Every landlord has stories about tenants who turned out to be more trouble than expected.

Missed rent, damaged units, and endless excuses can drain time and cash flow. That’s why tenant screening services are essential. With the right tools, property managers can run credit reports, eviction history checks, and income verification in minutes.

This guide breaks down the best tenant screening services, shows how each platform works, and helps you decide which one will keep your rental property running smoothly.

What is Tenant Screening?

Tenant screening is the process of evaluating prospective tenants before signing a lease agreement. It involves collecting and reviewing credit history, rental history, employment status, and criminal background reports to help property managers and owners make confident leasing decisions.

Without screening, landlords risk late rent, property damage, or costly evictions. With the right tools, property managers can filter applicants quickly and reduce long-term risk.

Here’s what most tenant screening services cover:

- Credit reports: look at credit scores, payment history, and debt load

- Eviction records: check for prior evictions or court judgments

- Criminal background checks: review national and state-level databases

- Employment and income verification: confirm stable earnings and the ability to pay rent

- Rental history: confirm previous landlords and tenant behavior

Modern property management platforms combine these reports into one comprehensive screening package, often letting the applicant pay the screening fee. That makes the process easier for landlords managing multiple units while keeping costs transparent.

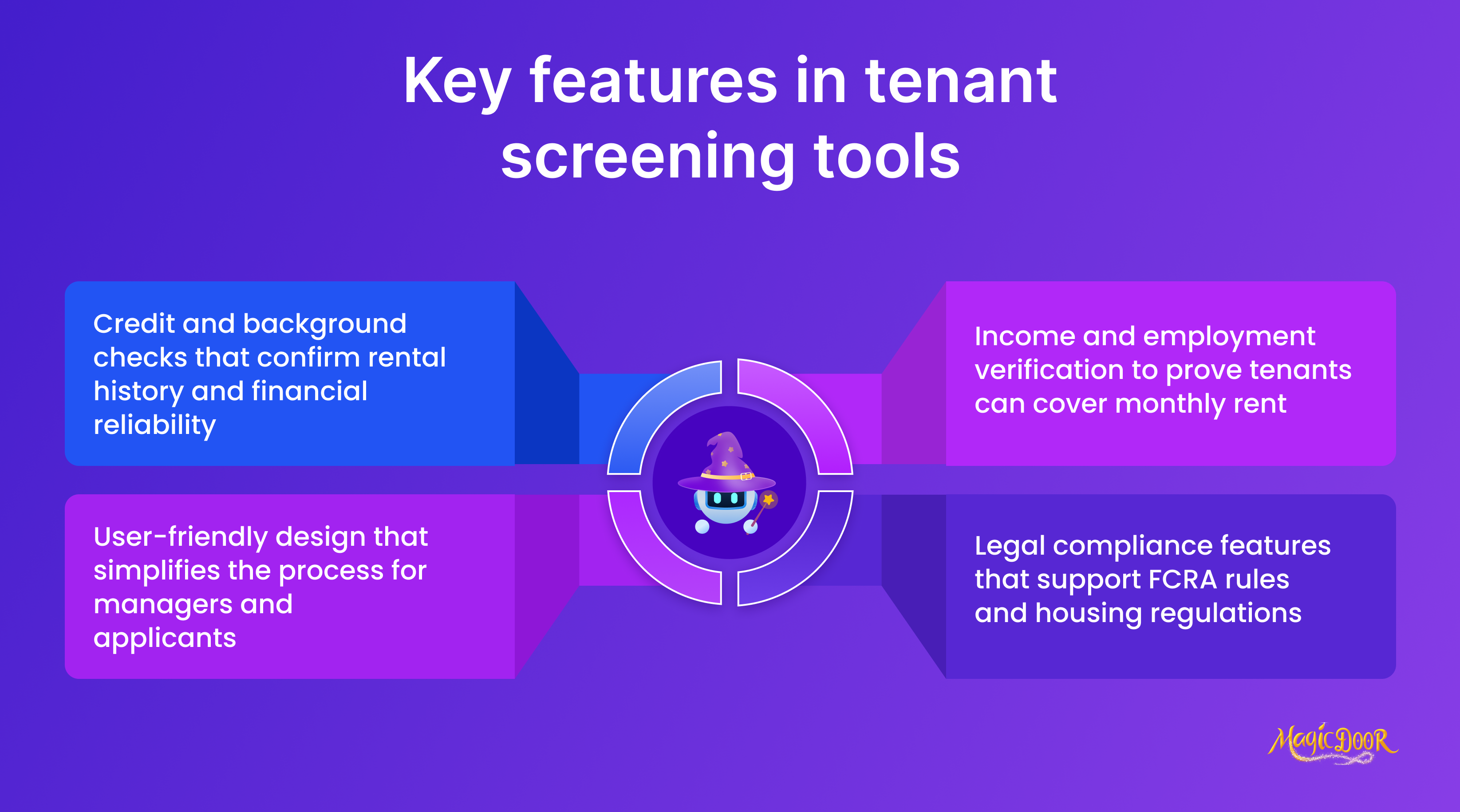

Features to Look for in Tenant Screening Tools

Credit & Background Checks

A reliable tenant screening tool must go beyond a simple credit report. Landlords and property managers need comprehensive screening reports that include:

- Credit score details: payment history, debt levels, and traditional credit scores

- Eviction records: past eviction history reports and court judgments

- Criminal background checks: national and state-level criminal history reports

- Identity verification: SSN validation and fraud alerts

When these data points are combined in a single tenant screening report, landlords can screen prospective tenants with far more confidence. This step reduces the risk of late rent, legal issues, and disruptive tenancies.

Income & Employment Verification

A tenant may have a clean credit history but still lack a steady income. That’s why income verification and employment history checks are essential. Modern tenant screening services often connect directly with payroll providers or banks, making the process faster and more accurate.

Look for tools that offer:

- Employment verification: current employer and job stability

- Income insights: proof of monthly earnings vs. rent amount

- Self-reported income checks: cross-referenced with financial data

- Past employer history: patterns that may indicate reliability or frequent job changes

For property owners, verifying income means fewer surprises down the line. A strong tenant screening process makes it easier to approve applicants who can reliably pay rent and maintain lease compliance.

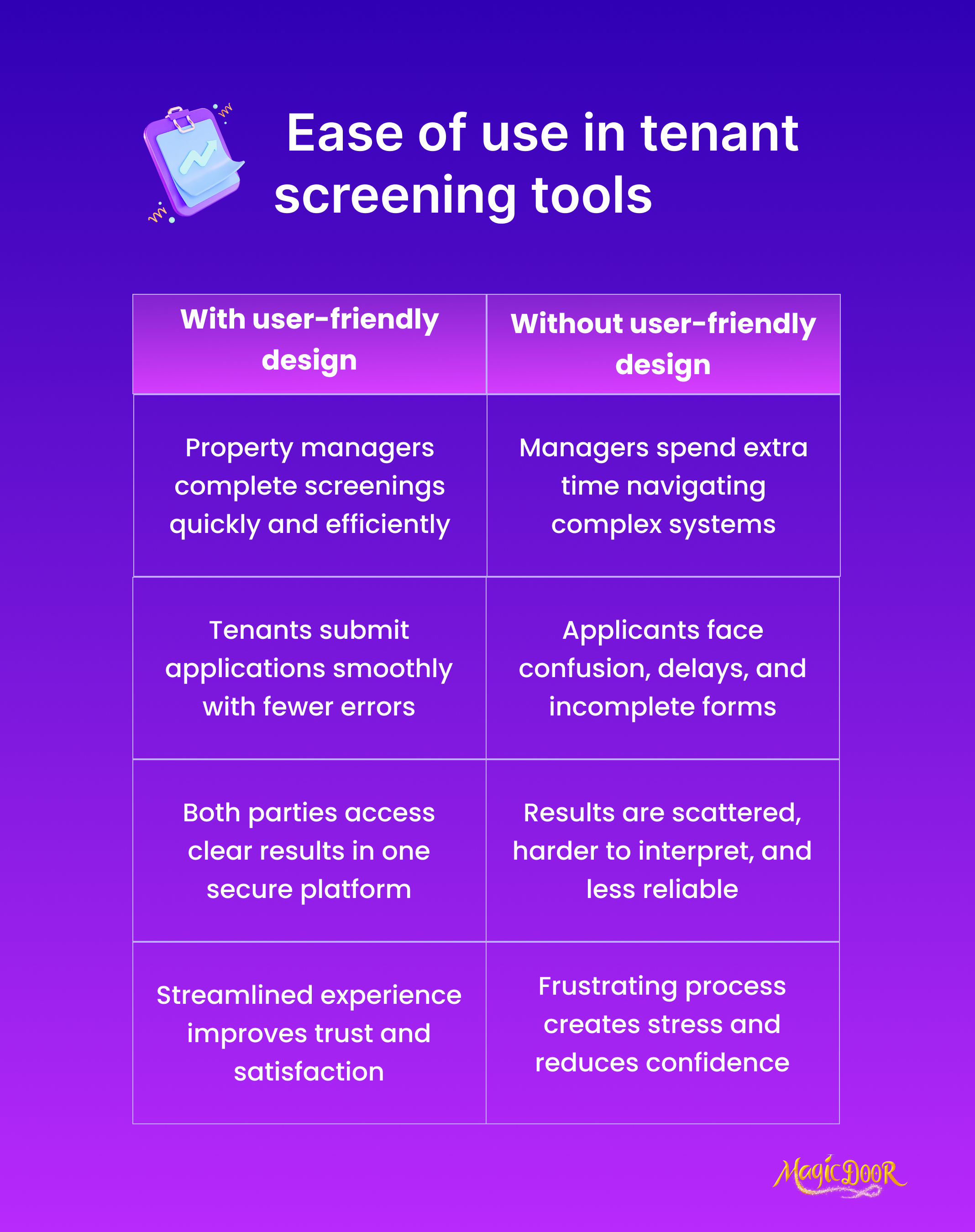

Ease of Use for Property Managers & Tenants

Even the best tenant screening services lose value if the platform is clunky. Landlords and property managers need systems that reduce time spent on admin tasks and make the process straightforward for applicants. A well-designed tool should:

- Let applicants submit rental applications and screening reports online

- Offer easy payment options when the tenant pays the screening fee

- Provide property managers with a clean dashboard for tracking results

- Deliver clear, comprehensive tenant screening reports without hidden steps

User-friendly design matters. When the tenant and landlord can complete the screening process quickly, it sets the tone for a smooth rental relationship.

Legal Compliance & FCRA Support

Tenant screening isn’t just about data, it must follow the law. Every tenant screening report falls under the Fair Credit Reporting Act (FCRA), and failure to comply can expose landlords to legal risk. A compliant tool helps property owners stay safe by:

- Including applicant consent before pulling a credit report background check

- Providing adverse action notices if an applicant is denied

- Ensuring criminal and eviction history data is up-to-date and accurate

- Offering guidance on fair housing standards and state-specific laws

For property managers, compliance features mean less guesswork and fewer legal headaches. With the right property management platform, you can confidently screen tenants and avoid costly mistakes.

Top 11 Tenant Screening Tools for Property Management

1. MagicDoor

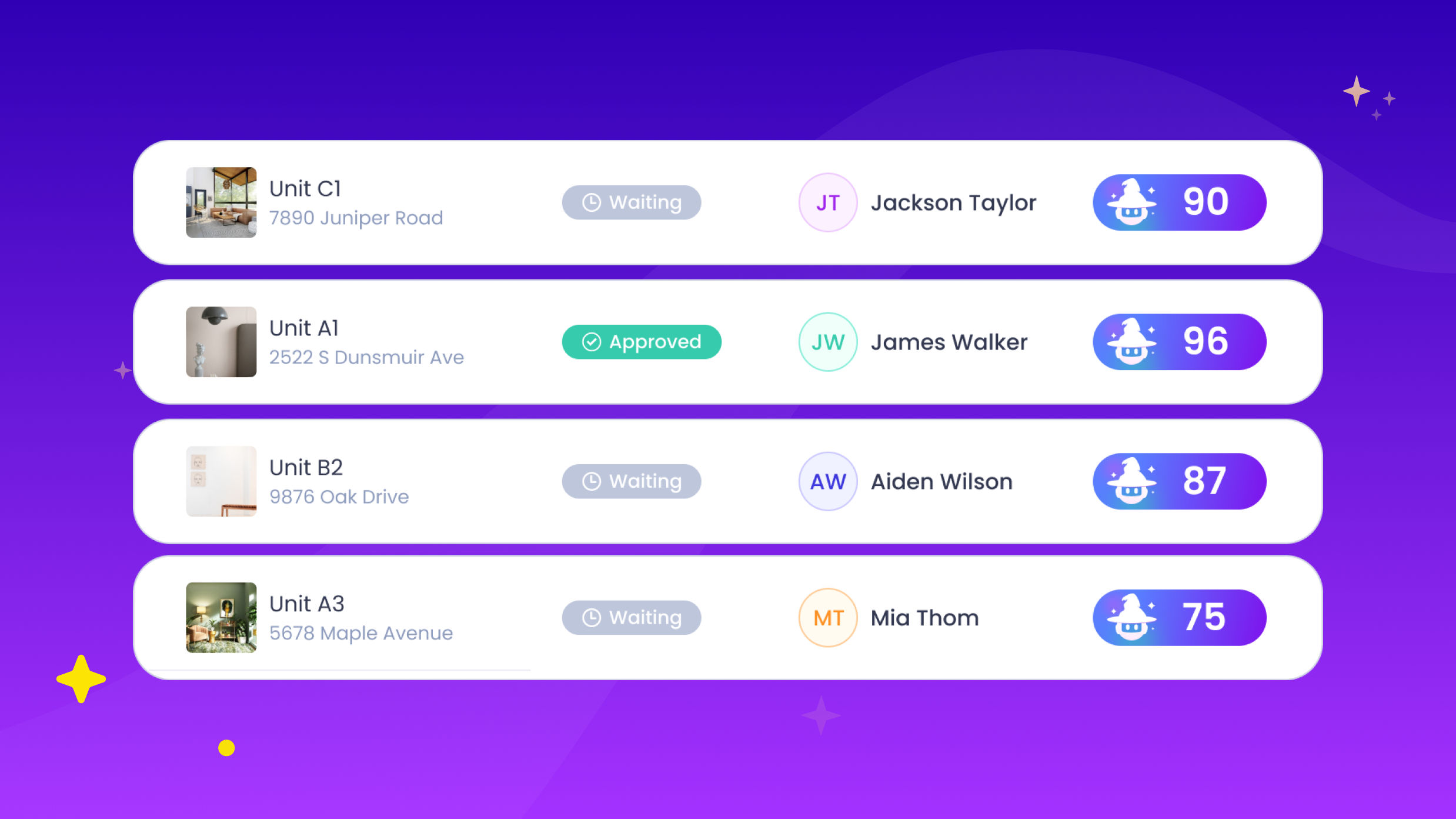

MagicDoor combines tenant screening services with property management tools, giving landlords and property managers everything in one place.

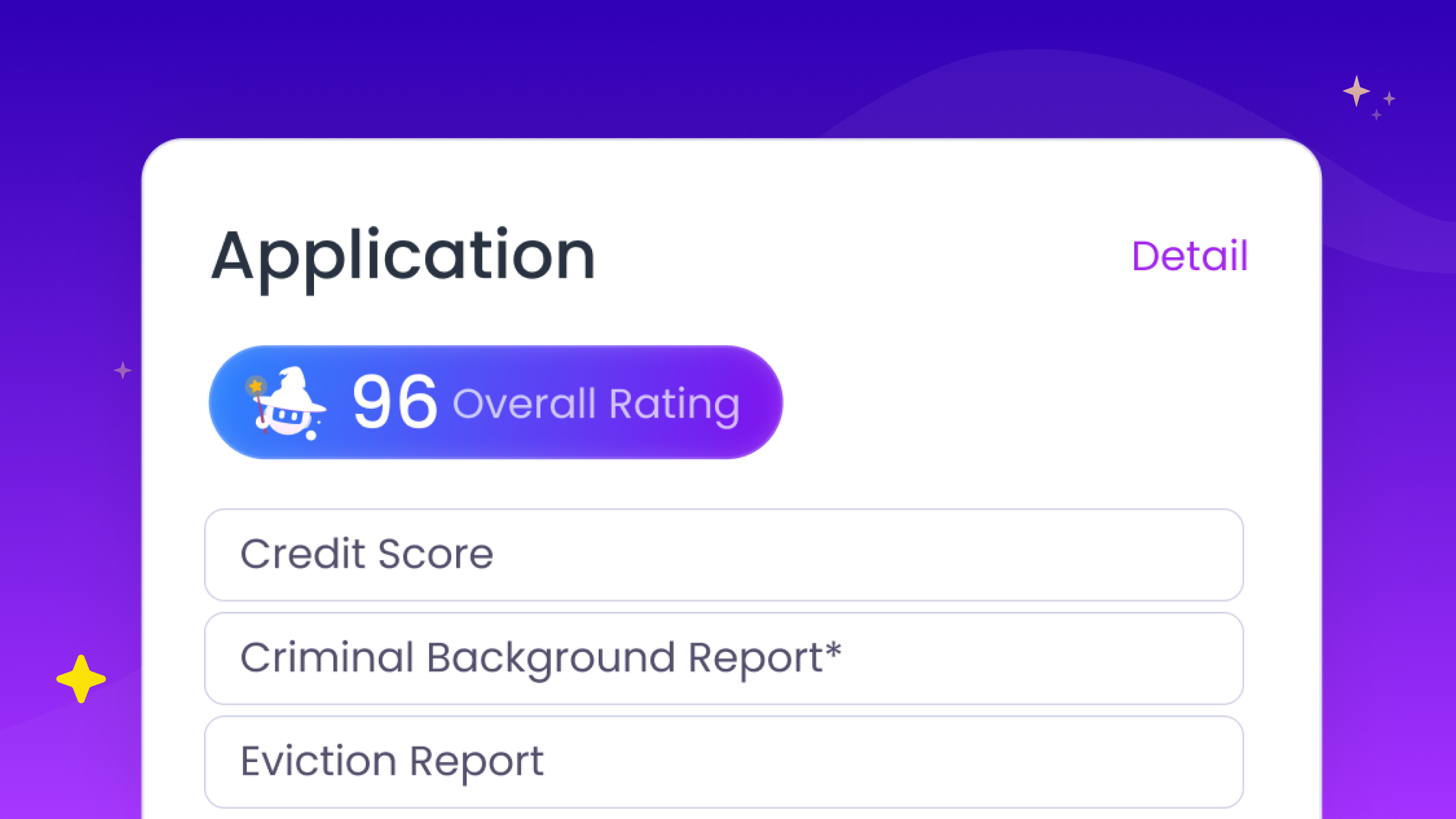

Beyond standard reports, the platform uses AI-powered evaluation to summarize applications and generate screening scores, saving time in the decision-making process. Reports are permanent after a single purchase, and unlike other providers, there is no 60-day expiration, so you always have access.

Key features for tenant screening:

- AI insights and screening score from rental application data

- Credit, eviction, and criminal history reports

- Permanent, one-time reports with no re-ordering

- Online rental applications and applicant-paid fees

Pricing notes: No subscription fees, only per-report payments.

Best for: Any landlord or property manager seeking fast, permanent, AI-enhanced screening.

2. Avail

Avail is a property management platform built for independent landlords. Its tenant screening services provide detailed reports through TransUnion, covering credit, eviction history, and criminal background checks. Landlords can also collect rental applications online and have tenants pay the screening fee.

Pricing notes: No subscription required; tenants usually cover the screening cost.

Best for: Small landlords managing a few rental properties who want integrated leasing and screening tools.

3. TurboTenant

TurboTenant simplifies the rental process with free listing tools, lease templates, and tenant screening reports. Screenings include credit history, eviction reports, and criminal background checks, giving landlords insight into an applicant’s rental performance. Applicants typically pay the screening fee, making it cost-effective for property owners.

Pricing notes: Free to use for landlords; tenants pay per screening.

Best for: DIY landlords seeking quick, affordable screening services with built-in marketing features.

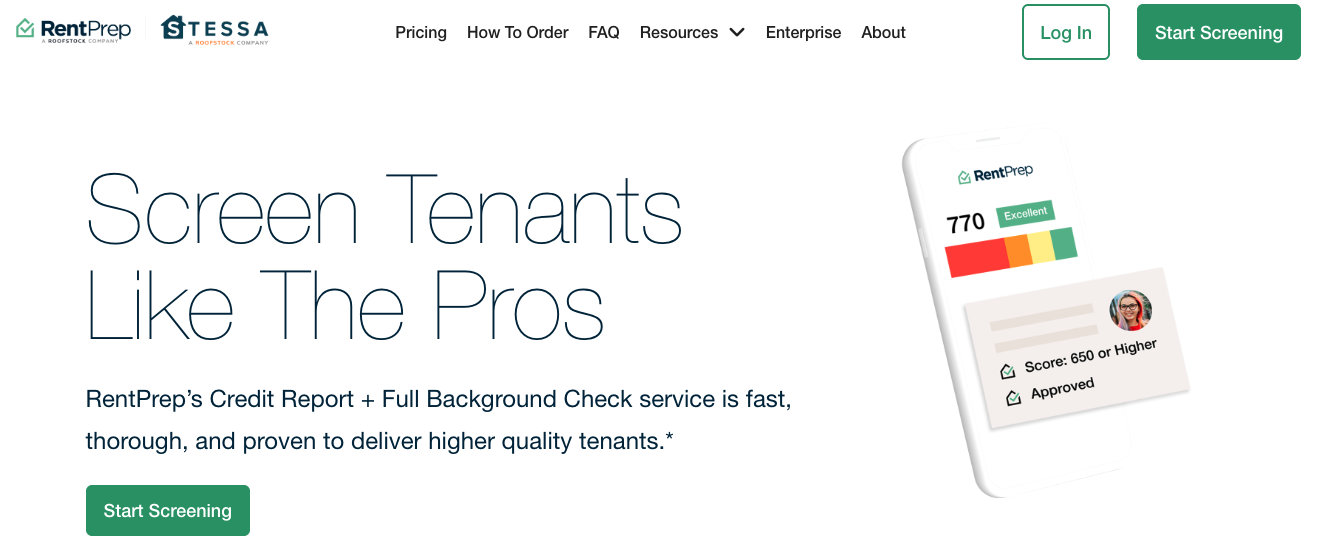

4. RentPrep

RentPrep specializes in tenant background checks with a mix of automated and manual screening services. Its screening process includes identity verification, credit report background checks, eviction history, and employment insights. Some packages even include human-reviewed reports for added accuracy.

Pricing notes: Starts with per-report pricing; no monthly subscription needed.

Best for: Landlords who want flexible screening costs and the option of human-verified screening reports.

5. Buildium Screening by TransUnion

Buildium integrates tenant screening services directly into its property management software, giving landlords quick access to credit reports, eviction history, and criminal records. Reports are powered by TransUnion, and results are available almost instantly. Landlords can request applicants pay the screening fee during the rental process.

Pricing notes: Screening reports are pay-per-use; no base subscription required.

Best for: Property managers who already use Buildium for rental management.

6. SmartMove (TransUnion)

SmartMove is TransUnion’s standalone tenant screening platform, offering comprehensive credit reports, eviction records, and criminal background checks. Results include an applicant’s credit score and a leasing recommendation based on TransUnion data. The screening process is fully online and requires only the applicant’s consent.

Pricing notes: Costs are charged per report, with tenants often covering the fee.

Best for: Landlords who want direct access to TransUnion credit report background checks.

7. TenantCloud

TenantCloud is a property management platform aimed at small landlords. Its tenant screening services provide credit, eviction, and criminal history reports, with the option for tenants to pay the fee directly. Reports integrate with online applications, making it easier to manage prospective tenants in one system.

Pricing notes: Tenant screening is offered as a per-report add-on; platform has free and paid tiers.

Best for: Independent landlords who need affordable tenant management tips and screening in one place.

8. MyRental (CoreLogic)

MyRental, powered by CoreLogic, delivers tenant screening services with detailed reports including credit, eviction, and criminal history. It also offers income verification and identity checks to help landlords make informed leasing decisions. Reports are customizable, letting landlords choose what level of detail they need.

Pricing notes: Pay-per-report; no subscription required.

Best for: Property owners who want flexibility in choosing comprehensive tenant screening reports.

9. Rentspree

Rentspree is a popular tenant screening platform used by landlords and real estate agents. Its reports cover credit history, eviction records, and criminal background checks, paired with online rental applications to simplify the screening process. Applicants pay the fee, keeping landlord costs low.

Pricing notes: Free for landlords; tenants pay per screening.

Best for: Landlords and agents seeking easy rental applications plus screening in one workflow.

10. TenantAlert

TenantAlert provides tenant screening services with options for credit checks, eviction reports, and income insights. Some plans include landlord reference verification and employment checks for a more comprehensive tenant screening package. Reports are delivered quickly, helping landlords move fast during the rental process.

Pricing notes: Tiered packages; per-report pricing starts at a low cost.

Best for: Landlords who want customizable screening levels at different price points.

11. National Tenant Network (NTN)

National Tenant Network (NTN) is one of the oldest tenant screening services, trusted by many property management companies. Reports include credit details, eviction history, criminal records, and rental performance data. NTN also provides risk scores that summarize applicant suitability, streamlining the screening process for busy landlords.

Pricing notes: Subscription plans available through member accounts.

Best for: Larger property managers who value established screening services with long track records.

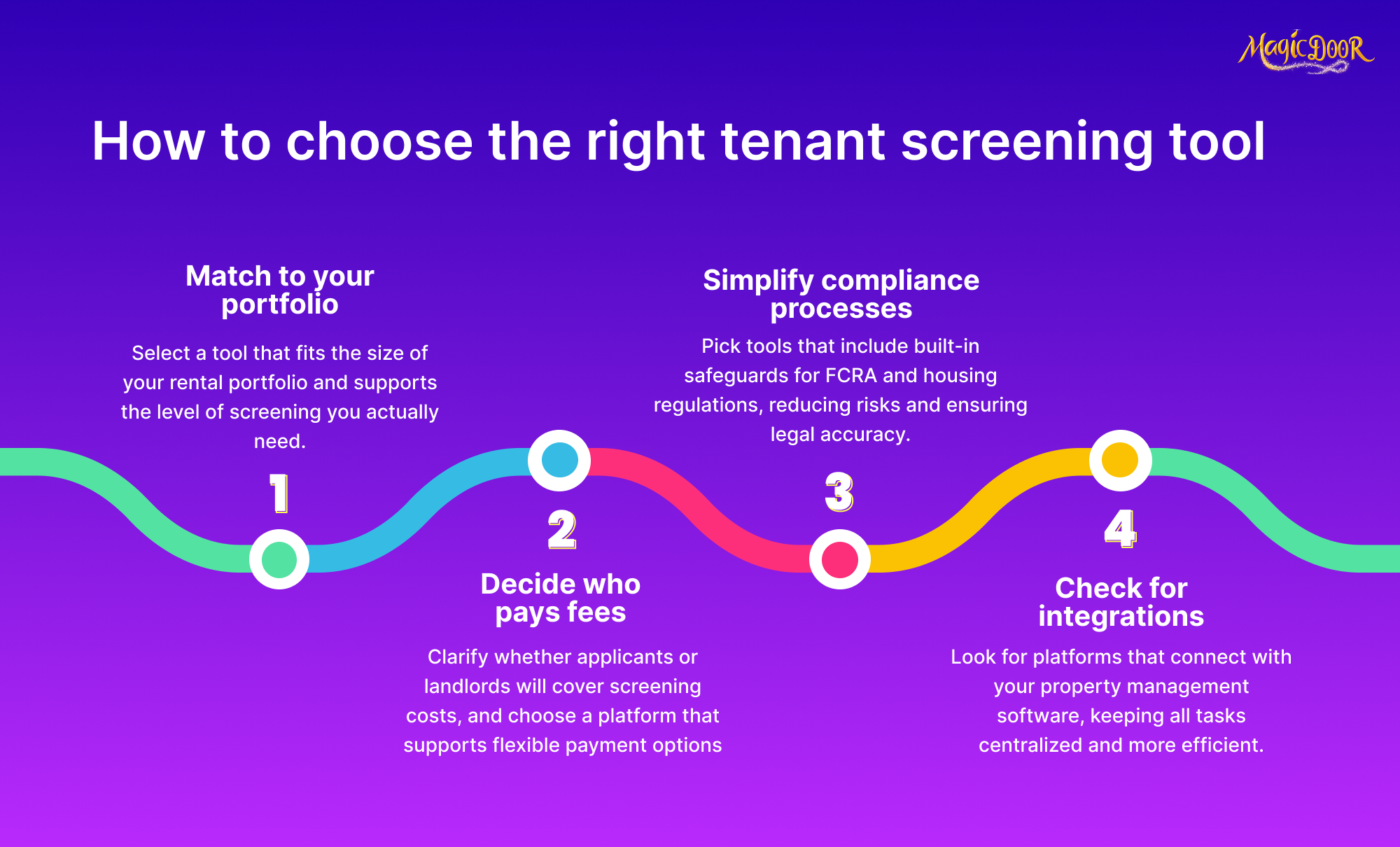

How to Choose the Right Screening Tool for Your Rentals

Match the Tool to Your Portfolio Size and Process

Not every landlord needs the same level of detail. A DIY landlord with one rental property may prefer simple tenant screening services that provide a credit report, eviction history, and criminal background check.

In contrast, a property manager overseeing dozens of rental units will want a property management platform that integrates screening reports with leasing, rent collection, and maintenance requests.

Questions to ask yourself:

- Do I need detailed reports for every applicant, or just credit and background checks?

- Will screening costs add up with multiple applicants per vacancy?

- Does the tool connect with my lease agreement and rent collection system?

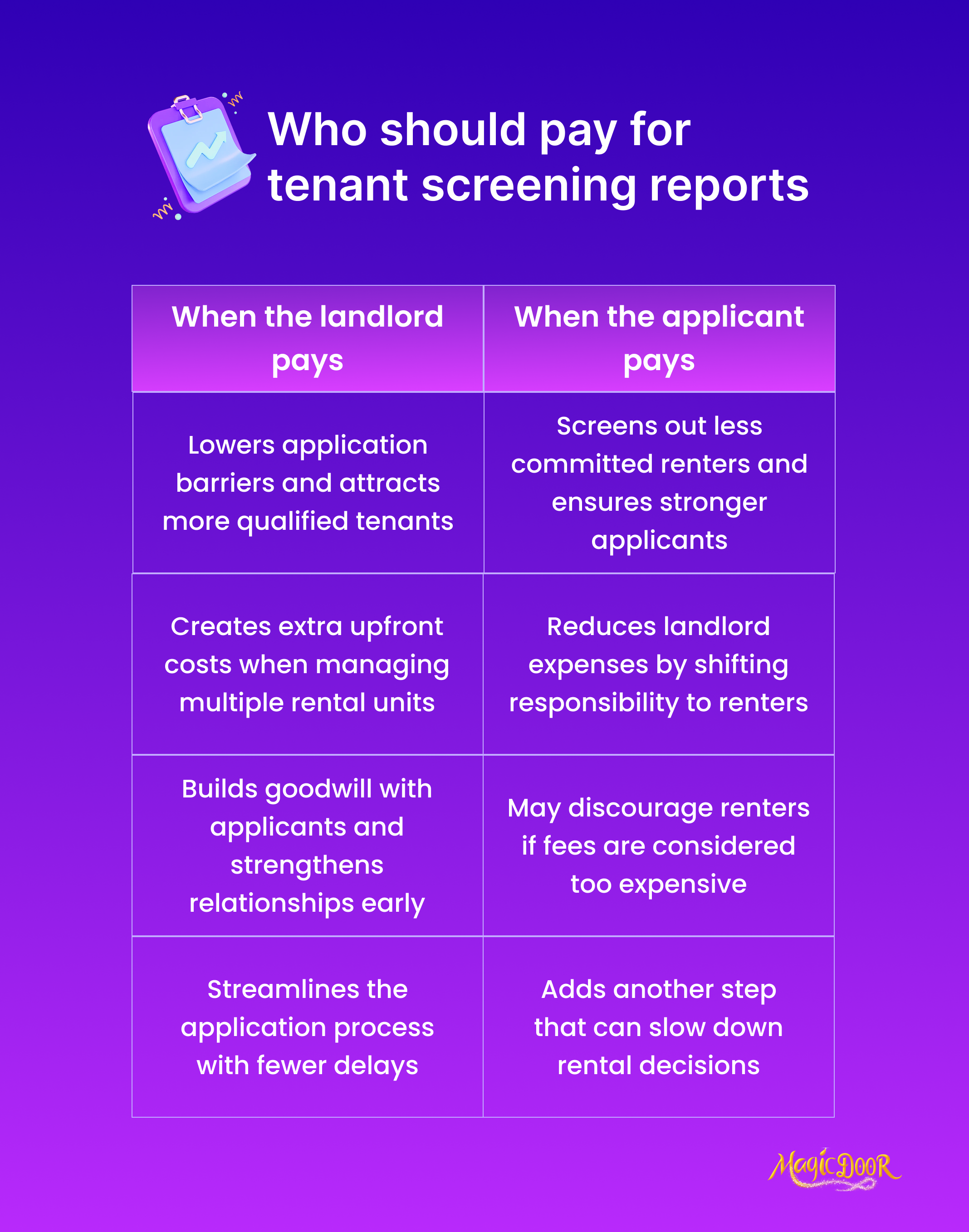

Consider Who Pays for the Report, You or the Applicant

Tenant screening isn’t free, and deciding who covers the screening fee can shape your rental process.

Some landlords prefer to absorb the cost as part of doing business. Others have the tenant pay directly, which keeps expenses predictable and filters out unserious applicants.

Common approaches:

- Applicant’s responsibility: The tenant pays during the application stage.

- Landlord’s responsibility: The landlord covers the fee for qualified applicants only.

- Hybrid model: Tenants pay upfront, refunded if they sign the lease.

Choosing the right model depends on your market, the number of applications you expect, and how you want to present your rental business to prospective tenants.

Prioritize Tools That Simplify Compliance

Tenant screening must follow legal standards like the Fair Credit Reporting Act (FCRA) and local fair housing laws. The best tenant screening services don’t just generate a credit report, they also guide landlords through compliance steps.

Look for features that:

- Require tenant consent before running a credit and background check

- Provide automated adverse action notices when applicants are denied

- Keep screening reports accurate and up to date

- Include built-in safeguards for fair housing and state-specific rules

For property managers, these protections save time and reduce the risk of costly legal disputes.

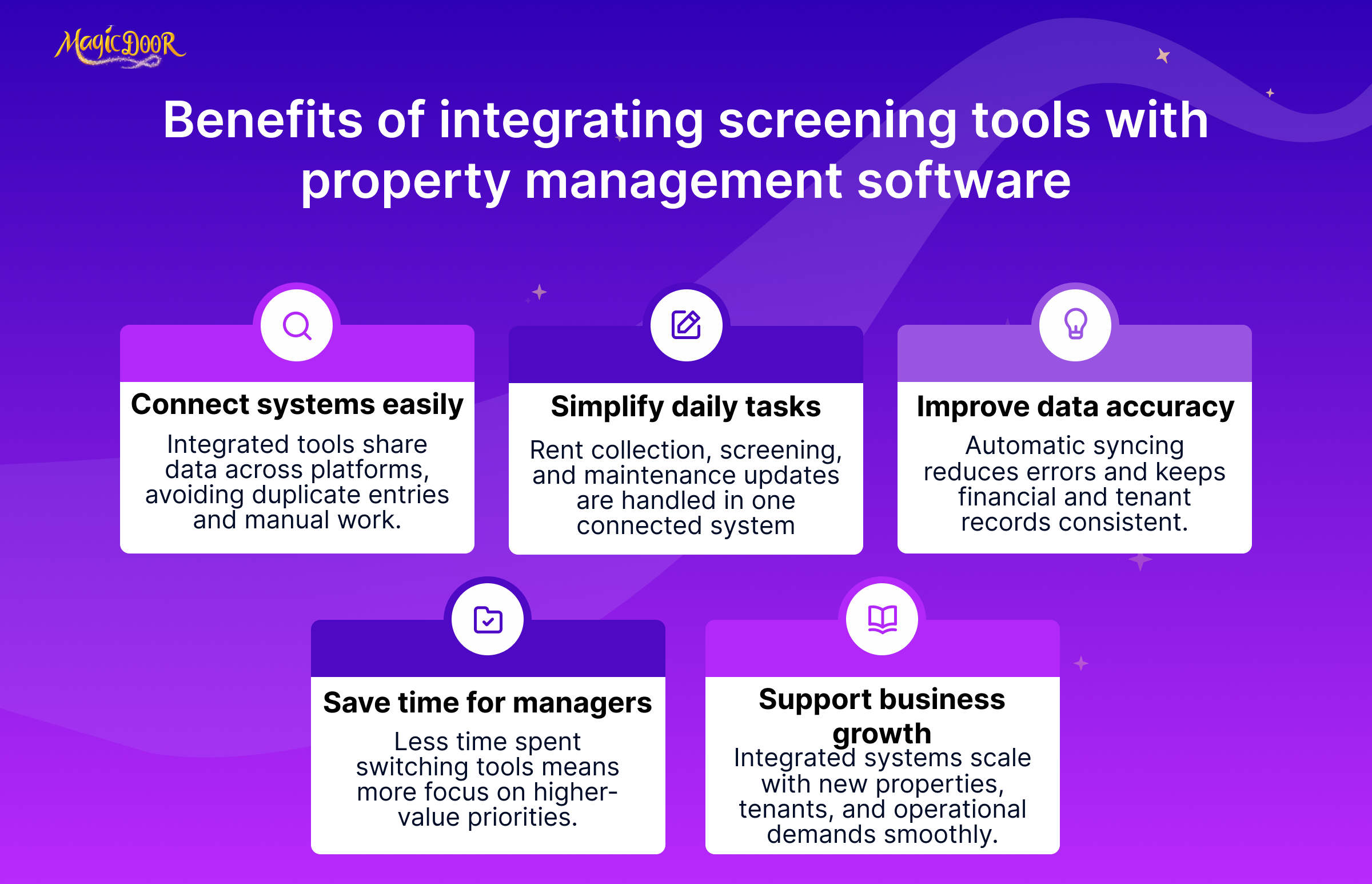

Look for Platforms That Integrate With Your PM Software

Running tenant checks in isolation creates more admin work. Instead, many landlords prefer property management platforms where the screening process, lease agreement, and rent collection connect in one system.

Integration benefits:

- Import applicant data directly from rental applications

- Sync approved tenants into lease management and rent collection workflows

- Keep detailed reports stored with maintenance requests and financial records

- Eliminate duplicate data entry and hidden fees

When tenant screening tools work alongside rent payments, maintenance tracking, and financial reports, property managers gain a single source of truth for all rental operations.

MagicDoor Makes Tenant Screening Simple

MagicDoor combines modern tenant screening services with a full property management platform, giving landlords and property managers one place to handle applications, rent collection, and accounting.

Backed by $4.5 million in recent seed funding, MagicDoor is built for long-term reliability and growth.

What sets it apart:

- AI-powered evaluation: automatically summarizes applications and generates a screening score for quick decisions

- Permanent, one-time reports: unlike TransUnion or others, you pay once and always have access

- Comprehensive reports: credit details, eviction reports, criminal records, and income verification in a single file

- Tenant-paid screenings: applicants cover the fee, making it cost-efficient for property owners

MagicDoor offers accurate, affordable, and future-ready tenant screening services without monthly fees or limited access windows for landlords managing one rental property or real estate agents handling multiple units.

Conclusion

Good tenants make property management easier. The right tenant screening report helps avoid late rent and disputes and builds stronger relationships with potential tenants from the start. Whether managing a single rental property or scaling an extensive portfolio, reliable screening saves hours of admin work and reduces costly risks.

With tools like MagicDoor, you can merge background checks, payment processing, and tenant communication in one place, with no monthly fees and no wasted time.