Property tax in California affects every landlord and property manager, shaping both annual budgets and long-term investment returns. From the moment a property is purchased, its assessed value becomes the basis for calculating taxes that fund local schools, infrastructure, and public services.

While the 1% base rate under Proposition 13 offers stability, local voter-approved measures, reassessments after new construction, and county-specific charges can add complexity.

This guide explains how California property taxes work, how they’re calculated, and how they influence rental income. You’ll also find strategies for staying compliant, reducing liability, and planning ahead, whether you manage a single rental home or a multi-property portfolio.

What is Property Tax?

Property tax is a mandatory annual payment levied by local governments on real estate. It is calculated based on a property’s assessed value and provides critical funding for public services such as schools, infrastructure, and safety programs.

In California, property owners receive a property tax bill each year based on the assessed value of their property.

This assessed property value is determined through a property assessment conducted by the county tax collector or assessor, and it generally reflects the purchase price adjusted annually according to the California Consumer Price Index, capped at specific annual increases under state law. For most residential properties, this tax is an ad valorem tax, meaning it’s calculated as a percentage of the property’s assessed value.

The property tax rate in California typically combines the base levy with special assessments for community services, infrastructure projects, or new construction improvements.

Tax obligations are usually split into two installments, and tax bills list details such as the parcel number, base year value, applicable fees, and due dates.

Property owners in Orange County and other counties are subject to the same general framework, though certain charges may vary by location. Failure to pay within the required timeframe can result in penalties, liens, or eventual sale of the secured property to recover the unpaid balance.

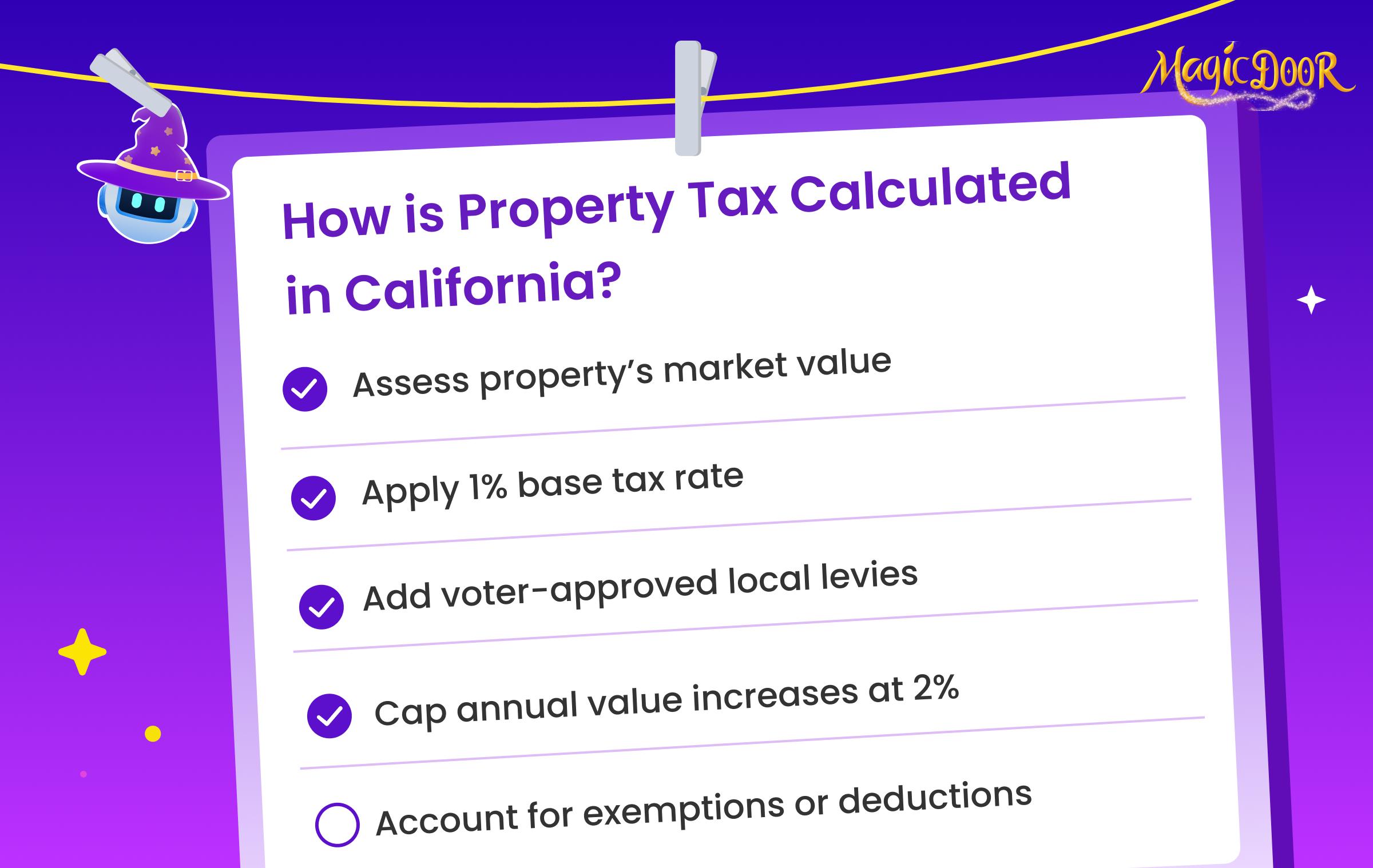

How is Property Tax Calculated in California?

Determining California property tax starts with a clear formula shaped by state law and local rules.

Each county’s tax collector calculates your property tax bill using the property’s assessed value, which is set at the purchase price or after significant new construction.

Under Proposition 13, the property tax rate begins with a standard 1% applied to the base year value. This baseline may rise by no more than 2% per year, as limited by the California Consumer Price Index, regardless of broader inflation rate or market swings.

For example, a real property purchased for $400,000 would generate an initial tax bill of $4,000. Over time, predictable increases keep annual amounts steady, creating stability for long-term owners.

In addition to the base levy, California voters can approve special assessments for local services. These charges appear on tax bills and may fund schools, parks, public safety programs, or infrastructure upgrades. Some communities, especially newer developments, include Mello-Roos fees to cover added amenities.

Local variations exist. A home in Orange County may carry the same 1% base rate as one in Los Angeles County but have different voter-approved amounts. Each county sets its own supplemental charges, making location a key factor in total liability.

Since reassessments occur only after a sale or major improvements, many owners enjoy stable rates for decades. However, new buyers should factor possible special charges into their long-term budget.

Tax relief programs can lower obligations for qualifying owners, such as veterans, seniors, or homeowners claiming exemptions. Contact your county assessor for details, including your parcel number, due date, and payment methods to ensure your account remains in good standing.

What is The Impact of Property Tax on Rental Income?

Understanding how property taxation affects rental income in California is essential for landlords looking to keep returns healthy. Property taxes are a fixed obligation for anyone managing real property, and they directly influence both monthly cash flow and long-term profitability.

Every property tax bill is based on the home’s assessed value.

If the county reassesses after new construction or a sale, the tax obligation can increase, creating higher operational costs for the owner. While Proposition 13 caps annual increases at 2% of assessed value, voter-approved measures can still add new charges.

These impacts on rental income are seen in several ways:

- Reduces net revenue: Payments toward an ad valorem tax come directly out of rental income, leaving less profit after expenses.

- Varies by location: Local assessments differ across counties, making some areas more expensive to operate in over time.

- Influences rental pricing: Landlords may raise rent to cover higher tax costs, which can affect tenant demand in competitive markets.

- Allows for deductions: Property taxes lower cash flow but may be deducted at tax time, offering partial relief for the business owner.

- Affects investment performance: Higher recurring charges can reduce overall return, especially if held for more than five years without significant value growth.

Property taxes are more than an administrative task, they are a key financial factor for every landlord with secured property, and understanding them helps protect short-term income and long-term asset performance.

Main Elements of California Property Tax

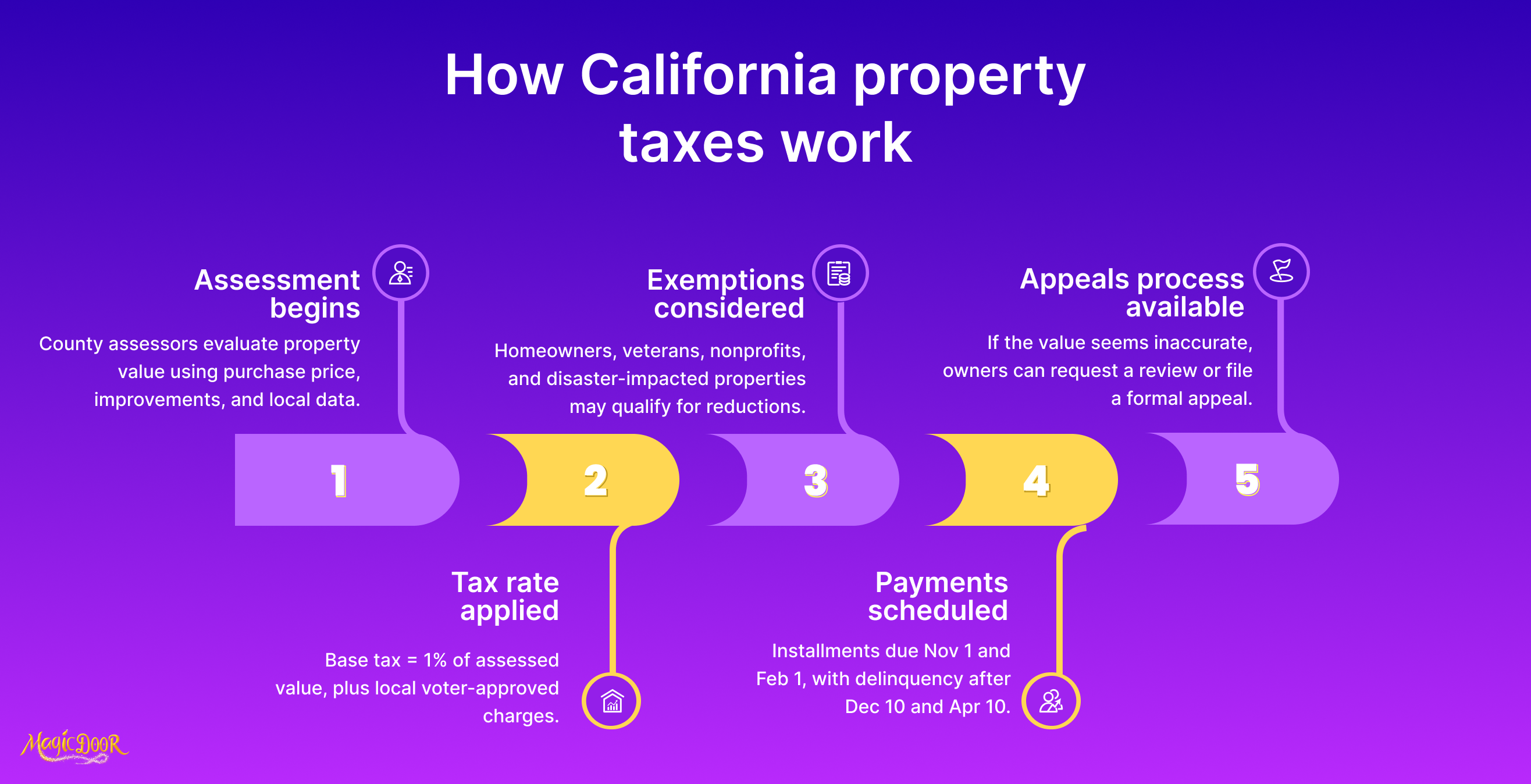

Assessment Process

The assessment process is the foundation of property tax in California. County assessors evaluate each property’s taxable value, which is used to calculate the annual tax bill. This value is often derived from the original purchase price or the cost of major renovations.

Proposition 13 limits assessed value increases to a maximum of 2% annually, regardless of changes in market conditions. This rule protects long-term property owners from sudden jumps in their tax burden caused by fluctuating property values.

However, specific events can trigger a reassessment.

For instance, transferring ownership or completing construction automatically sets a new base value, reflecting the property’s updated market value.

Additionally, county assessors rely on extensive data, including sales of comparable properties and adjustments for recent improvements, to ensure accurate valuations. This detailed process guarantees fair tax assessments, supporting county budgets while protecting property owners from unfair charges.

Tax Rates

The structure of property tax in California revolves around a straightforward principle. The base rate across the state is set at 1% of the assessed value of each property, as outlined by Proposition 13.

However, the total tax bill varies because of additional charges imposed by local jurisdictions. These supplementary levies are often voter-approved and fund services such as education, emergency response, and community improvements.

Take, for example, a home purchased for $500,000. At the standard rate, the base tax owed would be $5,000. If the property is located in an area with a school bond measure or other special assessments, the owner might pay an additional $500 or more, depending on the approved rates.

These localized charges emphasize the importance of understanding specific tax details within your property’s region. By doing so, property managers and landlords can better plan for these costs within their financial strategies.

Exemptions

Exemptions offer significant financial relief for qualifying property owners in California. They reduce the taxable portion of the property’s value, effectively lowering the total tax bill.

One of the most common benefits is the Homeowners’ Exemption, which reduces the assessed value of a primary residence by $7,000. This modest savings helps ease most homeowners’ annual financial obligations.

Disabled veterans, in particular, may qualify for substantial reductions through the Disabled Veterans’ Exemption. Depending on the level of disability and income, this exemption can result in significant tax savings.

Additionally, nonprofit organizations often benefit from exemptions tailored to their charitable purpose, reducing costs associated with property taxes.

Reassessments and reductions may be granted to properties impacted by natural disasters to alleviate unexpected financial pressure. Property owners must check with their county assessor’s office to explore all available exemptions.

Payment Deadlines

California provides a split-payment system to make property taxes more manageable.

Payments are divided into two equal installments each fiscal year. The first installment is due on November 1 and must be paid by December 10 to avoid penalties. The second installment follows, with payment required by February 1 and a final delinquency date of April 10.

Lateness incurs penalties of 10% on the unpaid portion of the tax bill, so meeting these deadlines is essential.

Many counties offer online payment options and reminders to enhance convenience. Some property managers integrate tax payments into escrow accounts, allowing lenders to handle the process.

Appeals Process

The appeals process allows property owners to challenge their assessed value if they believe it does not reflect the property’s fair market worth. This can come up when comparable properties are valued lower or if errors in assessment occur.

Filing an appeal involves submitting evidence, such as recent sales data or appraisals, to the local assessment appeals board.

Owners should adhere to strict filing periods, which differ across counties.

The initial step in disputing an assessment often begins with requesting an informal review by the assessor’s office. If no resolution is reached, formal appeals can proceed, usually requiring a detailed presentation of evidence to support claim adjustments.

A favorable ruling can lead to a reduced tax obligation and may result in a retroactive refund for overpayment.

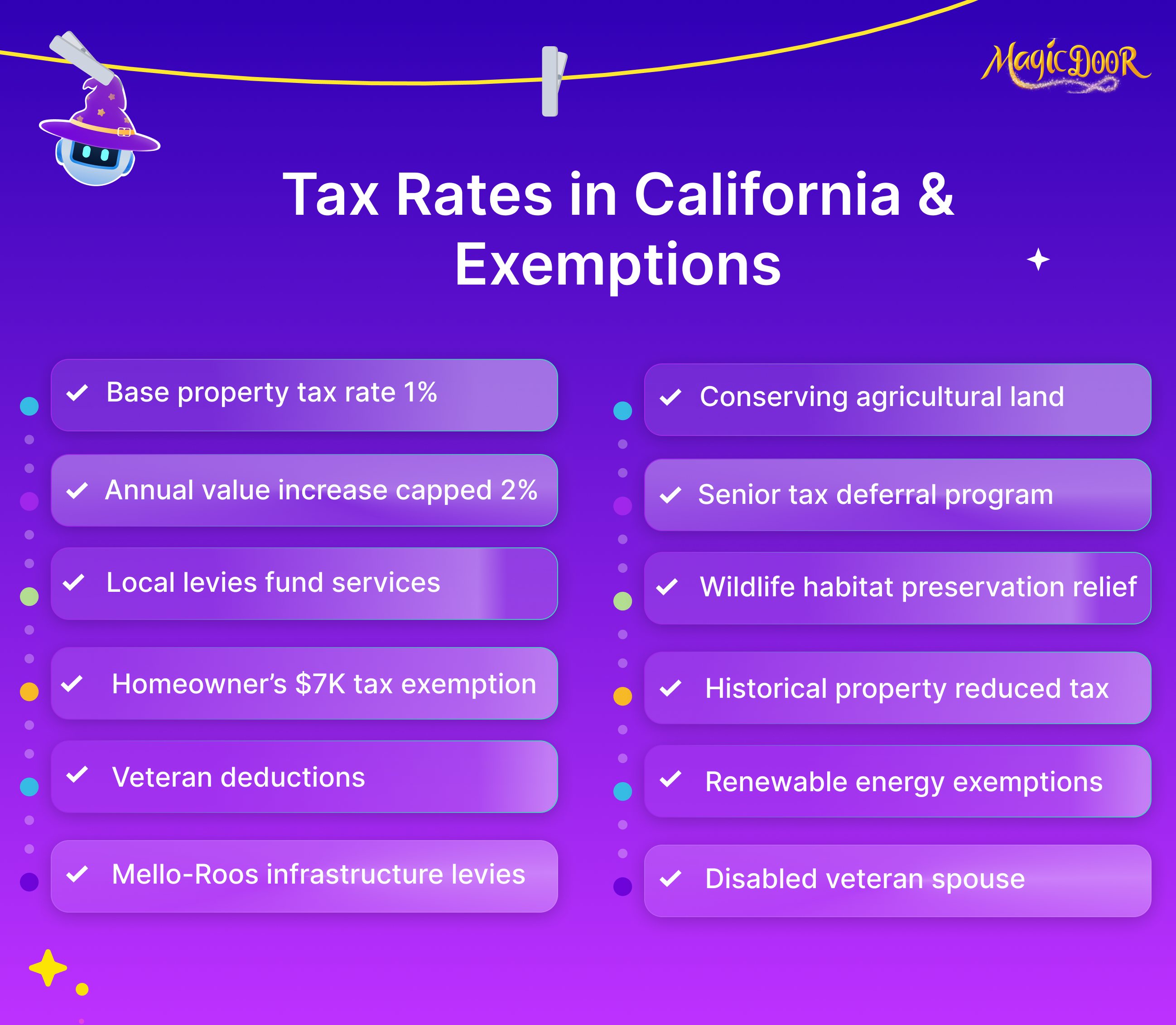

Tax Rates in California & Exemptions

Base Tax Rate

Property tax in California begins with a foundational base rate of 1%, established under Proposition 13.

This rate directly applies to the assessed value of all real estate, serving as the starting point for property tax calculations. The assessed value typically equals the purchase price when a property changes ownership.

Over time, annual increases to this value are capped at either 2% or the inflation rate, whichever is lower.

For a property purchased at $500,000, the base tax under Proposition 13 would be $5,000 annually.

Calculations remain straightforward, allowing homeowners to forecast yearly payments without surprises. However, the 1% rate is just the beginning, as additional charges and adjustments based on local conditions and voter-approved measures are also involved.

Local Levies

Local levies represent California’s additional component beyond the 1% base rate.

These charges vary by jurisdiction and typically fund services such as schools, libraries, public safety, and infrastructure projects. They are often the result of voter-approved initiatives to improve communities

For instance, a special school bond in a district might add a 0.2% charge to the property tax rate.

The cumulative effect of these charges depends greatly on location. Properties in areas with more extensive infrastructure requirements or community programs might incur higher tax bills.

For example, a home in a district with a Mello-Roos bond, frequently found in newer developments, could be charged an extra $300–$500 annually for services like new roads or utility installations.

Proposition 13 Cap

Proposition 13, passed in 1978, remains one of California’s most defining elements. It sets the base tax rate at 1% and limits the increase in assessed values to a maximum of 2% per year. This regulation ensures stability for property owners and protects them from dramatic tax hikes due to rising real estate market prices.

For example, a homeowner who purchased a property for $200,000 20 years ago would have seen its assessed value grow incrementally, subject to annual caps.

Now, even if the market value has risen to $800,000, the homeowner’s taxes are still based on the adjusted assessed value, which is much lower. These rules particularly benefit long-term property owners.

However, significant improvements or ownership transfers reset the clock entirely, triggering a reassessment of the current fair market value.

Homeowner’s Exemption

One of the most accessible tax relief options is the Homeowner’s Exemption, which reduces the taxable value of primary residences by $7,000.

Based on the 1% base rate, this translates to savings of approximately $70 annually for eligible homeowners. While the amount may appear modest, it provides consistent relief and is especially valuable for residents managing tight budgets.

To qualify, the property must be the owner’s principal residence. Applying for the exemption is a one-time process, but new homeowners should ensure they claim it after purchasing their property.

Small savings like this can increase over time, helping residents control recurring expenses and potentially reallocating funds for maintenance or other needs.

Veteran’s Exemption

California veterans can benefit from the Veteran’s Exemption, designed to assist military personnel.

Disabled veterans, in particular, receive substantial tax reductions depending on the nature and degree of their disability, as well as their income levels. This exemption can significantly lower or even eliminate their property tax burden.

Qualifying veterans should consult with their local assessor’s office to understand the specific benefits available to them. Documentation verifying military service, disability status, and income may be required.

These savings provide crucial support to veterans and their families while alleviating the financial burden of homeownership.

Property Tax Responsibilities for Property Managers

Tax Payment Management

Staying on top of due dates is critical, as property taxes are divided into two installments.

The first installment is due on November 1 and becomes delinquent after December 10. The second installment is due by February 1; penalties apply if not paid by April 10. Missing these deadlines can result in a penalty of up to 10% of the unpaid balance, creating unnecessary financial strain.

Opting for digital payment systems, such as county-specific tax portals, helps the timely submission process.

Tools like the Los Angeles Property Tax Management System offer features like tailored account setups, property tracking, and real-time payment confirmations. Property managers handling multiple holdings can benefit immensely from such tools, as they consolidate information and simplify transactions.

Record Keeping

Tax authorities in California may perform audits up to four years after filing, making comprehensive record-keeping a necessity. Documents such as payment receipts, assessor reports, and exemption filings help ensure transparency and compliance during these reviews.

Storing records digitally provides a secure and accessible option while reducing clutter.

Records related to property sales, significant renovations, and tax exemptions should be retained beyond the typical timeframe, as they can impact future assessment values and tax outcomes.

Compliance Monitoring

Laws in this domain undergo periodic updates, making it important for property managers to stay informed. Tracking changes to tax laws, such as adjustments to Proposition 13 or new local levies, helps managers accurately calculate obligations while avoiding missteps.

Non-compliance risks include government liens, audits, or financial penalties, which can damage reputations and lead to client dissatisfaction.

Partnering with tax professionals and using software designed for compliance oversight backs accuracy, streamlines workflows, and reduces potential liability for every property under management.

Budget Planning

Taxes are calculated based on the property’s assessed value, with the base rate of 1% potentially increased by additional voter-approved levies. Anticipating and incorporating these costs into annual budgets ensures smooth financial management for landlords and property owners.

Collaborative discussions with property owners about upcoming tax deadlines, assessment cycles, and possible exemption applications establish realistic financial expectations.

When budgeting for tax payments, managers can factor in unexpected events, such as reassessments due to value increases or costly renovations.

Tenant Communication

Communicating tax-related information effectively with tenants builds trust and ensures transparency. Rising taxes may influence rental pricing, particularly in regions where additional fees fund local services.

Communicating this information to tenants before implementing any rate adjustments maintains open lines of communication and justifies increases when necessary.

Additionally, educating tenants about how property taxes contribute to infrastructure, schools, and community services demonstrates a reasonable approach to rental price management.

When informed, tenants are often more willing to accept changes from property tax adjustments.

Property Tax Challenges for Landlords in California

Rising Tax Rates

Although Proposition 13 caps the base tax rate at 1% of the assessed value, additional voter-approved measures and local levies can raise total tax bills. These localized fees often fund schools, emergency services, and infrastructure improvements but vary significantly depending on the property’s area.

For example, a property in a district with a Mello-Roos bond may face hundreds of additional yearly charges.

Understanding these variations allows landlords to project expenses more accurately. Keeping abreast of local initiatives, such as bond measures or special taxes, helps property owners foresee potential cost increases.

Long-term financial planning must account for these variables to maintain profitability and avoid unexpected financial hardships.

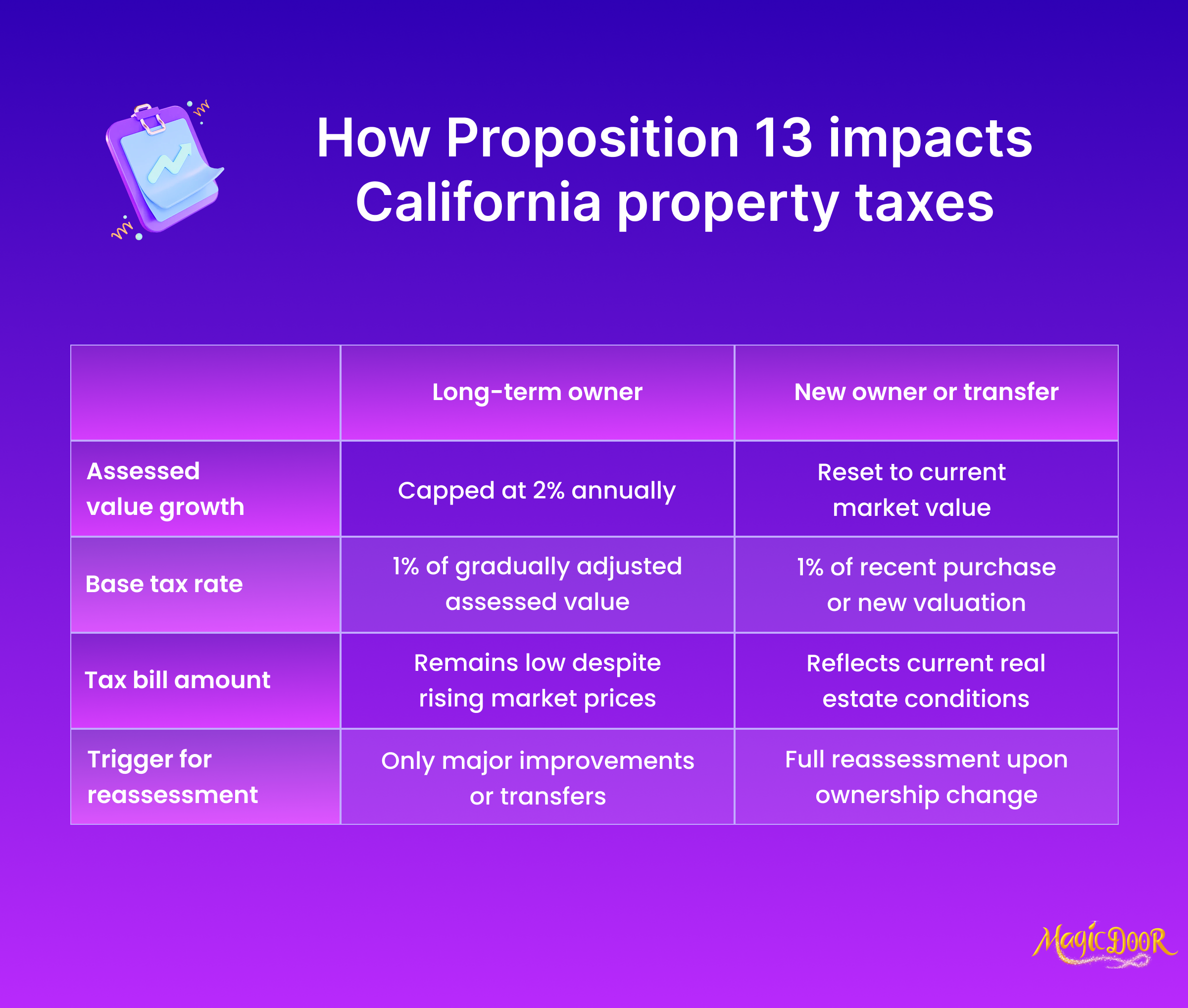

Proposition 13 Limitations

Proposition 13 restricts annual increases in assessed property values to a maximum of 2%, protecting property owners from unpredictable tax hikes driven by market fluctuations. However, its limitations have created disparities for landlords.

A property held for decades with a lower assessed value could yield vastly different tax obligations than a newly purchased property in the same neighborhood.

Such disparities often put new landlords at a financial disadvantage, with higher initial tax burdens than established owners. Additionally, reassessments triggered by new construction or ownership transfers reset properties to current market values, leading to higher taxes.

Landlords must weigh these implications carefully before purchasing or significantly improving properties.

Assessment Disputes

Errors in property tax assessments can have substantial financial implications.

A higher-than-expected assessed value leads directly to heightened tax burdens. Disputes often arise when assessments fail to reflect changes in market conditions or property characteristics, such as damage or deferred maintenance.

Property owners concerned about discrepancies should gather evidence, including recent sales data for comparable properties, property appraisals, or documented structural issues, to submit to their local assessor. Informal reviews allow landlords to resolve disputes without resorting to formal appeals.

However, consistent oversight of annual assessment notices ensures inaccuracies are caught early, avoiding years of inflated tax bills.

Compliance Issues

Changes in ownership, remodeling projects, or missed exemption deadlines often trigger landlord compliance concerns. Adherence to Proposition 13 caps and considering applicable special assessments complicate remaining compliant.

Proactively tracking all deadlines, including installment payments and reassessment notifications, safeguards against costly non-compliance. Consulting tax professionals familiar with California regulations can simplify processes, ensure accurate submissions, and reduce liability.

Using technology, such as property management software, provides an extra layer of organization to support compliance efforts.

Appeal Processes

Successfully managing the appeals process can lower an unfairly high tax bill. When property owners believe an assessment exceeds their actual market value, they can appeal through their county’s assessment appeals board.

Initial steps typically involve informal discussions with the county assessor’s office, offering an opportunity to present supporting documentation.

Formal appeals commence with filing paperwork and assembling evidence, such as appraisals or comparable sales data. During hearings, property owners must effectively prove that the assessed value requires adjustment. A successful appeal reduces future tax obligations and may result in refunds for prior overpayments.

However, adhering to appeal deadlines, often 60 days from receiving the notice of assessment, ensures that property owners maintain their rights to challenge inaccuracies.

Strategies to Optimize Property Tax Management in California

Use Property Management Tools

Managing property tax in California can become overwhelming without the right tools.

Property management software provides landlords and managers with features customized to help them effectively manage these responsibilities. Platforms like MagicDoor, for instance, offer comprehensive solutions, from organizing tax documents to tracking payment history.

These applications can also set reminders for tax deadlines, reducing the risk of late fees.

Specific tools simplify communication with tenants and provide landlords with options like automated payment reporting for tax deductions. Additionally, software that integrates bookkeeping can assist in generating reports and keeping financial records organized for taxation purposes.

- Use property management software to consolidate and track tax-related documents.

- Automate reminders for payment deadlines to avoid penalties.

- Use tools combining tenant management with financial reporting for oversight.

Hire Tax Professionals

Expert advice from tax professionals helps ensure compliance and maximize savings. Enlisting experienced professionals familiar with California’s unique property tax system offers landlords tailored guidance on managing Proposition 13 limitations or dealing with local levies.

Tax professionals ensure accurate filings and recognize opportunities for deductions or exemptions that may otherwise be missed.

For landlords with several properties or large estates, a professional can evaluate strategies to reduce liabilities and streamline all filings. Regular collaboration with these experts minimizes risks and keeps landlords updated on changing tax laws.

- Consult experts to identify deductions and avoid errors.

- Use professional advice for large portfolios or complex tax structures.

- Regularly review property tax strategies with an advisor to remain compliant.

Regular Property Assessments

One of the simplest strategies for maintaining control over property taxes in California is conducting regular property assessments. This oversight can prevent overassessments, which can lead to unnecessarily high tax bills.

Annual reviews of assessed values help identify potential discrepancies with similar properties nearby. This strategy is especially critical for landlords managing multiple buildings, where any minor assessment error can add to substantial extra costs.

Proactively addressing inaccuracies strengthens your ability to forecast accurate annual tax expenses.

- Compare assessments with local market trends to catch overvaluations.

- Review assessed values yearly to identify errors early.

- Document property changes that may impact value for future reference.

Monitor Legislative Changes

Legislation regarding property taxes constantly changes, and it requires close monitoring. Local governments can introduce or modify regulations directly impacting tax rates or exemptions.

California’s 2% annual cap on reassessments under Proposition 13 provides stability but doesn’t exempt properties from broader legislative updates on tax policy.

Subscribed newsletters or dedicated tools tracking policy changes inform landlords about upcoming amendments. For instance, alterations to Mello-Roos taxes or other special levies can result in higher property obligations within specific districts.

- Stay subscribed to resources updating on regulatory changes.

- Monitor alterations in local levies affecting specific regions or areas.

- Adjust financial forecasts to anticipate potential legislative impacts.

Appeal Unfair Assessments

Property assessment errors are common, making the ability to appeal crucial for property tax management in California.

If an evaluation seems too high compared to market trends or local comparables, landlords can request a review or initiate a formal appeal. This process involves submitting evidence, such as current appraisals, property conditions, or comparable sales data, to the county assessor.

Pursuing appeals can result in significant tax savings, and depending on the case, reductions may be retroactive. Filing within the required timelines, usually 60 days from receiving the assessment notice, ensures eligibility.

While the process demands time and effort, successfully challenging unfair assessments offsets costs and prevents extended financial strain.

- Collect and submit evidence like appraisals or sales data for fair reassessments.

- Start informal reviews before committing to a formal appeal.

- Be vigilant about appeal deadlines to safeguard appeal rights.

MagicDoor Can Help Manage Your Property Tax in California

Managing property tax in California presents unique challenges for property managers and landlords, especially with the layers of local levies, assessments, and compliance needs. That’s where MagicDoor’s AI-enabled property management software steps in, offering a smart way to tackle these complexities.

MagicDoor simplifies rent collection and tracking payments through a centralized hub that ensures uninterrupted cash flow. Automated financial management, including recurring rent payments and customizable late fee terms, adds precision to property accounting.

Its AI-driven capabilities set MagicDoor apart.

The software intelligently uses data to automate maintenance priorities and generate easy-to-understand reports. Real-time insights from MagicDoor’s Magic Score help landlords analyze property trends and tenant behaviors, creating opportunities for smarter tax planning.

Organizing documentation is vital for property tax filing. MagicDoor’s tenant and owner apps provide seamless workflows that centralize tax-related data. This ensures landlords can retrieve receipts, track expenses, and prepare for tax season without unnecessary stress.

Whether handling one property or a more extensive portfolio, the user-friendly interface keeps processes efficient.

MagicDoor also recognizes the importance of clear communication. The platform integrates tools that simplify interactions with tenants, vendors, or other stakeholders and ensures that every aspect of property management is in compliance with tax laws.

Conclusion

California property taxes are more than a line item on a budget; they shape cash flow, rental pricing, and overall investment performance. Understanding property tax rates, exemptions, and the assessment process allows landlords to plan with confidence and avoid costly surprises.

For owners seeking an efficient way to manage payments, track documentation, and maintain compliance, MagicDoor offers an all-in-one platform that combines tenant management, financial oversight, and automated reminders. Its AI-powered tools help keep records accurate, deadlines visible, and workflows efficient, freeing up time for growing your portfolio instead of chasing paperwork.

If you want a smarter, faster way to handle property taxes and day-to-day management, start exploring how MagicDoor can facilitate your operations today.