Collecting rent as a landlord doesn’t have to be complicated.

The right system can reduce late payments, cut down on manual work, and give you more control over your rental income and property management. From online rent collection platforms to traditional options like checks or bank transfers, there are multiple ways to collect rent that work for landlords and tenants.

This guide walks you through each method, highlights tools like MagicDoor, and shows you how to reduce delays, track rent payments online, and protect your rental income without uncertainty.

Rent Payment Methods for Landlords & Tenants

Choosing how tenants pay rent affects more than convenience; it makes how smoothly you manage your rental property month to month.

Different rent payment methods come with different levels of speed, reliability, and cost.

Online Payments

Online payments are one of the most effective ways to collect rent quickly and reliably.

Many tenants already use digital tools for banking, so offering online rent options feels natural. Platforms like MagicDoor, PayPal, or Zillow Rental Manager are rental management software that let tenants pay rent online using their preferred payment method, including debit card, credit card, or bank transfer.

Here’s how to make the most of it:

- Use a secure rent collection tool that supports recurring payments

- Let tenants choose between ACH transfers, debit card payments, or digital wallets

- Offer rent reminders to help encourage on-time payments

- Enable features like block partial payments or automated late fees if supported

Online rent collection helps property managers stay organized, reduces late payments, and improves recordkeeping during tax season.

Bank Transfers

Bank transfers give tenants a direct way to pay rent without using checks or cards. Many landlords prefer this method because it skips cash handling and reduces late payments.

Set clear instructions upfront.

Share your bank account and routing number and confirm which day of the month tenants should transfer funds, to help avoid delays and confusion.

ACH transfers are common. They offer lower processing fees than cards and make it easier to track rent payments across multiple properties.

Some landlords use property management software to log transfers and match payments to tenants. This works for all types of residential properties.

It’s also smart to monitor incoming transfers regularly. That way, any missed rent payments or errors get caught early, before they become a problem at tax season.

Credit/Debit Cards

Allowing tenants to pay rent with a credit or debit card gives them speed and convenience. Payments clear quickly, and receipts are generated instantly.

To set this up, choose a rent collection tool or online payment platform that supports card payments. Options like MagicDoor, Stripe, or Square let tenants use their preferred card safely and with minimal hassle.

Be upfront about platform fees and any added charges.

Most credit card payments come with transaction fees, usually around 2.5% to 3%, which can be passed to tenants if allowed.

Tenants can pay rent online from any device, which helps support on-time payments. Because card payments are recorded automatically, there’s no need for manual tracking or paperwork.

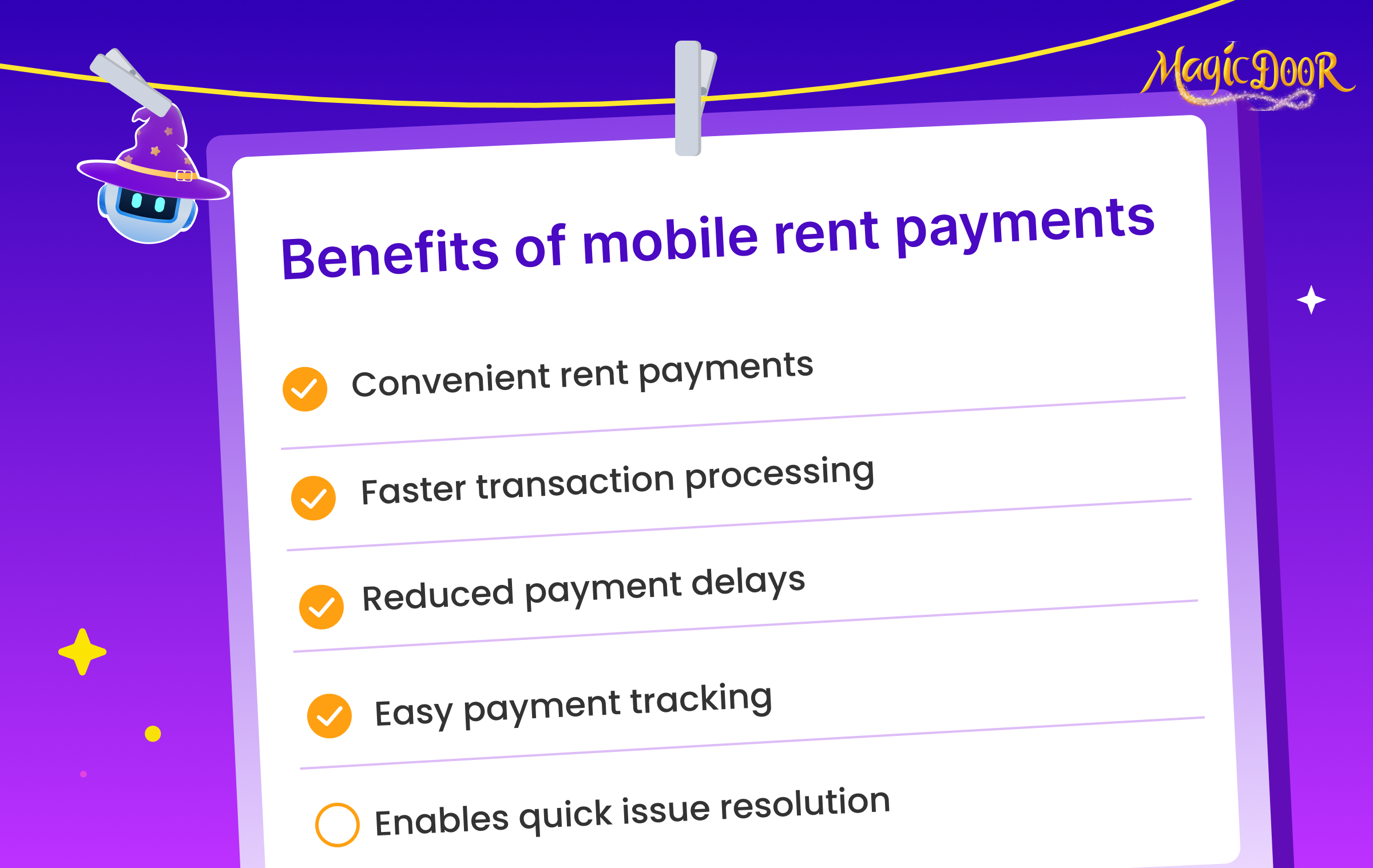

Mobile Payment Apps

Apps like Venmo, Zelle, and PayPal give tenants a fast and familiar way to pay rent online from their phones. They’re popular for a reason; most renters already use them for personal transfers.

These apps are simple to use and don’t require a steep learning curve. Landlords can receive rent payments directly to their bank account with just a few taps from the tenant’s side.

Before choosing a mobile app, compare platform fees, security policies, and payment limits. While most charge less than 1% per transaction, they differ in how quickly funds arrive and how disputes are handled.

To avoid confusion, give tenants clear steps to follow. Let them know which app to use, when to send payment, and how to confirm it was received. This reduces miscommunication and builds consistency in your rent collection system.

Cash Payments

Some tenants prefer using cash because it feels simple and avoids processing fees. But accepting cash comes with risks, and it requires careful handling from the landlord.

If you allow cash payments, always provide a written receipt and track every transaction.

Use a rent collection tool or spreadsheet to log amounts, dates, and tenant names. That audit trail is essential for tax season and resolving any disputes.

For safety, avoid handling large amounts in person. Use drop boxes with cameras or meet in a secure public place. Make it clear when rent is due and what happens if it’s late or incomplete.

Also, clarify your stance on partial payments. Decide if you’ll block partial payments or accept them with conditions.

Clear rules help avoid confusion and protect your cash flow.

Checks by Mail

Some tenants still choose to send checks through the mail. It’s familiar, doesn’t require apps, and offers a paper trail. But it introduces delays and security concerns that landlords need to manage carefully.

Encourage tenants to mail checks a few days before rent is due to avoid late fees.

Give them a clear mailing address, preferably a P.O. Box, to reduce risk. As checks arrive, deposit them promptly and record the details, amount, check number, and date received.

Late delivery or lost checks can affect timely payments. Your lease should be clear about what happens if rent isn’t received by the due date, regardless of when it was sent.

Best Way to Collect Rent as a Landlord

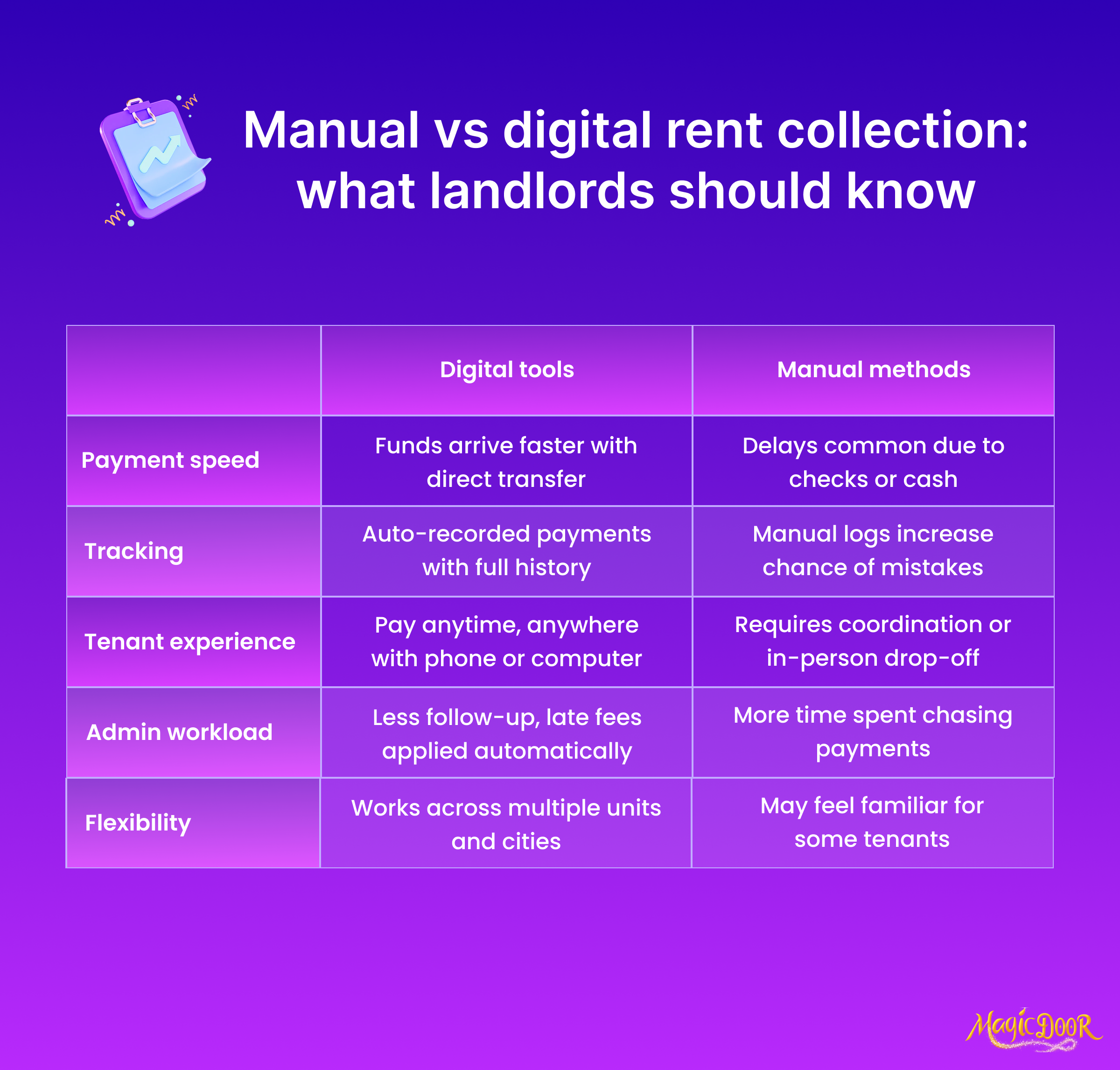

The most effective rent collection system balances consistency with tenant convenience. While traditional methods still work for some, digital tools now offer faster, more reliable ways to manage monthly payments.

Landlords who rely on digital systems benefit from better tracking, fewer errors, and faster access to funds. Payments are automatically recorded, which helps with bookkeeping, and tenants can pay from wherever they are, reducing delays caused by mailing checks or arranging drop-offs.

Here are a few reasons digital rent collection tools outperform manual ones:

- Clear payment history that helps during tax season

- Faster deposit times with less administrative follow-up

- Fewer disputes about payment dates or missing amounts

- Easier to send reminders or apply late fees when necessary

That said, not every tenant will prefer online systems.

Some tenants may still choose to pay by check or cash, which is why flexibility matters, especially for landlords managing multiple units or properties in different cities.

Providing a range of payment options helps reduce friction, encourages on-time payments, and builds better communication between you and your tenants.

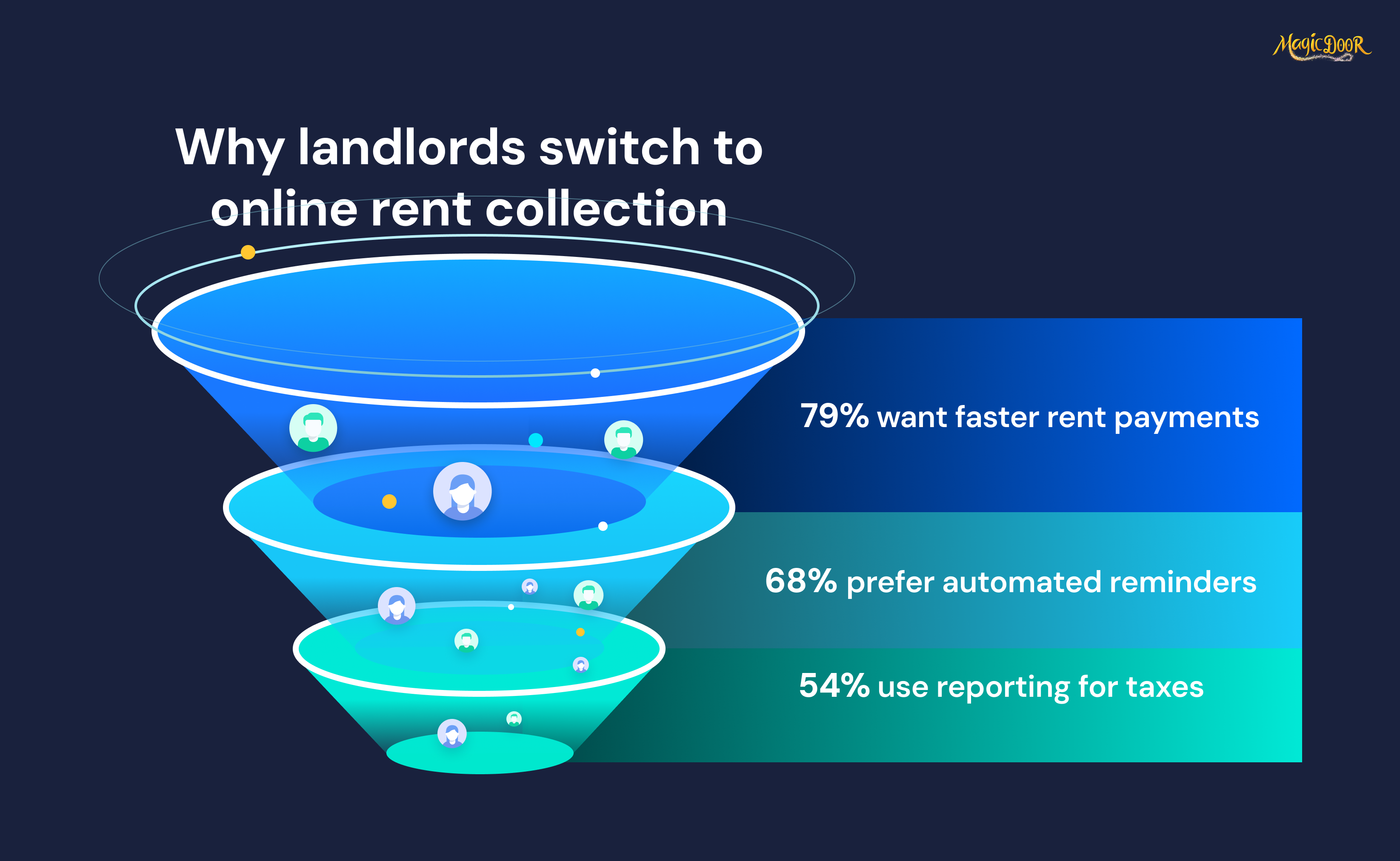

Benefits of Online Rent Collection Platforms

For landlords wondering how to collect rent from tenants without tracking reminders or handling paper checks, online platforms offer a clear upgrade. They simplify every step, from sending rent reminders to receiving deposits, and help keep rent payments consistent and traceable.

Here’s what online rent collection tools make easier:

- Rent tracking and real-time updates: You’ll know exactly when tenants pay rent, how much was paid, and what’s still owed. Many platforms also log partial rent payments, block them if needed, and apply late fees automatically.

- More ways to pay: Tenants can pay online using ACH payments, a debit card, or even mobile options like Google Pay or Apple Pay. Some platforms let renters split rent or set up recurring payments based on their pay schedule.

- Direct deposit to your bank: Most systems send funds directly to the landlord’s bank account or credit union, no waiting on mailed checks or delayed transfers. Some offer fast payment processing or instant transfers for a small fee.

- Fewer missed payments: Platforms like MagicDoor, Zillow Rental Manager, and Avail send automated rent reminders, enforce late fees, and allow tenants to pay through their preferred renter’s payment method.

- Cleaner records and reporting: All rent collection data lives in one place, making expense tracking and tax prep simpler. This also helps separate business transactions from personal ones, which is especially useful for landlords managing multiple units.

- Credit-building options: Some platforms report on-time payments to major credit bureaus, which can be a perk for tenants and a reason to pay consistently.

MagicDoor offers online rent collection with no monthly fees, no forced upgrades, and clear support for automated rent payments, partial payment settings, and direct bank transfer, without requiring tenants to download another app or deal with platform fees.

Common Rent Collection Challenges for Landlords & Property Managers

Late Payments

One of the most common challenges in rent collection is late or inconsistent payments. When tenants miss due dates, landlords lose valuable time chasing down updates, sending manual reminders, and applying late fees by hand.

Without a system to automate these steps, the delays stack up, significantly if you’re managing multiple units. Manual follow-ups also increase the chance of mistakes or miscommunication.

Using online rent collection tools with features like automated late fees, built-in reminders, and partial payment blocking gives landlords better control. Platforms like MagicDoor (which uses agentic AI to improve property management), Zillow Rental Manager, and newer rent collection apps offer the ability to collect rent payments automatically and log every transaction for easier expense tracking.

Systems that connect directly to a checking account or bank account also reduce delays, making it easier for tenants to pay rent and for landlords to stay up to date.

Payment Method Limitations

Not every tenant uses the same renter’s payment method, and that can cause friction during the rental process. Some may prefer debit card payments, others may want to use ACH payments from their bank or credit union, and a few might still rely on paper checks or money orders.

The more limited your setup, the more friction you create.

Landlords who only accept one payment type, like cash, Zelle, or bank transfers, usually deal with delayed rent payments, failed deposits, or inconsistent records. And if you’re using software that charges high processing fees or ACH fees, you might eat into your margin without realizing it.

Using a platform that supports multiple digital payments gives tenants more flexibility while keeping everything clean for the landlord.

Look for tools that support automatic payments, support for split rent, and allow deposits straight to the landlord’s bank account without hidden platform fees.

Tenant Communication Issues

Late rent payments don’t always happen because tenants are trying to delay them.

In many cases, the problem starts with unclear communication, primarily when landlords rely on texts or emails without a consistent system.

Without a centralized process, questions about security deposits, grace periods, or late fee enforcement often slip through the cracks. That confusion leads to frustration on both sides and delays in the rental process.

Using property management software with built-in messaging helps document everything.

Some platforms also log delivery receipts, automate payment reminders, and let tenants view account history alongside current balances.

Manual Processing Errors

Tracking rent payments online helps reduce errors, but only if the system is set up correctly. Landlords handling deposits by hand are more likely to misrecord payments, overlook partial rent payments, or apply late fees inconsistently.

![]()

These mistakes can add up quickly and create distrust or legal issues, particularly when reconciling month-end reports or issuing final statements tied to security deposits.

Digital tools help eliminate these risks.

Platforms with automated tracking and reporting give landlords a clear record of what’s been paid, what’s missing, and where every dollar went. That’s hard to do manually, especially when managing different rental units, due dates, and processing fees.

Inconsistent Cash Flow

For small landlords, a single missed rent payment can throw off the entire month. Without predictable income, it’s harder to plan for repairs, cover the mortgage, or budget for property improvements.

Manual methods make things worse.

Delays in mailing checks or waiting for a debit card payment to clear can stretch cash flow even thinner. Landlords relying on outdated systems may not realize just how much time passes between payment and deposit.

Online rent collection solves for timing and visibility. Tools that support instant or scheduled transfers let you collect rent online and see status updates in real time. Dashboards show monthly totals, missed balances, and projected income, so you’re not left guessing what will land in your bank account.

Having a reliable rental manager or platform in place also allows you to predict income more accurately, track credit scores if needed, and run a tighter financial operation, without surprises.

How to Collect Rent as a Landlord: Step-by-Step Guide

Choose Payment Methods

Before you begin rent collection, decide how tenants will pay.

You need a method that’s easy to manage and clear for both sides. Popular options include online rent payments, bank transfers, and debit card transactions. Some landlords still accept checks, but those take longer to track and clear.

Using platforms that let you collect rent online simplifies this part. Tenants can pay rent using their preferred method, and the system logs the transaction in real time.

Look for tools that give tenants options while keeping the accounting clean for you.

The best setup makes it simple to collect, confirm, and store rent payments, whether you manage one unit or work as a full-time rental manager.

Automate Payment Processing

Automation helps property managers and individual landlords stay on top of due dates. Tools with recurring billing let you set up rent collection once and remove the need for follow-ups.

Tenants get notified, and rent is processed directly to your account.

Choose a platform that tracks failed transactions, flags missed payments, and applies processing fees or late penalties when necessary. This will save you time and give you a complete picture of what's paid, what's late, and what to expect next month.

Automation also creates consistency in your books. Instead of reviewing each payment manually, you’ll know exactly where things stand every time someone clicks pay rent.

Establish Late Fee Policies

To collect rent reliably, you need late fee rules that are clear, enforceable, and easy to track. Tenants should know exactly when rent is due, what happens if they miss a date, and how penalties are applied.

Your lease agreement should spell this out, including grace periods, flat vs. percentage-based fees, and timelines for enforcement.

But it shouldn’t stop there. You also need tools that apply those rules automatically.

Platforms that support online rent payments with built-in late fee triggers reduce the risk of missed charges or inconsistent enforcement. Instead of adding penalties manually, the system does it for you based on your settings.

No follow-ups. No confusion. No rewriting emails each month.

Implement Tenant Portals

Portals give tenants a single place to view payment history, download documents, and pay rent on time. It’s one of the most effective ways to reduce support requests and make your workflow lighter.

Without one, you're balancing texts, calls, and emails for basic questions like “Did my payment go through?” or “When is rent due again?” That creates noise, delays, and more chances for errors.

A good tenant portal connects directly to your rent collection system. Tenants log in, view balances, view previous transactions, and make online rent payments using their preferred method, credit, debit, or ACH.

You also gain a paper trail. Everything is recorded in one place, which helps if you ever need to audit past transactions or enforce a fee. Most rental manager platforms now include this by default.

Integrate with Management Software

Once you’ve nailed the basics, payment rules, communication, and collection, you want everything to live in one system. This is where property management software becomes more than just convenient.

When your rent collection method connects with electronic lease signing, maintenance logs, and accounting features, you stop wasting time switching tabs or reconciling reports manually. That’s where tools with built-in payment modules give you a real edge.

Instead of exporting data from one platform to another, you log in once and manage everything: track payments, see which units are late, follow up, and document results. Integration also reduces processing fees from third-party apps and helps tenants stay inside the same interface from move-in to move-out.

For landlords who want clarity, automation, and clean records, this is the missing link.

How to Set Up a Landlord Rent Collection System

Offer Reliable Payment Methods to Pay Rent Online

Start by offering a simple, secure way for tenants to pay rent online. If you're still collecting cash or checks, you're adding friction to a process that should be consistent.

Online options let you collect rent faster, keep records cleaner, and reduce follow-up work later.

Choose a platform that allows tenants to pay rent online using ACH, debit, or card. Many tools also give the option to schedule payments, which helps with on-time rent and cuts down on back-and-forth.

Just keep an eye on processing fees, especially if you're passing them along or absorbing them yourself.

The easier you make it to collect rent online, the more likely payments come in on time, and without confusion about when or how.

Automate Reminders & Receipts

Manual reminders are easy to miss. A strong rent system should send alerts before the due date and follow up if the payment hasn't been made.

Tenants get notified without you needing to send texts or emails one by one.

Receipts matter too. After each payment, tenants should receive a clear record showing what was paid and when. It gives them visibility and gives you protection if questions come up later.

Look for a rental manager tool that handles both. The right system keeps tenants informed and gives you one less task to remember at the start of each month.

Establish Late Fees & Grace Periods

Setting clear late fee rules helps prevent rent delays before they happen. Tenants should know the rent due date, how many days they have before penalties apply, and exactly how much will be added if it's late.

Include this policy in the lease and use a tool that enforces it automatically.

That way, collecting rent doesn’t rely on reminders or back-and-forth. Some systems also support grace period tracking, giving tenants a short buffer while still keeping your payment flow structured.

If you collect rent online, look for platforms that apply fees based on your settings. This avoids manual tracking and helps reduce disputes later.

Track Payments & Work Orders Together

Rent collection doesn’t happen in a vacuum. If tenants are waiting on repairs or unclear about a property maintenance issue, it can affect when and how they pay. Keeping everything connected, rent, requests, updates, and saves time and prevents surprises.

Using a rental manager tool that logs both payments and work order software in the same dashboard helps you stay ahead of issues. You’ll know when someone paid, what’s outstanding, and whether any open requests are slowing things down.

Some systems also reduce processing fees or flag delays tied to pending rental house repairs.

When you collect rent and manage maintenance in one place, your workflow becomes easier, and tenants are more likely to stay on schedule.

Rent Collection Made Simple With MagicDoor

MagicDoor was built to take the stress out of rent collection, specifically for landlords managing a handful of units without a team. The platform helps you collect rent online, apply rules consistently, and stay on top of payments without logging into five different tools.

From day one, you can:

- Accept rent by ACH or debit with no hidden processing fees

- Set up automatic reminders and late fee rules

- Track incoming payments in real time

- Review tenant history, leases, and repairs, all from one dashboard

- Let tenants pay rent securely through their portal or app

Each feature is built to reduce the time you spend managing collections and cut down on missed payments. You don’t need to configure dozens of settings or worry about passing data between tools.

Rent comes in, records update, and you move on to the next task.

For any rental manager looking for a platform that handles the rent side without extra steps or costs, MagicDoor delivers what actually matters: clarity, automation, and control.

Conclusion

Rent collection is one of the most important parts of managing rentals, and one of the easiest to get wrong. Missed due dates, unclear payment methods, and manual follow-ups can all create friction that slows down your operation.

A reliable system helps you collect on time, stay organized, and give tenants a consistent way to pay.

Online platforms make that easier by connecting payments, reminders, receipts, and reporting in one place.

MagicDoor supports that kind of workflow. You can collect rent, apply rules, and keep everything logged, without extra complexity or monthly subscriptions. If you're managing rentals on your own, the right tools make a difference.

Get started today - MagicDoor has no subscription fees!

Frequently Asked Questions

How to collect rent after eviction?

You usually can’t collect rent through your normal system after an eviction. Unpaid rent becomes a debt, which may require small claims court or a collections agency. Keep all lease and payment records in case you need to file.

What is the best method to collect rent?

Automated systems, like property management software, are the most reliable. They ensure timely payments by allowing consistent schedules and efficiently tracking every transaction.

What is the best way for landlords to collect rent?

ACH bank transfers are highly recommended for their reliability and low transaction fees. Debit and credit card payments are also convenient but may involve higher costs.

Can I use PayPal to collect rent?

PayPal can be used, but it has transaction fees that may add up over time. Additionally, compared to dedicated property management platforms, it lacks specific tools tailored for managing rental payments.

What method do people use to pay rent?

Paying rent is commonly done by bank transfers, direct deposit, credit or debit cards, and sometimes checks. Automation through platforms is increasingly popular for its convenience.