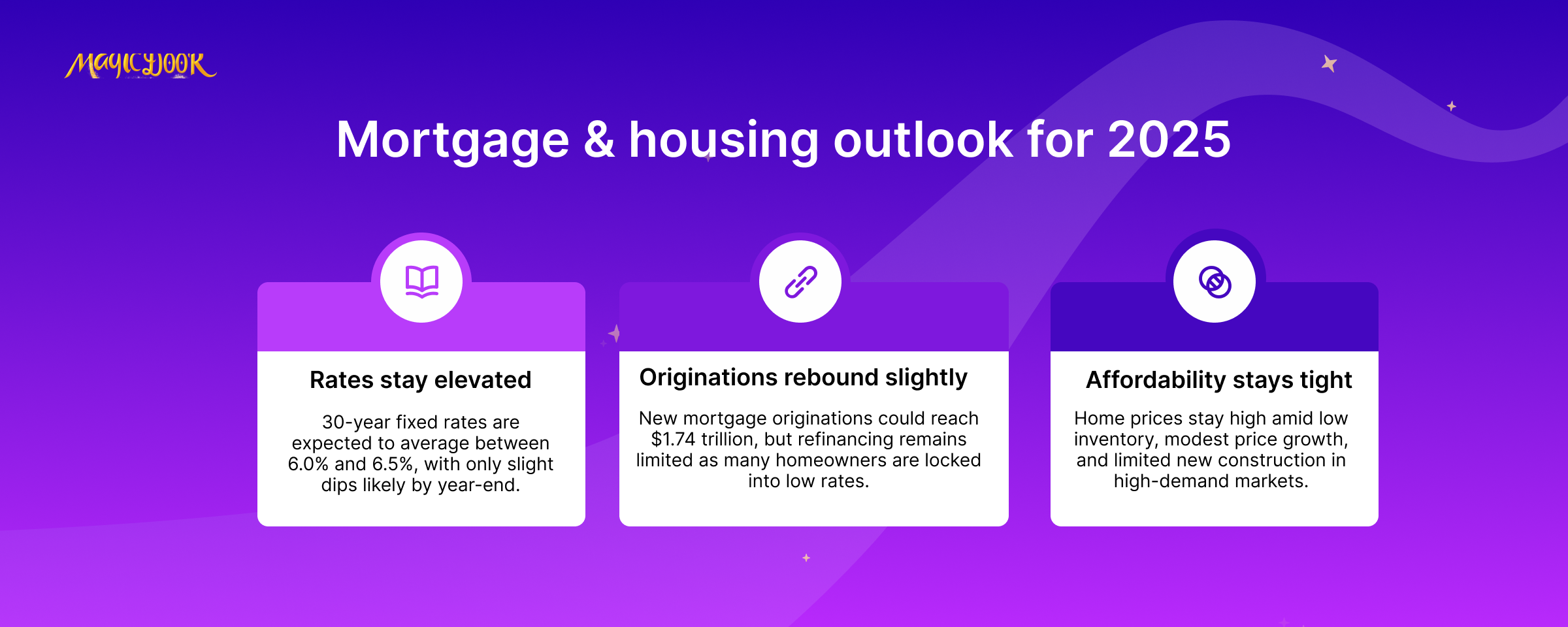

Mortgage Rates in 2025

Average 30-Year Fixed Rate:

- Mortgage rates are expected to stay elevated, averaging between 6.0% and 6.5% for the year. For comparison:

- Peak mortgage rates in 2023 exceeded 7%.

- Pandemic-era lows in 2021 dropped below 3%.

Forecast Trends:

- Economists predict rates may dip slightly as the Federal Reserve continues easing its federal funds rate policies, though rates below 6% are unlikely until at least 2026.

- Factors like federal deficit spending, inflation control, and Treasury bond yields will heavily influence the trajectory of mortgage rates.

Mortgage Originations

- New mortgage originations are forecasted to total $1.74 trillion in 2025, reflecting a partial recovery from the steep decline in 2022 and 2023 due to high borrowing costs.

- Subprime mortgage originations (credit scores below 620) remain low at 3.5%, while 80.6% of loans were issued to super-prime borrowers (credit scores above 720).

- Refinancing has significantly dropped since 2021 when record-low rates drove a refinancing boom. Many homeowners are “rate-locked” into low-rate loans and hesitant to refinance or sell.

- Despite this, approximately 10% of homeowners with loans above 6% are expected to refinance as rates decline modestly throughout the year.

Housing Prices & Affordability

- Average home prices remain high, with limited inventory and ongoing demand keeping prices elevated. The forecast indicates moderate price growth of 2–3% in 2025.

- The national average home price was $501,100 in Q3 2024, down slightly from the 2022 peak of $552,600 but still well above pre-pandemic levels.

- Rising home prices and high mortgage rates have strained affordability, with moderately fewer buyers entering the market.

- New home construction continues to lag behind demand, with a deficit of 1–4 million homes contributing to price pressures.

- Although builders are increasing activity in certain regions, high material costs and regulatory hurdles restrict supply growth.

Trends & Predictions for 2025

- Super-prime borrowers dominate the market, reflecting stricter lending standards and heightened risk aversion among lenders.

- Subprime borrowing remains subdued, reducing the likelihood of a large-scale mortgage default crisis.

- Strong population growth in states like Florida and Texas drives demand despite challenges like rising hurricane insurance premiums and regional housing shortages.

- However, northern markets like New York and Pennsylvania have experienced slower growth and some price stabilization.

- Many existing homeowners locked into lower rates are holding onto their properties, limiting inventory in the resale market. This “rate-lock effect” trend will likely persist, slowing housing market turnover.

- Non-qualified mortgages (Non-QM) are increasingly popular in the market, particularly for self-employed borrowers or investors. Non-QM originations are projected to grow by 16% in 2025, reflecting lender confidence in these less traditional loan types.

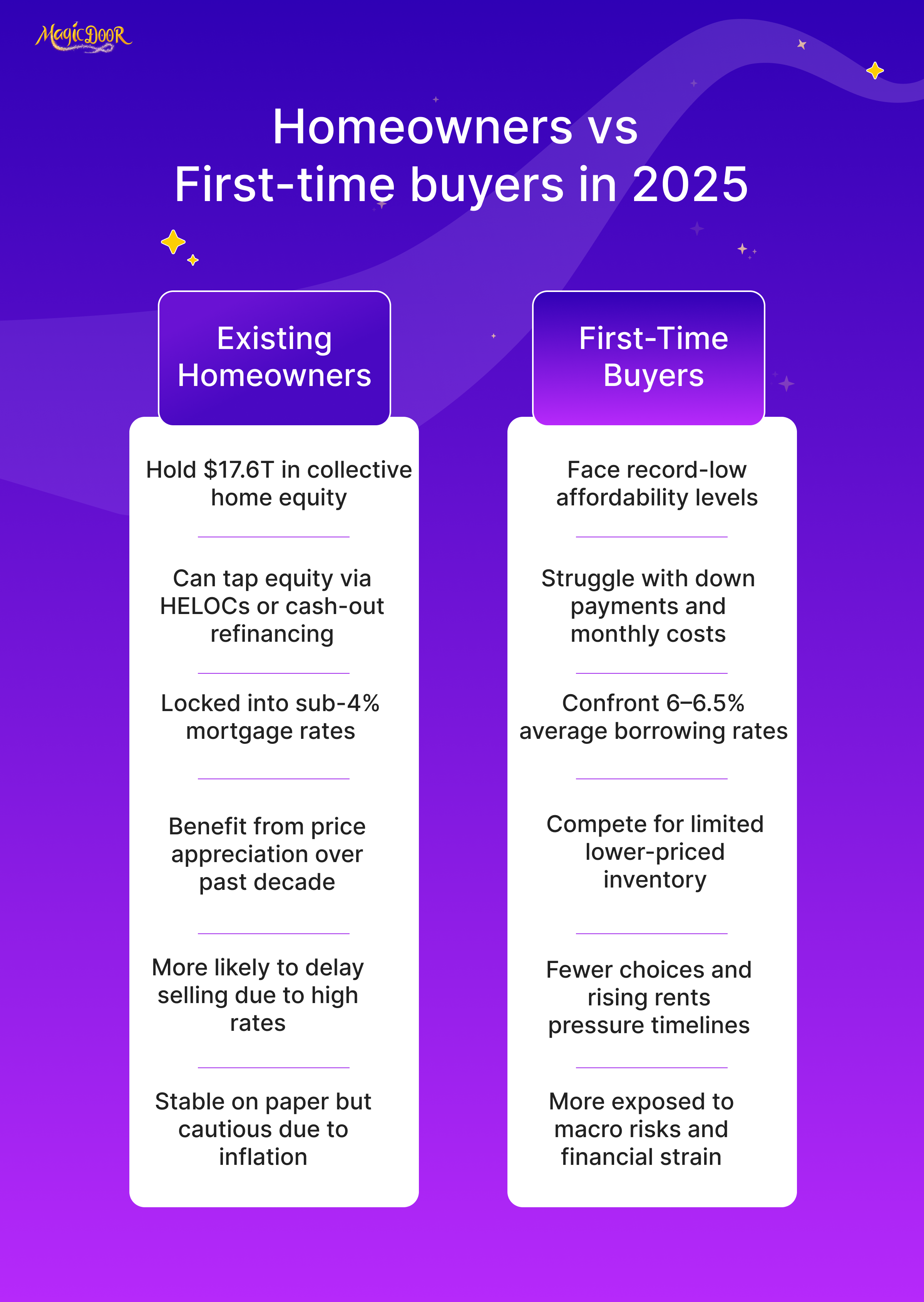

Impact on Homeowners & the Market

- Many are benefiting from record equity levels, with U.S. homeowners collectively holding $17.6 trillion in home equity as of mid-2024.

- Equity-rich borrowers may leverage cash-out refinancing or home equity products despite higher borrowing costs.

- Affordability for first-time buyers remains a significant hurdle, further exacerbated by volume shortages in lower-priced housing stock.

- Persistent inflation and higher borrowing costs in the real state market risk cooling market activity, but robust long-term demand for housing ensures some stability.

Final Thoughts

Mortgage trends in 2025 show a market balancing between sustained demand and affordability pressures. Elevated mortgage rates and limited housing supply continue to challenge buyers, while stable delinquency and foreclosure levels indicate underlying market strength.

For homeowners, record-high equity levels create opportunities for refinancing or accessing funds, despite higher borrowing costs.

For property owners and investors, monitoring changes in mortgage data, from interest rates to origination volumes, can help anticipate shifts in demand and potential returns. With lending standards remaining tight and the Federal Reserve Bank policy influencing rates, market conditions may evolve gradually rather than abruptly.