Managing rental properties from another country comes with real risks: late payments, delayed repairs, unclear communication, and legal blind spots. Without the right systems, even small issues can grow quickly.

But remote property management doesn’t have to feel out of reach.

This guide walks you through proven strategies to keep your investments running smoothly, even when you're thousands of miles away. From using technology that keeps you in the loop to building reliable local support, you'll learn how to stay in control without being on-site.

Keep reading for practical ways to simplify the process, and reduce the time you spend putting out fires.

What is Property Management?

Property management is the ongoing supervision of a property on behalf of the owner. For foreign investors in the U.S., this usually involves hiring a local manager to handle daily tasks tied to maintenance, leasing, and tenant communication.

A property manager oversees everything from repairs to tenant issues.

They collect rent, schedule maintenance, manage lease terms, and make sure the property stays in good condition. That’s critical for non-U.S. citizens who may not live near the home or understand local housing rules.

Foreign buyers often purchase single-family homes, vacation properties, or residential units in cities with strong rental demand. Managing those homes from another country requires clear communication, local knowledge, and support with legal paperwork.

Many international clients use property management services to avoid delays, track income, and reduce risks. It also helps with organizing documents for bank statements, mortgage lenders, or reporting rental income to U.S. tax authorities.

Legal Requirements for Foreign Investors in US Real Estate

Foreign investors can legally buy property in the U.S., including residential homes, rental properties, and commercial real estate. There are no federal restrictions on non-citizens owning real estate, but local rules and tax laws vary by state.

Some states limit foreign ownership of agricultural land, and zoning laws may restrict how certain properties can be used.

For example, a detached single family home purchased for investment may fall under different rules than a condo intended for personal use or short-term rental.

Foreign nationals must also understand how the Foreign Investment in Real Property Tax Act (FIRPTA) works. When a non-resident sells U.S. real estate, the buyer is required to withhold a portion of the sale price.

Some investors set up a U.S.-based LLC to hold title to the property. This can offer tax advantages, reduce personal liability, and simplify reporting obligations.

Because rules differ widely by location and ownership structure, international clients should work with a real estate attorney who understands property management for foreign investors.

Financing Regulations

Foreign nationals can finance a U.S. real estate purchase, but the process comes with stricter requirements than those faced by U.S. citizens. Most foreign buyers work with a mortgage lender that offers programs for non-resident foreigners or those without a Social Security Number.

These loans often require a larger down payment, usually 30% or more, and come with slightly higher interest rates.

To arrange financing, foreign citizens must provide documents that confirm identity and financial stability. That includes bank account statements, proof of income, and credit history from their home country.

In many cases, lenders also ask for a U.S. bank account to facilitate future payments and taxes.

Since credit reporting systems vary across countries, mortgage approvals may take longer. Some buyers work with a real estate agent who has experience handling international transactions and can recommend lenders familiar with non-U.S. documentation.

Purchasing an investment property or vacation home as a non-citizen often means dealing with additional steps, such as a home inspection, title search, and added closing costs. Buyers planning to generate income through rental activity should confirm that the loan terms allow it.

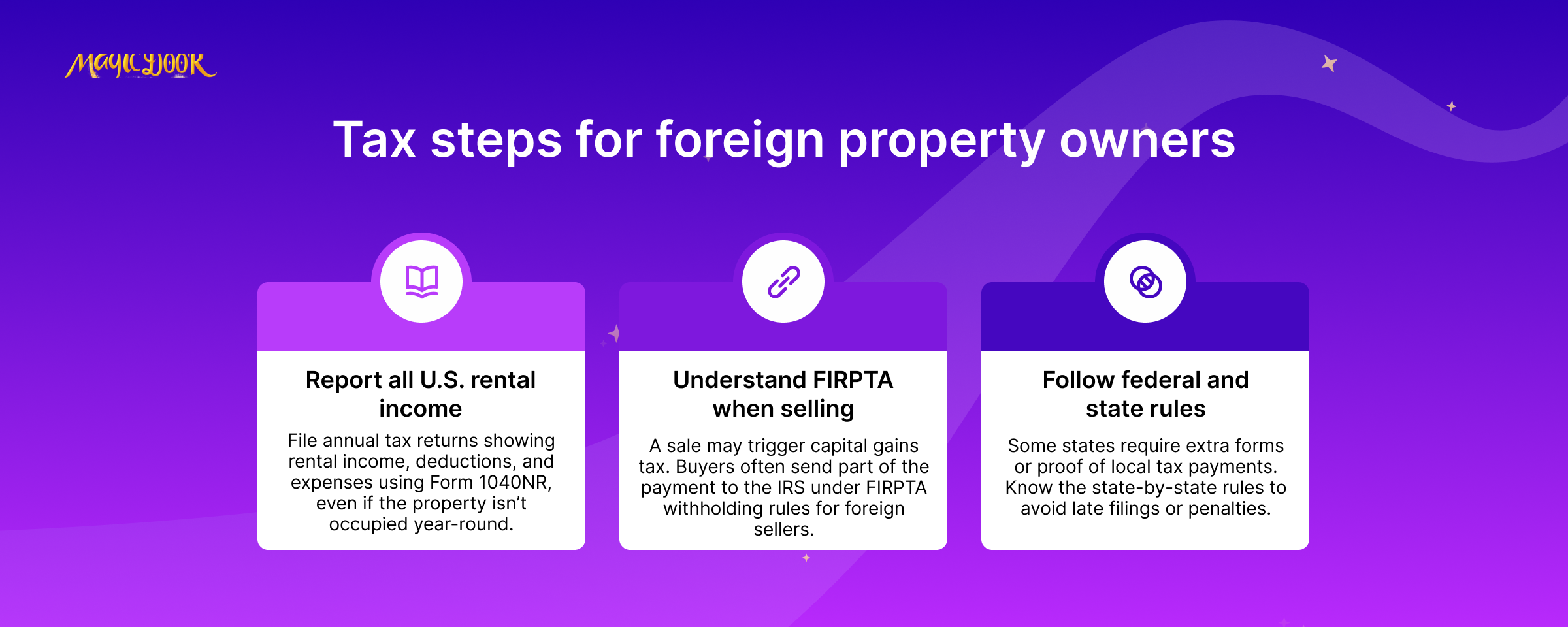

Reporting Obligations

Foreign buyers who earn income from U.S. real estate must follow specific tax reporting rules.

Rental income, capital gains from a sale, and certain expenses all need to be documented on an annual tax return.

Non-U.S. citizens who own a residential property or vacation home for investment purposes typically file Form 1040NR. This return includes income, deductions, and any withholding that may have occurred at the time of sale.

When a foreign national sells a house, the transaction may trigger a capital gains tax under the Foreign Investment in Real Property Tax Act (FIRPTA). In most cases, the buyer withholds part of the payment and sends it to the IRS on behalf of the seller.

In addition to federal requirements, some states ask non-residents to file property-specific forms or submit proof of local tax payments.

Working with a tax advisor or real estate agent who understands foreign ownership can help non-citizens avoid delays and penalties.

Common Challenges With Managing Properties Remotely

Communication Gaps

For foreign investors, managing a property from abroad can make basic communication harder than expected. Tenants might send messages during your night hours.

Small issues, like a broken appliance or a missed rent payment, go unanswered for too long, damaging trust.

Language can add another layer of confusion, especially when lease terms or payment instructions aren’t clear. Misunderstandings over rules or timelines often lead to frustration on both sides.

Property management tools with built-in messaging, document sharing, and repair tracking help reduce delays. But many foreign buyers still prefer hiring a local property manager to keep communication consistent and reduce friction with tenants.

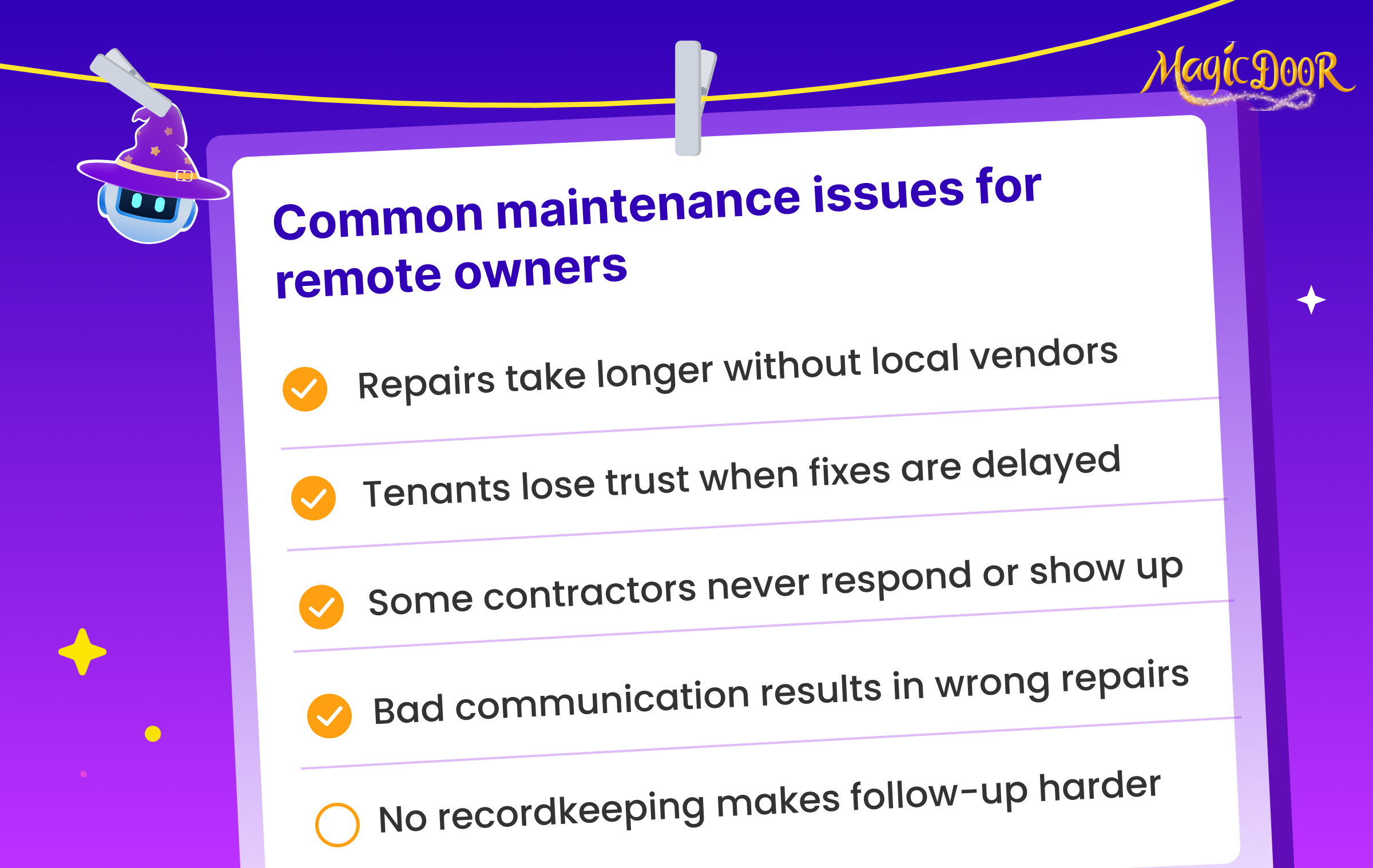

Maintenance Delays

Maintenance is one of the most visible parts of managing a rental, and it’s also where remote owners feel the most pressure. Without a trusted network of vendors, simple repairs take longer, and tenants notice.

Coordinating repairs from another country is hard.

Contractors may not respond promptly. Some may not show up at all. If there’s a language barrier or unclear instructions, the job might be done wrong, forcing more follow-up.

Most experienced property managers already work with reliable service providers. They also track every work order and timeline, helping investors document maintenance history and protect the property’s long-term value.

Tenant Verification

Verifying tenants from abroad introduces risk. You don’t get to meet them, ask questions in person, or review physical documents.

Instead, everything relies on digital screening tools and third-party checks.

That works in most cases, but it also increases the chance of missing red flags. Income verification, past rental history, and ID validation are harder to confirm when done remotely, especially across countries.

Property managers use specialized software to fill these gaps. They also know what local landlords expect and can spot inconsistencies foreign nationals may overlook.

Legal Compliance

Real estate law in the U.S. isn’t consistent. Every stat, and sometimes each city, has different rules around rentals, property taxes, lease terms, and tenant rights.

Foreigners buying property often miss critical updates.

For example, a new ordinance could limit short-term rentals, or updated inspection standards might apply to residential units over a certain size.

Online legal resources help, but most remote investors prefer to work with attorneys or property managers who monitor local requirements. That support reduces the chance of violations and keeps the investment compliant over time.

Time Zone Differences

Time zone mismatches slow everything down, from responding to maintenance requests to dealing with rent issues. When tenants need help, the owner might be asleep. When vendors are available, the investor might be working.

This lag leads to missed opportunities, slow resolutions, and tenant frustration.

The fix is a mix of automation and expectation-setting. Auto-replies, scheduled maintenance tools, and online portals keep things moving. Tenants get transparency, and owners stay informed, even if they’re managing the house from 5,000 miles away.

Considerations for Foreign Investors in US Property Management

Understand the Market You're Entering

Before buying a house or residential property in the U.S., foreign buyers need a clear picture of local market conditions. This includes pricing trends, neighborhood demand, and legal zoning rules. Cities like Austin and Raleigh have seen consistent growth, attracting non-residents seeking stable returns.

Market reports from sources like the National Association of Realtors or property sites like Zillow help track existing home sales, rental yields, and inventory changes.

For investors focused on rental income, areas with strong job growth and high tenant demand are worth prioritizing.

It’s also important to understand regional rules. Some counties impose ownership restrictions or property-specific taxes that may not apply to U.S. citizens.

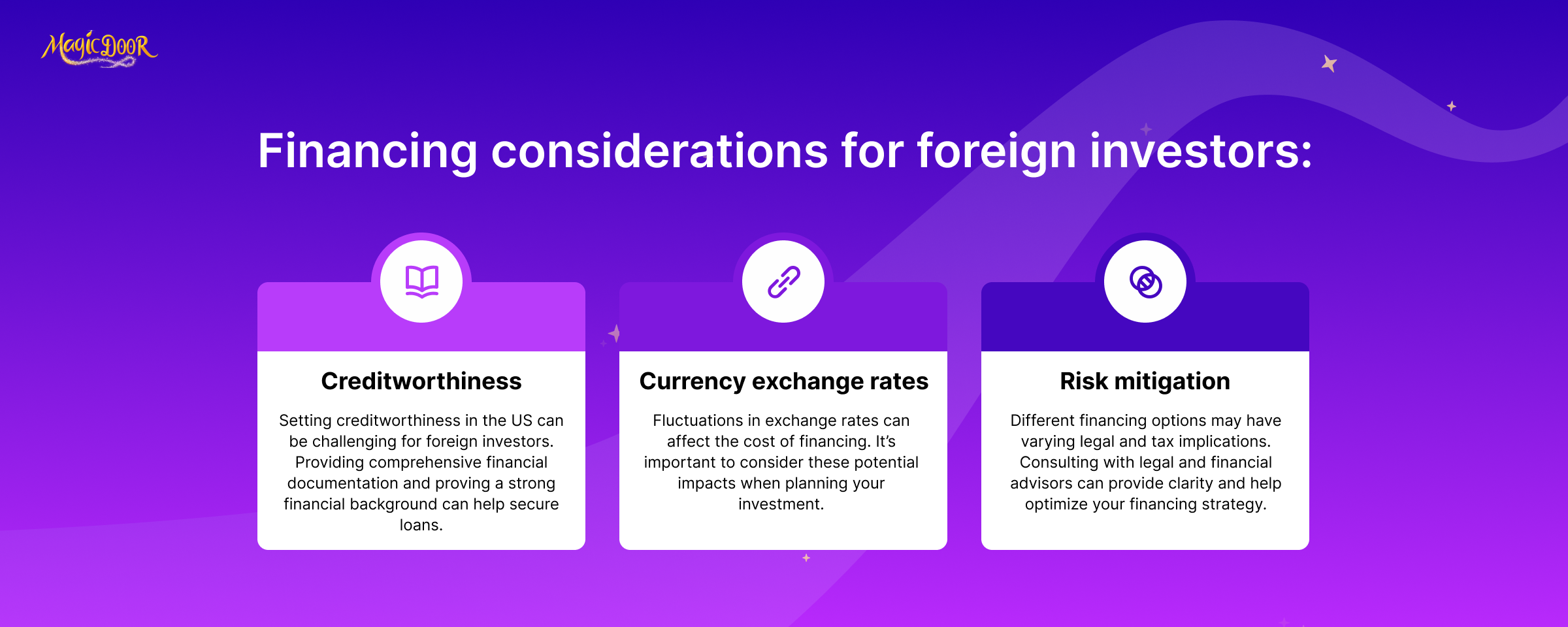

Watch Currency Exchange and Financing Costs

Currency exchange rates can change between the time you start a home purchase and when you finalize payment. For foreign nationals using a weaker currency, this difference can increase total costs.

To manage this risk, many investors use forward contracts or consult financial advisors to lock in favorable rates.

It’s also smart to compare conversion fees across banks to avoid unnecessary losses when moving rental income back into your home currency. Since many foreign buyers aim to generate income from U.S. properties, it’s worth reviewing resources like How to Prepare for Tax Season as a Landlord to stay ahead of reporting deadlines and avoid tax surprises.

AI bookkeeping tools can also help track exchange-related expenses and income fluctuations in real time, making it easier to monitor profitability across multiple currencies.

If you plan to arrange financing in the U.S., most lenders will ask for international credit history, proof of funds, and a larger down payment than they would from a local buyer. Some programs backed by the Federal Housing Administration are available, but most foreign investors rely on private lenders.

Know What You're Paying For in Management Fees

If you're not physically present, hiring a property manager is almost always necessary. But not every company offers the same level of service for the same price.

Most charge 8–12% of the monthly rent as a base management fee.

On top of that, you may see a one-time leasing fee (often one month’s rent) and extra charges for maintenance, inspections, or tenant placement.

Always review the contract closely. Know what’s included in the monthly fee and what counts as an add-on. Ask about reporting, local vendor access, and response time expectations, especially if the property is a vacation home or located in a region you’ve never visited.

Stay Focused on the End Goal

Every foreign investor has a different reason for buying U.S. property. Some want a long-term income stream from a residential property in a growing market.

Others are looking for short-term gains through flipping or a potential green card path tied to economic activity.

If you're investing for passive income, look for properties near job centers with low vacancy rates and stable rent growth. If your priority is long-term value appreciation, focus on markets with infrastructure development and population growth.

No matter the strategy, define your exit plan early.

Know when you intend to sell, what tax implications like capital gains tax might apply, and how that decision fits into your broader financial goals across many countries or asset types.

How Can a Foreigner Buy Investment Property in The US Through a Business?

Forming an LLC

Creating a Limited Liability Company (LLC) is a common route for non-resident investors. It separates personal and business assets, reducing exposure to legal claims related to the property.

Rental income and expenses are reported under the LLC, simplifying tax filings in many cases.

Basic steps:

- Choose the state where the property is located

- Register the LLC with a unique business name

- Appoint a registered agent for legal notices

- File Articles of Organization

- Set up an operating agreement

- Apply for an EIN from the IRS

An LLC is widely used by foreigners buying property for investment purposes, especially when holding residential units or small portfolios.

Establishing a Corporation

Setting up a corporation can offer advantages for larger portfolios or commercial holdings. Corporations provide legal protection and have access to broader financing options, but involve more administrative tasks and ongoing compliance.

Steps include:

- Incorporate in a chosen state

- File Articles of Incorporation

- Appoint a board of directors

- Write corporate bylaws

- Determine share structure

Corporations are typically better suited for investors building a U.S.-based real estate business, not just holding a single house or vacation home.

Partnering With a U.S. Entity

Foreign nationals often enter the market by partnering with an existing U.S. company. These partnerships combine funding with local experience, making it easier to deal with legal, financial, and property management responsibilities.

To set up a partnership:

- Research experienced firms with a strong reputation

- Review past investments, legal standing, and available resources

- Define each party’s role and profit share in a formal agreement

- Work with legal and tax advisors to document the terms

This structure can be useful for investors who want local support without setting up a U.S. entity independently.

Using a Real Estate Trust

A real estate trust places the property under the control of a trustee. This structure is used for privacy, legal protection, or estate planning.

Instead of listing the investor’s name on public records, the trust holds title to the property.

Key steps:

- Choose a trust type (revocable or irrevocable)

- Appoint a trustee

- Work with an attorney to draft the trust agreement

- Transfer ownership of the property into the trust

Trusts require legal guidance and come with ongoing costs. For non-U.S. citizens focused on long-term asset protection or succession planning, this option may be worth exploring.

Creating a Joint Venture

Joint ventures give foreign buyers access to U.S. real estate by combining resources with a local partner. The foreign party contributes funding, while the U.S. partner handles management, permitting, and compliance.

Structure typically includes:

- Shared investment goals

- Defined capital contributions

- Clear division of roles and decision-making

- A legal agreement outlining the full scope of the project

Joint ventures are often used for commercial real estate or development projects where oversight and speed matter.

Financial Planning for Foreign Property Investors in the USA

Tax Implications

Foreign buyers investing in U.S. property must account for tax obligations at every stage, from rental income to resale.

Requirements include:

- FIRPTA withholding: When a foreign investor sells a U.S. property, the buyer must withhold part of the sale under the Foreign Investment in Real Property Tax Act. This ensures capital gains tax is addressed at the federal level.

- Rental income tax: Any income generated from residential or commercial rentals must be reported to the IRS. Investors can deduct eligible expenses, such as mortgage interest, property management fees, and repairs.

- Estate tax exposure: U.S.-based assets may fall under federal estate tax laws. Holding property through a legal entity, such as a corporation or trust, may reduce exposure depending on structure and jurisdiction.

To reduce tax burdens:

- Hire a U.S.-based tax advisor with experience in international real estate.

- Review tax treaties between the investor’s home country and the U.S. Some agreements lower withholding rates or simplify reporting.

- Evaluate ownership structures early. An LLC or corporation can provide strategic benefits, but each setup has its own filing rules and liability considerations.

Financing Options and Loans

Securing financing in the U.S. as a foreign national requires advance preparation. Access to loans may be limited, but several options exist depending on documentation, credit history, and down payment.

Available structures:

- Traditional mortgages: Some U.S. banks lend to foreign nationals. These loans typically require a larger down payment, often 30% to 50%, and interest rates may be higher than those offered to U.S. citizens.

- Portfolio loans: These loans are kept by the lender instead of being sold on the secondary market. Requirements tend to be more flexible, which can benefit foreign buyers without local credit files.

- Cash purchases: Buying with cash simplifies the transaction and removes loan conditions but requires significant capital up front.

When applying:

- Document income, assets, and liabilities in detail. U.S. lenders will often request financial statements, international credit reports, and bank references.

- Consider exchange rate impacts. Currency fluctuations affect purchasing power and future mortgage payments.

- Understand local laws and tax rules tied to the financing structure you choose.

To increase approval chances:

- Work with lenders who specialize in non-resident financing.

- Prepare a clean file with translated and certified documents.

- Explore joint ventures or local partnerships to improve access and simplify underwriting.

Risk Management and Insurance

Every property carries risk, but foreign investors face added variables, currency changes, limited supervision, and legal complexity.

Insurance protects against sudden events and financial loss. The most common types include:

- Property insurance: Covers damage from fire, theft, weather events, and other hazards.

- Liability insurance: Provides coverage if someone is injured at the property and seeks legal compensation.

- Loss-of-income insurance: Replaces rental income if a covered event renders the property uninhabitable.

Coverage should reflect the value of the asset, local risk factors, and the investor’s financial goals. A policy suited for a primary residence may not apply to a rental or vacation home.

Review annually. If the portfolio expands or market conditions change, coverage may need to be adjusted.

Work with a licensed agent who understands foreign ownership, especially if the property is held in a trust or LLC. Insurance needs may vary based on location, structure, and use.

How to Manage Properties Remotely as a Foreign Investor

Use AI Property Management Software

Reliable software can reduce the friction of managing property from abroad. A strong platform offers tools to track repairs, view lease status, monitor payments, and message tenants, all in one place. The best rental management software often includes AI tools that replace manual property management tasks, helping you stay efficient no matter where you are.

AI automation is a major advantage.

Rent reminders, late fee notices, and lease renewals can run on autopilot, reducing delays and manual oversight. Some platforms also apply agentic AI to improve property management workflows, making decisions based on logic rather than pre-set rules.

Most platforms include built-in analytics. You can monitor occupancy, income trends, and expenses remotely, helping you stay alert to changes in property performance.

Look for tools with cloud access, mobile support, and simple pricing. Features like in-app messaging and maintenance tracking can simplify coordination across time zones.

MagicDoor is one option that covers everything above.

It centralizes operations, automates daily tasks, and includes AI features to manage communication, billing, and lease renewal, ideal for managing U.S. properties remotely.

Work With a Local Property Manager

Hiring a trusted manager on the ground can help maintain rental quality and tenant satisfaction. They handle tenant screening, repairs, rent collection, and emergencies on your behalf.

Their knowledge of local regulations and pricing trends helps reduce risk. They can also catch maintenance issues early and act without delay.

A good manager improves tenant experience, often resulting in longer stays and fewer complaints.

Look for someone with a strong reputation, quick communication, and experience working with foreign clients.

Conduct Virtual Inspections

Virtual inspections help you maintain oversight without flying in. Video calls and inspection apps allow you to view interior and exterior conditions, verify maintenance, and check tenant compliance with lease terms.

These sessions can be live or recorded.

Supplement with 360-degree tours and timestamped photos for full transparency. This setup gives you documentation for future disputes, move-outs, or property inspections.

Regular inspections show tenants you're involved, even from abroad. It also helps you act early if anything needs attention, before it turns into a bigger issue.

Always brief tenants in advance so they know what to expect and how to prepare.

Set Up Clear, Consistent Communication

Managing from abroad depends on reliable communication. Missed updates can lead to payment delays, unresolved repairs, or frustrated tenants.

Use tools that centralize messages, like built-in chat features in your property software, so conversations don’t get lost across apps or time zones.

Regular updates build trust and reduce friction. Monthly check-ins with your property manager and occasional updates to tenants keep everyone on the same page.

Encourage feedback from tenants. You’ll usually spot issues faster by listening early, not waiting for a formal complaint.

Automate Repetitive Tasks

Automation reduces manual errors and keeps everything on schedule. Tasks like lease renewals, rent reminders, and invoice follow-ups can run on fixed timelines without your daily input.

Use auto-pay systems to avoid late payments. Add scheduled notices for expiring leases or upcoming inspections. Some tools even flag irregularities in tenant behavior or rent trends.

The goal is not to replace involvement, but to reduce the amount of attention each task demands. Once your workflows are set, you can focus on scaling instead of micromanaging.

Choose systems with strong security, mobile access, and clear audit trails.

Use MagicDoor To Manage Your Properties From Abroad

Managing properties remotely requires more than just communication tools, it demands structure, visibility, and automation.

MagicDoor brings all of that together in one simple platform.

You can handle rent collection, lease renewals, maintenance tracking, and tenant messaging without switching between apps or relying on manual follow-ups. MagicDoor automates these tasks and logs every action under each lease, so nothing slips through.

The platform offers real-time insights into payments, occupancy, and property performance.

You can track income, spot trends, and review activity from anywhere, no spreadsheets, no guesswork.

MagicDoor also supports direct messaging, file storage, and policy uploads. Need tenants to submit insurance or respond to reminders? The system handles that for you, with built-in prompts and logs you can access anytime.

There’s no monthly subscription or surprise add-ons. Just one platform built to simplify remote property management, so you can stay in control from across the globe.

Try MagicDoor for free and see how much easier remote ownership can be.

Conclusion

Owning property abroad shouldn’t mean waking up to problems you can’t fix. With the right setup, you can stay informed, keep tenants happy, and protect your income, without being on the ground.

MagicDoor was built to make this possible.

It automates key tasks like rent tracking, renewals, and maintenance while giving you full visibility into what’s happening with each unit. Real-time insights, clear communication, and no subscription fees.

If you’re ready to manage properties without second-guessing every detail, try MagicDoor today.

Frequently Asked Questions

Are foreigners allowed to buy property in the USA?

Yes, foreigners can buy property in the USA. There are no citizenship or residency requirements for owning property.

Can I buy a house in the U.S. if I am not a citizen?

Absolutely. US real estate laws allow non-citizens, including those without permanent residency, to purchase homes.

How to invest in real estate in the U.S. as a foreigner?

You can invest in properties directly or through real estate investment funds. To get started, secure financing (if needed), research local markets, and work with professionals who understand local real estate laws.

Can I buy land in the USA without a visa?

Yes, you don’t need a visa to buy land in the US. The process is open to all foreign investors, regardless of immigration status.