The U.S. residential real estate market in 2025 will face the challenges of improving mortgage rates, changing home prices, and increasing inventory levels. Following years of volatility driven by the pandemic, inflation, and fluctuating interest rates, 2025 will be a key year for buyers and sellers.

Here’s a comprehensive look at the key data points and predictions driving this year’s housing market.

Why Are Residential Real Estate Statistics Important for Buyers, Sellers, and Investors?

Understanding residential real estate statistics is essential for making informed decisions.

These statistics clearly show the current state and trends of the housing market, offering valuable guidance to buyers, sellers, and investors.

For buyers

- Budget planning: Real estate statistics, such as median home prices and the average cost per square foot, help buyers estimate the budget they need to purchase homes in specific areas. Knowing the average price of single-family homes in a region allows buyers to compare options accurately.

- Timing the purchase: Data about inventory levels and the average number of days properties remain on the market can indicate whether it’s a buyer’s or seller’s market. Buyers might find better negotiation opportunities when inventory is high and houses sit longer.

- Neighborhood comparisons: Buyers can use statistics to compare neighborhoods. Information such as property age, local affordability, and average rental rates can guide buyers toward areas that match their priorities.

For sellers

- Pricing accuracy: Sellers can use real estate reports to price properties competitively. Knowing the average sale price, sales volume in the area, and market trends ensures sellers attract serious offers without undervaluing their homes.

- Market positioning: Understanding demand and average property condition data helps sellers strategically prepare their homes for sale. This may include staging insights or small renovations that target what buyers are actively pursuing.

- Predicting buyer behavior: Sellers can gauge buyer interest through data like recent sales activity and housing availability. Fewer active listings combined with quick sales suggest a strong market where sellers can price confidently.

For investors

- Spotting opportunities: Investors rely on localized statistics to identify areas with high growth potential. For example, if demand for affordable apartments rises in a specific state, it could signal an area ripe for development or rental investments.

- Risk assessment: Factors like interest rates, property tax trends, and foreclosure rates help investors understand market stability. They can avoid risky investments by evaluating such data and choosing properties with steady appreciation potential.

- Market trends for returns: Historical sales data and rental yield averages guide investors in estimating future returns. Investors can also explore emerging markets by analyzing demographic and socioeconomic data shifts.

Benefits of Understanding Residential Real Estate Statistics

Negotiation Advantage

Negotiation in residential real estate requires a deep understanding of numbers and trends to support strategic decisions. Residential real estate statistics offer a significant advantage by providing clarity and evidence during these discussions.

Accurate data on recent sale prices within the neighborhood helps establish reasonable expectations for property value.

When parties use well-researched numbers during conversations, they create a fair starting point. Knowing homes' average time on the market and current inventory levels can also reveal insights about urgency and leverage.

For example, if a property has been listed for an extended period, buyers might use that detail to negotiate a lower price or request additional terms.

Market conditions are influential.

When abundant residential properties are available, sellers may need to be more accommodating in negotiations.

On the other hand, limited supply can strengthen their ability to hold firm on price or minimize concessions. Understanding these dynamics, backed by reliable information, ensures both sides negotiate confidently.

Statistics allow participants to justify positions and counteroffers objectively, encouraging agreements that align with market realities.

Avoid Common Errors in Buying or Selling

Preparation and access to accurate information are often key to avoiding errors during real estate transactions.

One key strategy involves using statistics to evaluate market conditions.

Understanding how long properties stay active or analyzing the number of successful transactions in a specific timeframe creates realistic expectations. Accurate pricing is another area where errors occur frequently.

Without a clear view of recently sold properties within a neighborhood, it becomes harder to gauge value in a competitive market. Familiarity with average sale prices ensures properties are neither undervalued nor listed at unrealistic levels.

Proper preparation includes thorough inspections during the early stages. Leveraging data on common structural concerns in similar homes gives insights into potential risk areas. Avoiding surprises during the later phases often reduces costly repairs and simplifies negotiations.

Clear, fact-driven communication ensures that all parties involved are aligned every step of the way.

Incorporating trusted property statistics prevents confusion and allows conversations to remain productive. Establishing agreements based on real insights enhances transparency and often mitigates delays.

Make Long-Term Financial Decisions With Confidence

Data is your most reliable guide when making wise financial decisions in real estate. Residential real estate statistics provide crucial information that helps identify market trends, assess risks, and plan effectively.

Real estate statistics allow you to estimate property values by analyzing recent sales, rental income potential, or the average time homes stay active on the market. Tracking trends in single-family homes and understanding shifts in demand ensures that investments or sales are based on clear expectations rather than speculation.

Additionally, accessing financial metrics like cash flow data or net operating income (NOI) provides clarity about long-term benefits.

Predicting the growth potential of a residential property becomes easier when you have a clear view of its income-generating capacity compared to maintenance costs or taxes. This assessment reduces the chance of overcommitting financially or underestimating expenses.

Practical uses of real estate data include:

- Setting competitive listing prices.

- Balancing mortgage costs with predicted returns.

- Identifying emerging neighborhoods with promising growth.

Anyone exploring broader investment options should evaluate residential properties using localized statistics. This can uncover opportunities in lesser-known areas.

Reliable data also reduces reliance on intuition or emotion, keeping decision-making objective. For instance, knowing the frequency of properties sold in certain seasons helps time purchases or sales for better results.

Key Metrics in Residential Real Estate Statistics

Median Home Prices & Trends

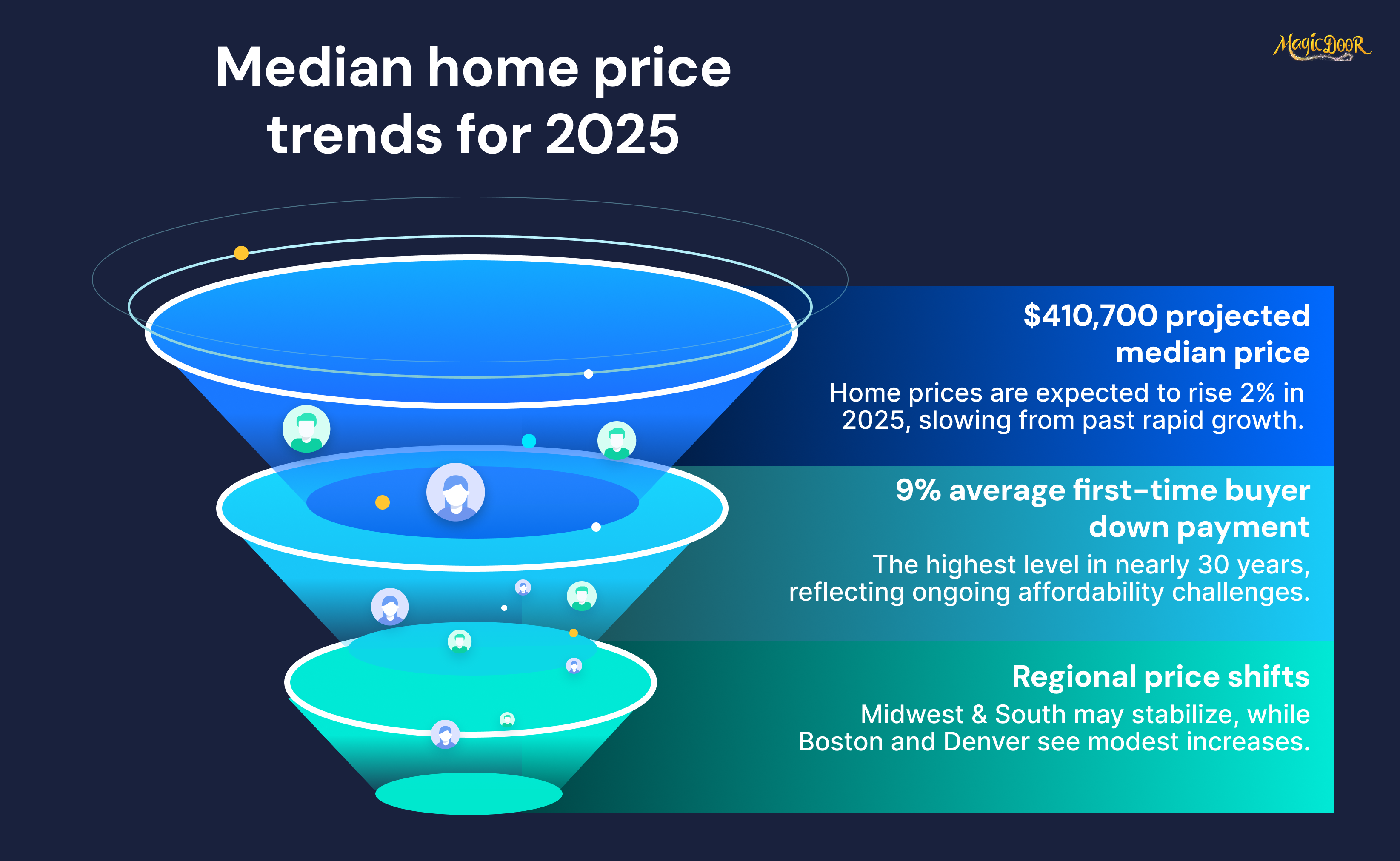

- Median home prices are predicted to reach $410,700 in 2025, marking a 2% annual increase, a significant slowdown compared to the rapid price growth of earlier years.

- Due to improving inventory, cities in the Midwest and South, such as Kansas City and parts of the Carolinas, are expected to see price stabilization or mild declines.

- However, high-demand regions like Boston and Denver may continue experiencing modest price increases due to persistent supply shortages.

- In recent years, homebuyers have faced challenging affordability barriers. Elevated home prices and mortgage rates have made saving for a down payment difficult. First-time buyers now provide an average of 9% down payment, the highest in nearly 30 years.

Average Days on Market

The average days on market (DOM) is one of the most revealing residential real estate statistics metrics. It measures the days a property remains listed for sale before reaching a signed contract.

This figure offers an overview of the state of the real estate market, helping individuals assess trends, identify opportunities, and make informed decisions.

DOM reflects the balance between supply and demand in specific neighborhoods or regions. A low number suggests that properties sell quickly, often due to competitive conditions or accurate pricing.

- National Average DOM (February 2023): 34 days, as reported by the National Association of Realtors (NAR).

- Regional Differences in March 2023:

- Austin, Texas: 59 days.

- San Diego, California: 20 days.

- Atlanta, Georgia: 34 days.

- Low DOM signals a seller’s market. Homes sell quickly due to strong demand, which often results in higher competition.

- High DOM points to buyer opportunities: Longer listings might suggest properties are overpriced or less competitive, creating room for negotiation.

Inventory Levels & Availability

Inventory levels play a critical role in understanding the residential real estate market dynamics.

This metric reflects the number of properties available for sale and highlights the balance of supply and demand.

- National inventory levels (October 2023): 1.22 million listings, a 3.3% increase from September but 0.8% lower than the previous year.

- Months’ supply of homes: Just 3.2 months, significantly below the historical average of six months, indicating constrained supply.

- Impact of market influences: Some contributors to the low inventory include strong buyer demand, pandemic-related supply chain challenges affecting construction, and increased activity by real estate investors.

- Historical comparison: Pre-pandemic inventory levels in December 2019 reached 1.03 million active listings, higher than the December 2023 figure of 714,176, according to Realtor.com data.

- Austin, Texas, reported inventory much closer to pre-pandemic levels, adjusting for demand dynamics.

- Areas seeing higher investor activity coincide with greater restrictions on available housing stock.

Mortgage Rates and Their Impact on Market Behavior

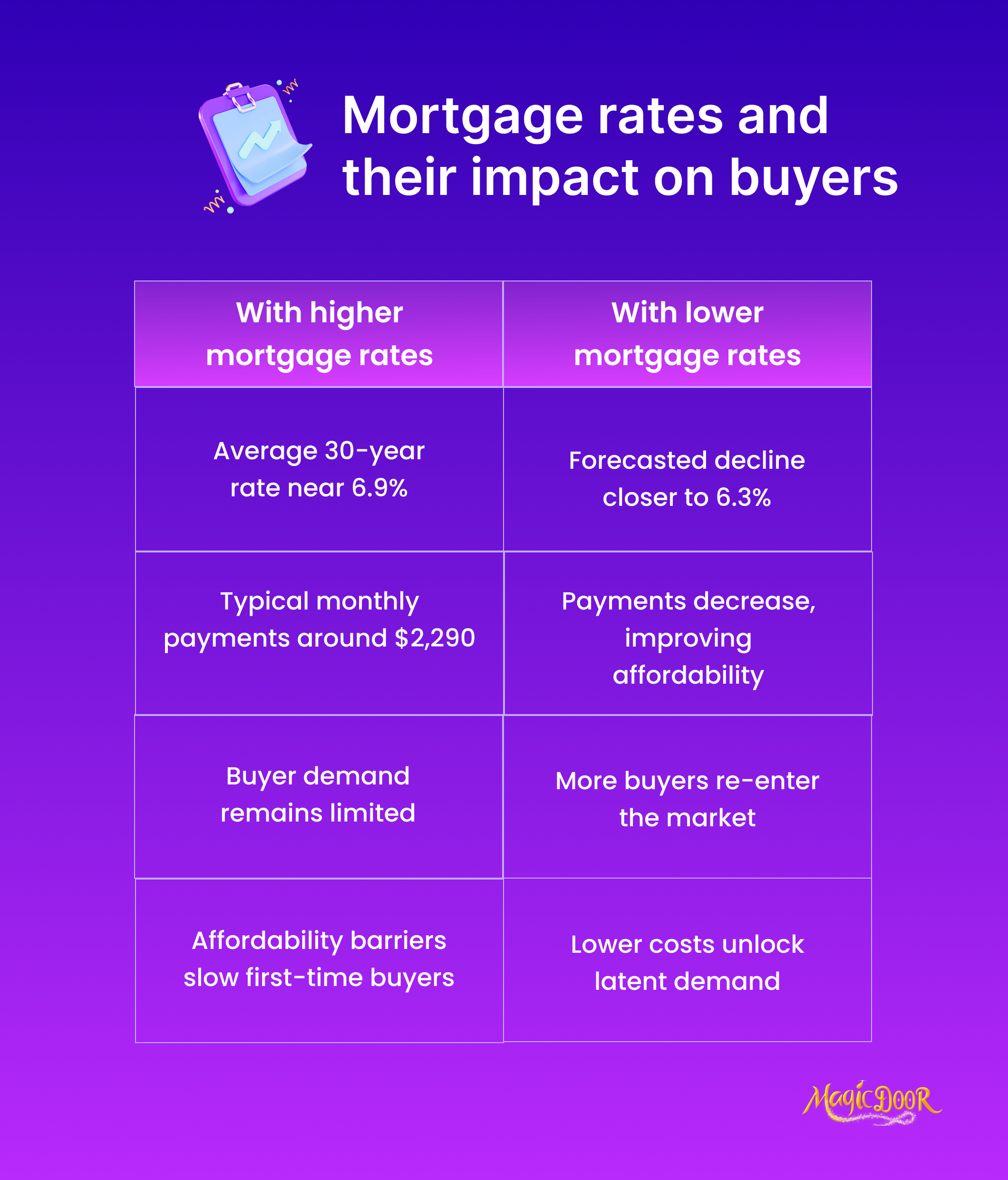

- Mortgage rates entered 2025 at an average of 6.91% for a 30-year fixed loan, slightly lower than 2024’s peaks but still higher than the historic lows seen during the pandemic.

- Experts from Redfin and the Mortgage Bankers Association forecast a steady decline throughout the year, with some projecting rates to approach 6.3% by year-end.

- High borrowing costs continue to weigh on affordability, with the average mortgage payment for new buyers hovering around $2,290 for decades. Even a modest rate decrease could unlock latent demand as more buyers enter the market.

Residential Real Estate Sales Volumes & Inventory

- The National Association of Realtors (NAR) projects existing home sales to climb by 9% this year, driven by easing mortgage rates and job growth.

- New home sales will likely increase by an even greater 11% as builders ramp up production to meet demand.

- Housing inventory has risen to a 4.2-month supply, an improvement over the 2.9 months seen in early 2024. However, a balanced market is still below the 5-6 months required.

- Homebuilders are optimistic, with renewed confidence, thanks to lower borrowing costs and strong pent-up demand.

Conclusion

U.S. residential real estate in 2025 balances positive momentum and lingering affordability concerns. Potential buyers may find more opportunities as inventory grows and mortgage rates gradually decline.

However, understanding local market dynamics will be critical for buyers and sellers aiming to thrive in this evolving landscape. Investors seeking long-term opportunities and first-time buyers managing tight budgets will find 2025 an intriguing year for real estate.