When owning a home in the United States, there’s a good chance you’ll encounter a Homeowners Association (HOA). With nearly 30% of homes governed by HOAs, these organizations are a significant part of today’s housing market.

But what exactly do they manage, and how do their policies impact homeowners?

This blog examines statistics about HOAs, breaking down their fees, regulations, and growing numbers nationwide. Community association research provides valuable insights into these statistics, helping readers understand the prevalence, benefits, and considerations of living in HOA-managed properties.

From average costs to regional variations, we’ll give you the data you need to make informed decisions about HOA-governed properties.

Here’s a comprehensive look at HOA statistics, key trends, and their implications for 2025.

What are Homeowners Associations (HOAs)?

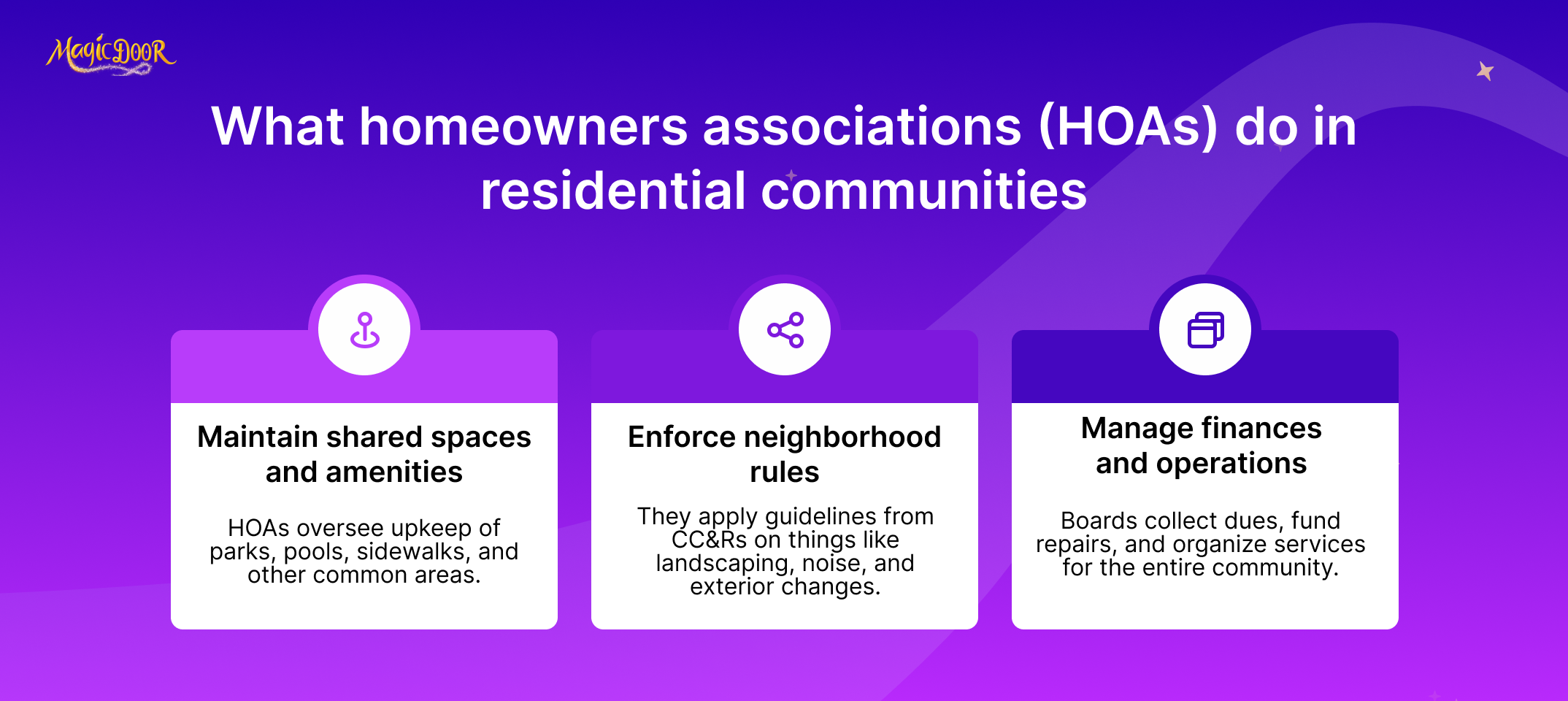

A community association, which includes homeowners associations (HOAs), condominium communities, and property owner associations, is an organization that governs and oversees the shared spaces and rules within a residential community. These communities can include neighborhoods with single-family homes, condominiums, or townhouses.

If you purchase a property within an HOA, you automatically become a member of the association, agreeing to abide by its regulations and pay regular fees.

An HOA manages shared amenities, enforces community standards, and maintains property values. The organization establishes rules usually outlined in Covenants, Conditions, and Restrictions (CC&Rs).

HOA guidelines might include restrictions on home paint colors, landscaping, or how properties are maintained.

Governance is provided by a board of directors, often composed of resident volunteers elected by other members. This board is responsible for implementing community rules, organizing maintenance services, and managing financial matters such as collecting monthly or annual dues.

Although living in an HOA-regulated community has benefits, such as access to well-maintained amenities and a consistent neighborhood appearance, it also involves certain limitations.

Homeowners may be restricted from personalizing their properties, and failure to comply with rules can sometimes result in fines. However, these regulations balance individual freedom and collective harmony, ensuring the community remains pleasant.

Why HOAs are Common in the US

Homeowners Associations (HOAs) are widespread in the United States due to housing trends, community needs, and urban planning priorities.

Over the last few decades, suburban growth has increased, creating demand for neighborhoods that provide shared amenities, uniform property standards, and organized management structures. These factors have made HOAs common in many residential areas.

One key reason for their prevalence is the desire to preserve and maintain property values. Community associations, including HOAs, play a crucial role in maintaining property values and community standards by enforcing guidelines that help keep neighborhoods visually appealing and orderly. For instance, rules might regulate landscaping, exterior home modifications, or parking standards.

Another driving factor is the popularity of shared amenities among residents.

Many modern neighborhoods include parks, swimming pools, clubhouses, and walking trails that require collective maintenance. Homeowners within an HOA contribute fees to fund these facilities, balancing costs across the community and making such amenities accessible to residents without placing financial strain on individuals.

Local governments also contribute to the expansion of HOAs.

They encourage private organizations to manage community services so governments can reduce their responsibility for public infrastructure, such as streets, sidewalks, and utilities in these neighborhoods.

The blend of regulated upkeep, shared perks, and financial incentives for municipalities has made HOAs an integral part of the American housing market. While they may not suit every homeowner, their popularity reflects a growing preference for managed, amenity-rich neighborhoods designed to enhance the quality of life for all residents.

Why Are HOAs Increasing in Number?

Rising demand for structured neighborhoods and growing suburban development have contributed to the increasing number of Homeowners Associations (HOAs) in the United States.

Several factors, ranging from economic motivations to lifestyle shifts, drive this growth, intertwining the needs of both developers and homeowners.

One significant reason is urban expansion.

As cities continuously grow, large areas of undeveloped land are transformed into new suburbs. Developers often favor establishing HOAs in these areas, as they help manage community spaces like parks, swimming pools, and fitness centers. Condominium communities, a specific type of HOA, are governed under distinct state laws and include various forms of property governance.

With shared costs and collective maintenance, HOAs ensure these neighborhoods retain a polished and appealing appearance.

Additionally, modern homebuyers tend to prioritize secure, well-maintained environments.

Regulations enforced by HOAs, such as guidelines on exterior aesthetics or prohibited activities, provide reassurance that the community will reflect a consistent standard.

Local authorities also contribute to the surge. By relying on HOAs to oversee private roads, streetlights, and trash services within communities, municipalities can save on public funding.

Another reason lies in shifting preferences toward shared amenities.

Neighborhoods with features like playgrounds, walking trails, and communal gathering areas attract those looking for added convenience and lifestyle perks. HOAs coordinate and maintain these amenities, offering a more streamlined experience for residents.

The steady increase in demand for such features, combined with the need to uphold property standards and curb public management costs, ensures that HOAs continue to grow in number across the country.

Can HOA Fees be Negotiated?

Individual homeowners typically do not have the option of negotiating association fees, which can be a significant financial burden. These fees are established based on the community’s budget and the needs of the shared amenities.

The HOA board calculates costs such as landscaping, pool maintenance, trash collection, and reserve fund contributions during the annual budget process. Once the fees are decided, all homeowners within the association must pay the same amount, ensuring fairness across the board.

However, some scenarios are worth exploring if you feel your fees are excessive or incorrect.

First, reviewing your HOA’s financial documents is a good idea. These are usually accessible upon request and can provide insight into how funds are set aside. If you notice areas where costs could be reduced, such as overpriced vendor contracts or unnecessary expenses, you can bring your concerns to the next board meeting.

Collaborating with other residents with similar concerns can give your suggestions more weight.

Late fees or penalties, on the other hand, might have room for adjustment. If you’ve experienced a temporary financial setback, contacting the HOA board or management company to explain your situation and request a payment plan could be helpful.

While not guaranteed, some boards may be willing to waive certain penalties or offer short-term flexibility.

Advocating for greater budget transparency and efficiency within the association is key to long-term changes to HOA fees. Serving on the board or joining a financial committee allows homeowners to impact how the community’s finances are managed directly.

Key Statistics for HOA Communities

Percentage of Homes in HOAs

Most US homes are governed by Homeowners Associations (HOAs), reflecting the growing popularity of structured community living. HOA homeowners contribute to the community through fees for amenities and services, and by complying with rules that support maintenance and operations. These associations manage shared spaces, enforce community rules, and strive to maintain neighborhood standards.

The influence of HOAs on residential properties is evident in their rising numbers nationwide.

- Approximately 30% of U.S. homes are part of an HOA, including over 75.5 million residents.

- Nationally, about 22% of all homes fall under HOA governance.

- Roughly 40 million U.S. households, or 53% of homeowners, reside in HOA-governed communities. This equates to 76.5 million Americans, representing 22.5% of the US population.

- Certain states report even higher proportions:

- Florida leads with 45% of homes in communities managed by HOAs.

- Colorado follows with 38.6%, while California features 36.8% of residences in such associations.

- Each year, approximately 8,000 new HOAs are established, showing the consistent expansion of these communities.

Homes in HOA neighborhoods often share common characteristics.

For instance, neighborhoods under these associations typically offer improved amenities such as parks, pools, and shared recreational areas. This setup can contribute to higher property values, with estimates suggesting homes in HOA communities are worth 4% to 6% more than those without similar governance.

Over the past decade, the number of HOAs has grown significantly, seeing a 13% increase in just ten years. This trend aligns with the changing preferences of modern buyers who value organized, well-maintained spaces and access to shared community benefits.

From annual dues to compliance with specific regulations, informed decisions can help homeowners find the right balance between structure and independence.

Average Size of an HOA Community

The average size of a Homeowners Association (HOA) community in the United States offers insightful information about how these associations operate and manage residential neighborhoods.

Key statistics on HOA community sizes:

- Average number of homes per HOA community ranges from 22 to over 1,000, depending on the type and location.

- Large-scale HOAs, those managing over 1,000 homes or operating with budgets exceeding $2 million annually, make up about 2% to 3% of all associations.

- Approximately 365,000 HOAs exist nationwide, encompassing around 28.2 million housing units.

- Due to the individualized nature of single-family plots, single-family home associations tend to include fewer households than condominium-based associations.

Most HOAs are small to moderately sized, managing a few dozen homes to several hundred properties. HOA members play a crucial role in the governance and management of these communities, contributing to decision-making processes, maintaining property regulations, and providing services.

These communities are common in suburban developments where amenities like parks and playgrounds require centralized management.

Smaller HOAs may not always provide many features but focus on maintaining neighborhood standards.

Conversely, larger HOAs, frequently found in urban or high-demand regions, manage communities with hundreds or thousands of residents. Such associations often provide extensive amenities, including fitness centers, pools, and community event spaces.

Their larger scale requires more structured governance and, often, professional property management companies.

The average size of an HOA community can also vary significantly depending on the region. For instance:

- Urban and coastal areas, like California and Florida, tend to have larger associations due to their greater population density and the inclusion of condominiums in HOA management.

- Midwestern and rural regions often see smaller HOAs focused around single-family neighborhoods with fewer shared facilities.

Growth Trends in HOA Development

The expansion of Homeowners Associations (HOAs) in the United States reflects shifting housing trends and development priorities.

The HOA’s board plays a crucial role in managing the growth and development of these communities. It oversees financial oversight, sets dues, assesses fees, and imposes fines or liens for unpaid dues. With the appeal of shared amenities and centralized community management, HOAs continue to grow.

- Approximately 14 new HOAs are formed daily, equating to around 5,000 new associations annually.

- 82.4% of new homes sold in 2023 were part of HOA communities, highlighting their prevalence in modern housing developments.

- Since 2013, the number of HOA communities has increased by 11%, while the number of HOA-resident populations has grown by 14.9%.

- The number of HOA communities has grown by 11.1% over the last decade, and recent estimates estimate that there will be 370,000 associations nationwide in 2024.

- Housing developments with HOAs now manage 28.2 million housing units, a figure expected to increase as construction trends favor these communities.

- Approximately 370,000 HOA-governed communities across the US, with an average of 14 new HOAs forming daily. Over the past decade, HOA numbers have risen annually by about 4,600.

- Homeowners opting for HOA communities make up 53% of the homeowner population, covering a collective property value surge of 32.6% since 2020, now estimated at $12.2 trillion.

The surge in HOA development is most prominent in regions experiencing high housing demand. New residential projects in the South and the West often include planned HOA governance, with nearly 70% of new homes in these areas falling under such associations.

Regions like California, Colorado, and Florida have the highest HOA density, with over 60% of owned homes operating within such frameworks. These states lead efforts to implement HOAs in new suburban projects and high-density urban developments featuring condominium-style associations.

The upward trajectory of HOA development is unlikely to slow. With suburban expansion and an increasing number of new housing units, HOA communities will likely grow further in the coming years.

Average HOA Fees Across the US

HOA fees contribute to maintaining shared spaces, amenities, and community operations but vary widely depending on location, services offered, and other factors.

Monthly HOA fees are dues paid by homeowners to support various amenities and services provided through their homeowner’s association. These fees can vary based on home size and the amenities’ quality.

Let’s explore the average HOA fees across the United States with key statistics and considerations.

- National average HOA fee: $170 per month, as estimated by Census data.

- Fees typically range from $50 to $1,000 monthly, influenced by location and amenities.

- Home values in HOAs: Homes in HOA communities average a value of $432,624, which is 10.9% higher than the national average for non-HOA homes.

- HOA fees in high-cost metropolitan areas:

- New York City: $653/month

- San Francisco: $390

- Miami: $283

- Lower cost areas:

- Dallas, TX: $98

- Detroit, MI: $114

- Knoxville, TN: $122

- Due to additional shared facilities, single-family homes typically cost $200-$300/month, while condominiums cost around $300-$400/month.

Your pay varies depending on your community’s needs and the services provided. Smaller neighborhoods with minimal amenities often have lower fees.

Alternatively, luxury developments or urban condos with features like pools, gyms, or concierge services can mean significantly higher dues.

Here’s what’s commonly covered:

- Maintenance services for landscaping, trash removal, and pest control.

- Operating costs of amenities like fitness centers, pools, or clubhouses.

- Contributions to reserve funds, which prepare for unexpected repairs or large-scale improvements.

The location also affects HOA fees. Urban centers and coastal regions tend to have higher costs relative to amenities. For instance, California homeowners often pay an average of $363 per month, while the national average is lower.

States with the Highest & Lowest HOA Fees

Homeowners Association (HOA) dues significantly affect the overall cost of homeownership. Residents must pay HOA fees, essential for maintaining common areas and providing community services. These fees vary widely across the country and are influenced by location, community size, and available amenities.

Here’s a detailed breakdown of the states with the highest and lowest HOA fees:

- States with the highest HOA fees:

- Alabama: $458 per month, totaling $5,490 annually, the highest average in the country.

- Missouri: On average, HOA fees are $469 per month or $5,627 annually, making it one of the most expensive states.

- Arizona: $448 per month, up to $5,371 annually for its 875,000 HOA households.

- Maryland and Colorado: Both states average $401 per month, equaling $4,812 annually.

- Oregon: $402 monthly, totaling $4,825 annually for HOA costs.

- Tennessee and Mississippi: Each state averages roughly $400 monthly or $4,800 annually.

- Arkansas and Wyoming: HOAs charge around $394 and $393 monthly, respectively, with annual costs of $4,728 and $4,716.

- Virginia: $392 per month on average, up to $4,704 annually across 786,000 HOA homes.

- States with the lowest HOA fees:

- South Carolina: The lowest average HOA fees nationally at $310 per month, totaling $3,715 annually.

- Florida: $312 per month, despite having one of the highest HOA membership rates in the United States.

- Mississippi and Arkansas also remain among the lower ranges, with fees presenting more affordable options under $400/month.

Financial Summary of HOAs in 2025

- Monthly HOA contributions for single-family homes average $300 ($3,600 annually). HOA board members play a crucial role in financial oversight and management, ensuring funds are allocated efficiently and transparently.

- Fees vary by state, ranging from $37 per month in West Virginia to as high as $990 per month in New York.

- HOA fees have increased 32.4% over the last decade, far outpacing the 15.1% rise in home prices over the same period.

- In 2023, total financial contributions by HOA residents reached $371 billion, covering professional management, maintenance, capital projects, and more.

HOA Trends & Challenges for 2025

Following structural disasters like Florida’s Champlain Towers, HOAs in states like Florida are legally required to maintain sufficient reserve funds for capital repairs. This has pushed HOAs to adopt stricter budget and financial planning practices, such as professional reserve studies.

Many HOAs are expected to increase monthly assessments or call for special contributions to meet reserve requirements. This raised financial burden could lead to homeowner resistance in some communities.

Many HOAs are adopting green initiatives, including renewable energy technologies and water conservation programs, to respond to rising utility costs and environmental concerns. Sustainability-driven upgrades can also increase home values and attract eco-conscious buyers.

Additionally, HOA rules are crucial in maintaining community standards and protecting property values, although they can sometimes be overly restrictive.

Digital voting has simplified elections and community decision-making, already mandated in states like California.

Modern HOA websites and digital payment systems are now essential for efficient communication and financial transparency.

Advanced security technologies like keyless access and real-time monitoring are being installed to enhance community safety.

With more HOA operations shifting online, protecting sensitive member information has become critical. Cyberattacks, including phishing schemes, have driven HOAs to invest in secure systems and staff training to mitigate these risks.

HOA Development by State

- States like California (65%), Florida (63.1%), and Colorado (60.7%) lead the nation in HOA membership rates among homeowners.

- Mississippi (3.13%) and West Virginia (5.15%) report the lowest homeowner participation in HOAs, reflecting regional differences in housing governance structures.

- States with expensive real estate markets, like New York, naturally have higher HOA fees due to premium property management and amenity costs.

Impact on Homeowners & the Housing Market

HOAs are credited with maintaining high property standards, which increases home values by an average of 4-10% compared to similar homes outside HOA governance. They also enforce rules to ensure compliance with community standards, covering aspects like property maintenance and homeowner behavior, with consequences for violations.

Homeowners increasingly cite dues, fines, and special assessments as their top frustrations. Thirty-five percent of respondents stated that their HOA fees are overpriced.

HOAs are pushing for clearer financial reporting and resident engagement. To address homeowner expectations for accountability, boards use tools like online portals and detailed reports.

New state regulations often require more extensive record-keeping and compliance measures. Consequently, HOAs are increasing administrative spending, which can affect overall dues.

Conclusion

2025 promises further developments for HOA communities.

There’s a notable change towards sustainability, technology adoption, and financial transparency. However, rising fees and stricter compliance requirements will pose challenges for both boards and residents.

This data gives landlords and property managers a foundation for evaluating investments in HOA-governed properties or preparing tenants for potential obligations.

Frequently Asked Questions

What percentage of US homes are HOAs?

Around 53% of owner-occupied homes in the US are part of a Homeowners Association (HOA). Board members are crucial in managing these communities, often dealing with fee increases, training issues, and re-election challenges.

What is the biggest HOA in the US?

Lakewood Ranch in Florida is often considered one of the largest HOAs, with over 20,000 homes across multiple neighborhoods. HOA boards are crucial in managing large communities, overseeing regulations, and maintaining property values.

What is the average HOA fee in the US?

The average HOA fee is between $200 and $300 monthly, though it can be higher in certain areas or communities. The HOA’s board is responsible for setting these dues and managing the financial oversight, including assessing fees and imposing fines for unpaid dues.

Which state has the highest HOA?

Florida and California have the most HOAs but states like New York tend to have some of the highest HOA fees. HOA members play a crucial role in contributing to the community through these fees, which help maintain property regulations and provide services.

Why does Texas have so many HOAs?

Texas has many HOAs due to rapid suburban development and a preference for planned communities with shared amenities and consistent property standards. HOA homeowners play a crucial role in these communities by paying fees to support the maintenance and operation of amenities and services.