Affordable housing subsidies help families stay in their homes.

For landlords, this also means guaranteed rent, but often with added complexity. Section 8 vouchers, local programs, and employer assistance all follow different rules.

The challenge? Paperwork, inspections, and payment schedules that eat up time.

The solution? Knowing your responsibilities and using tools that simplify the process.

This guide explains how subsidies work, what landlords must manage, and which platforms can take the friction out of subsidy administration.

What is Affordable Housing?

Affordable housing is rental housing made available at a cost that low-income families can reasonably pay without exceeding a set portion of their income. The benchmark is often 30% of household earnings, covering rent and utilities.

Programs differ by state and city, but most rely on public housing agencies or nonprofit housing organizations to manage units, administer housing choice vouchers, and oversee compliance. Landlords who participate provide rental units at reduced rates while receiving guaranteed rent payments through housing assistance programs.

Subsidized housing can take many forms: apartments, townhouses, or single-family homes. Some developments are fully dedicated to affordable rental housing, while others set aside a percentage of units for community housing opportunities.

Public housing, housing vouchers, and other rental assistance programs are designed to serve vulnerable populations, including very low-income families, veterans, and individuals with disabilities.

For landlords, affordable housing brings responsibilities and benefits.

Lease compliance, inspections, and adherence to program income limits are required. In return, property owners gain reliable rent payments, shorter vacancy periods, and access to large waiting lists of eligible tenants.

What Are Rental Subsidies in Affordable Housing?

Rental subsidies are financial assistance programs that reduce the cost of housing for tenants with low incomes.

They close the difference between what a household can afford to pay and the actual rent for a housing unit. For landlords, subsidies guarantee timely payments from a housing agency or similar provider.

Several groups are responsible for offering rental assistance:

- Federal programs: The Housing Choice Voucher program (commonly known as Section 8) is the largest nationwide.

- Local public housing agencies: City and county agencies manage subsidized housing, handle waiting lists, and ensure compliance with lease terms.

- Nonprofits and employers: Some community organizations and companies provide rental housing support for vulnerable populations or their employees.

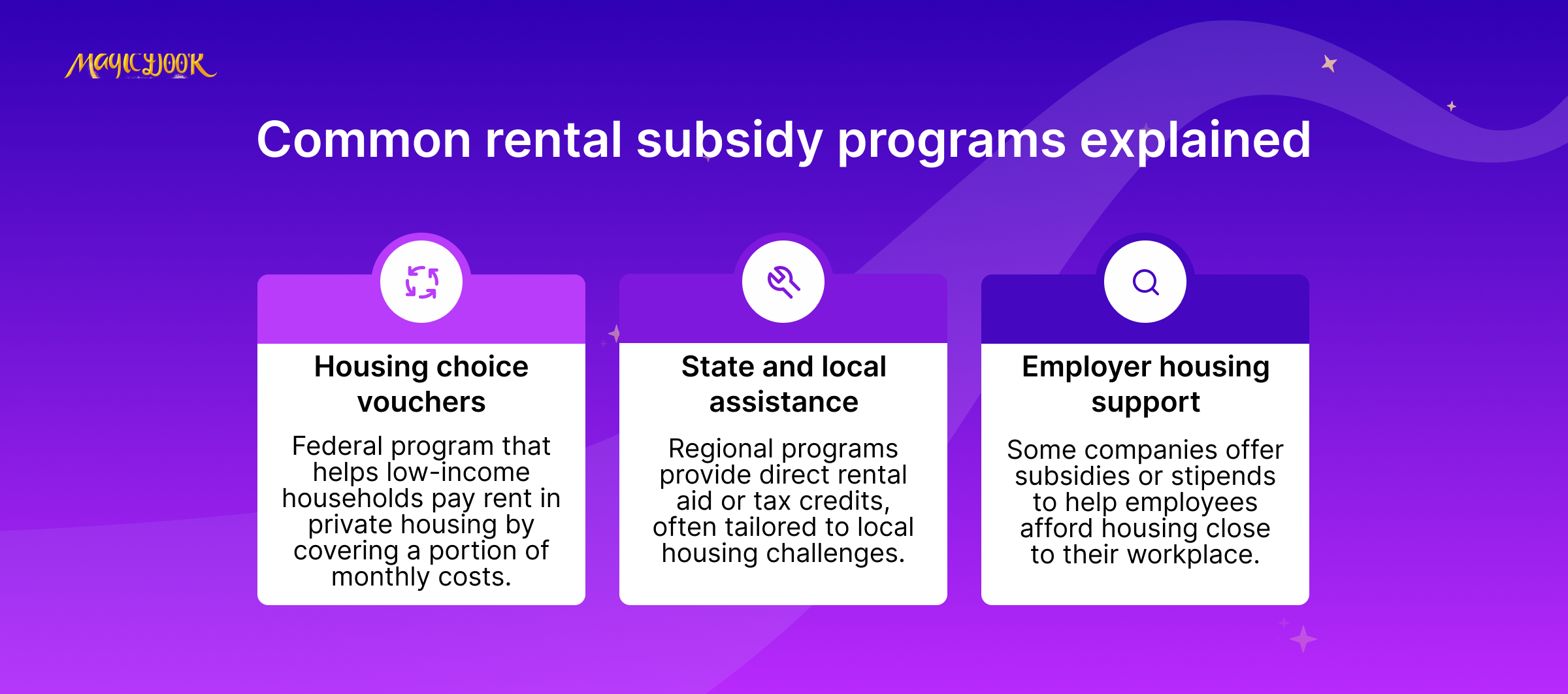

Subsidies appear in many forms. The most common include:

- Housing Choice Vouchers: Tenants pay a portion of income toward rent; the voucher covers the balance.

- State or local rental assistance: Targeted support for affordable rental housing in high-demand areas.

- Employer-based housing support: A growing option in industries and regions where housing affordability affects workforce stability.

Eligibility depends on income, family size, and other criteria. Typically, subsidies serve:

- Very low-income families struggling to pay rent

- Voucher recipients approved through public housing agencies

- Special groups, such as veterans, people with disabilities, or individuals at risk of homelessness

Subsidized housing offers affordable housing opportunities while ensuring landlords receive consistent payments and tenants maintain stable tenancies.

How Do Rental Subsidies Work for Landlords?

How Rent is Split Between the Tenant & the Subsidizing Agency

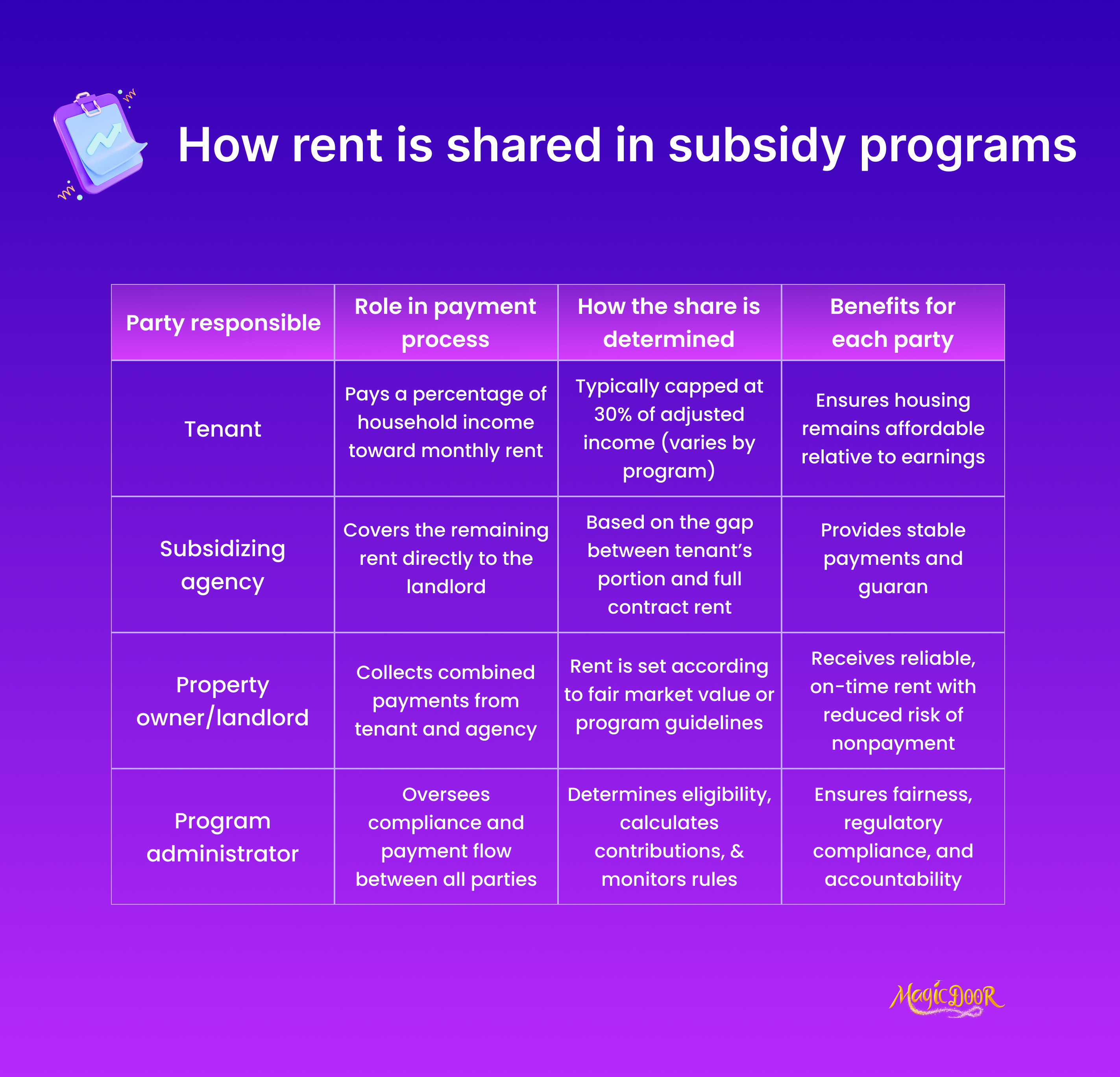

In most rental assistance programs, tenants pay a portion of their income toward rent while a public housing agency or other provider covers the rest.

The tenant contribution is calculated using household earnings, typically around 30% of adjusted income.

The subsidizing agency then pays the landlord directly for the remaining balance. This setup guarantees that rent is covered up to the program’s payment standard or maximum amount. For landlords, it means fewer missed payments and a reliable stream of rental income each month.

How Landlords Set Up Leases With Subsidized Tenants

When a landlord accepts a tenant with a housing choice voucher or other subsidy, the housing agency must approve the lease. The agreement includes the same terms as a standard lease, covering security deposits, lease length, and tenant responsibilities, but it also requires compliance with program rules.

Typical steps include:

- Submitting the proposed lease for review by the housing agency

- Passing property inspections to ensure the rental unit meets health and safety standards

- Signing a Housing Assistance Payment (HAP) contract with the agency, which outlines landlord and tenant obligations

For landlords, this process adds structure while still allowing them to protect their property, enforce lease compliance, and receive dependable rental payments.

How Compliance & Inspections Are Handled

Every rental unit approved for subsidies must meet standards set by public housing agencies.

Before a tenant moves in, an inspection is scheduled to confirm the unit is safe, clean, and up to code. Inspectors check basics like electricity, plumbing, and condition, but they also review details such as working smoke detectors and secure windows.

Inspections aren’t one-time events. Housing agencies often re-inspect annually, or whenever lease terms change.

Landlords who prepare ahead, by documenting repairs, keeping utilities active during checks, and tracking maintenance, avoid delays in receiving subsidy payments. The focus is less on perfection and more on ensuring the property is decent, safe, and habitable for tenants.

How to Register With Housing Authorities or Subsidy Providers

Before accepting tenants with vouchers or rental assistance, landlords must complete a registration process with a housing agency or subsidy provider. This step makes the property eligible to receive payments directly from the program.

The process usually involves:

- Submitting landlord details: ownership information, tax ID, and bank account details for direct deposit.

- Providing property records: proof of ownership, lease draft, and rental unit specifications.

- Reviewing program rules: payment standards, security deposit guidelines, and responsibilities related to compliance.

- Signing agreements: a Housing Assistance Payment contract or similar document that outlines duties for both landlords and agencies.

Once registered, landlords can advertise their housing opportunities to families on the waiting list or those already holding vouchers. This opens the door to a reliable pool of eligible tenants while ensuring timely rent through program assistance.

Benefits of Accepting Rental Subsidies

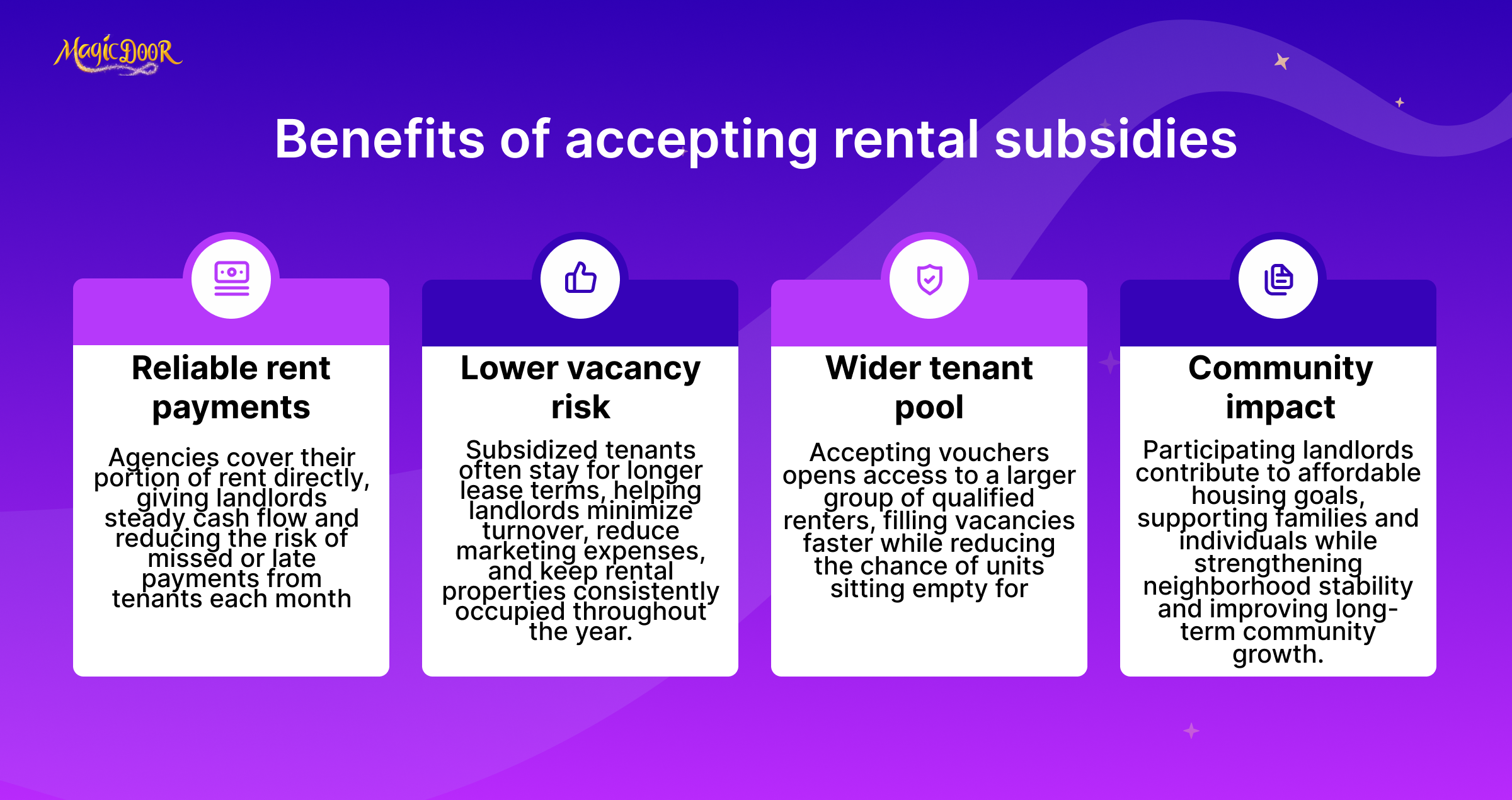

Subsidized housing often gets overlooked by landlords worried about red tape.

However, these programs can provide real advantages for property owners open to working with public housing agencies or voucher holders. Beyond steady income, subsidies can help keep units occupied and reduce the risks of leasing on the open market.

Here’s what landlords gain by participating:

- Reliable income: Housing agencies send their portion of the rent directly to the landlord, ensuring a consistent flow of funds.

- Lower vacancy rates: Families with housing vouchers face high demand for units, meaning landlords often have a waiting list of eligible tenants.

- Reduced collection stress: The program guarantees most of the rent, lowering the chances of late or missed payments.

- Community impact: Participating landlords support affordable housing opportunities and contribute to stability for vulnerable populations, including veterans, seniors, and people with disabilities.

Many landlords realize that the financial predictability and strong tenant demand make rental subsidies a valuable part of their portfolio strategy.

Challenges of Managing Subsidized Rentals

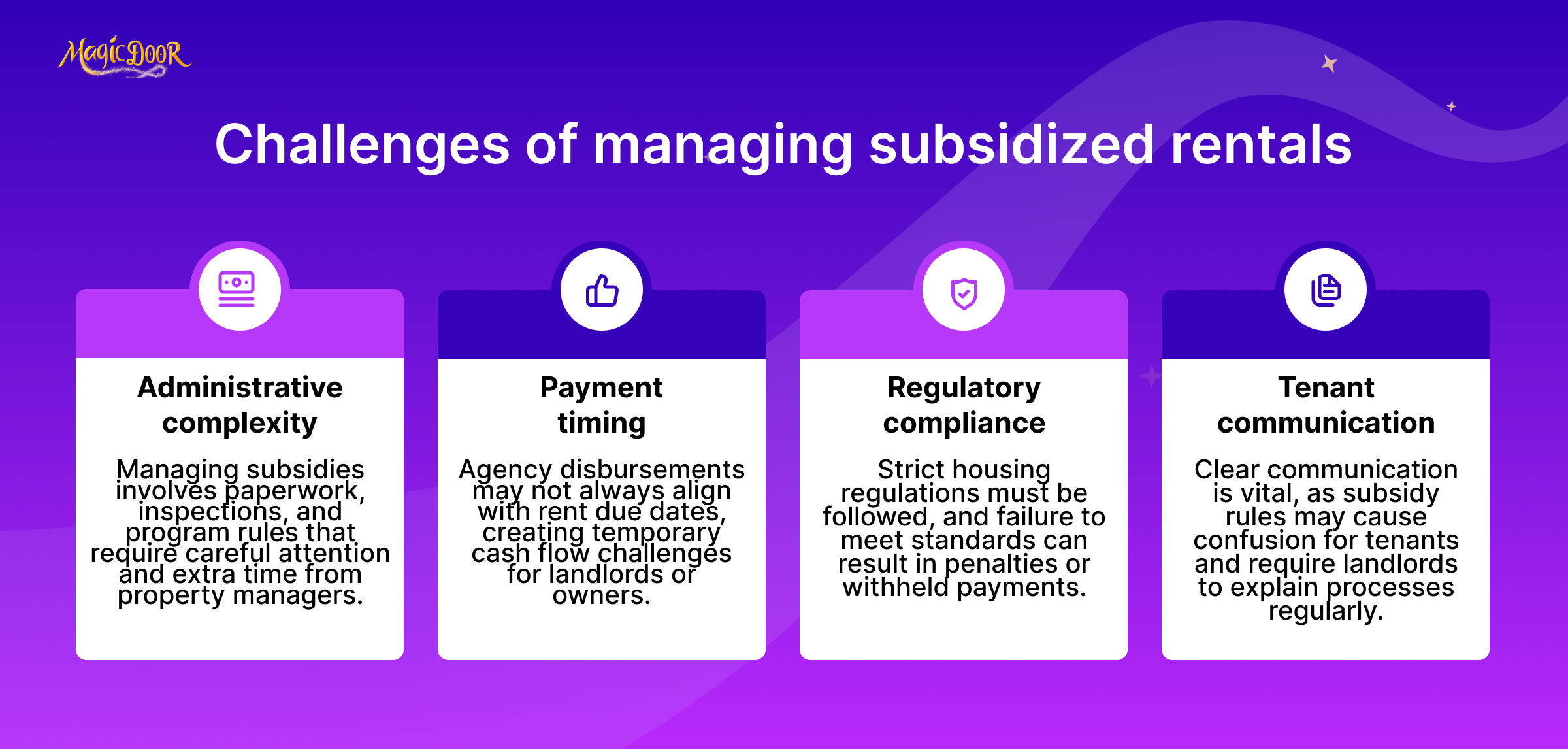

Subsidized rentals can provide stability but also bring extra responsibilities for landlords. These challenges don’t make participation unworkable but require planning and patience.

Some of the most common hurdles include:

- Administrative paperwork: Registering with a housing agency, submitting forms, and renewing contracts takes more time than a private lease.

- Inspections and compliance: Rental units must pass initial and ongoing inspections. Missed rental hosue repairs can delay payments or put landlords at risk of penalties.

- Payment limits: Agencies set a “payment standard” that caps how much rent can be covered. This may fall below market rent in high-demand areas.

- Tenant screening: Voucher holders are still subject to screening, but landlords may have less flexibility in setting criteria due to fair housing protections.

- Delays in processing: Initial payments or contract approvals sometimes move slowly through housing authorities, especially in large cities with high demand.

Managing subsidized housing means balancing financial stability with program requirements.

The trade-off can feel significant for landlords who value predictable rent but dislike bureaucracy. Those who prepare for the process, keep clear records, and stay proactive with maintenance usually see the most success.

Top 8 Tools to Simplify Subsidy Management for Landlords

1. MagicDoor

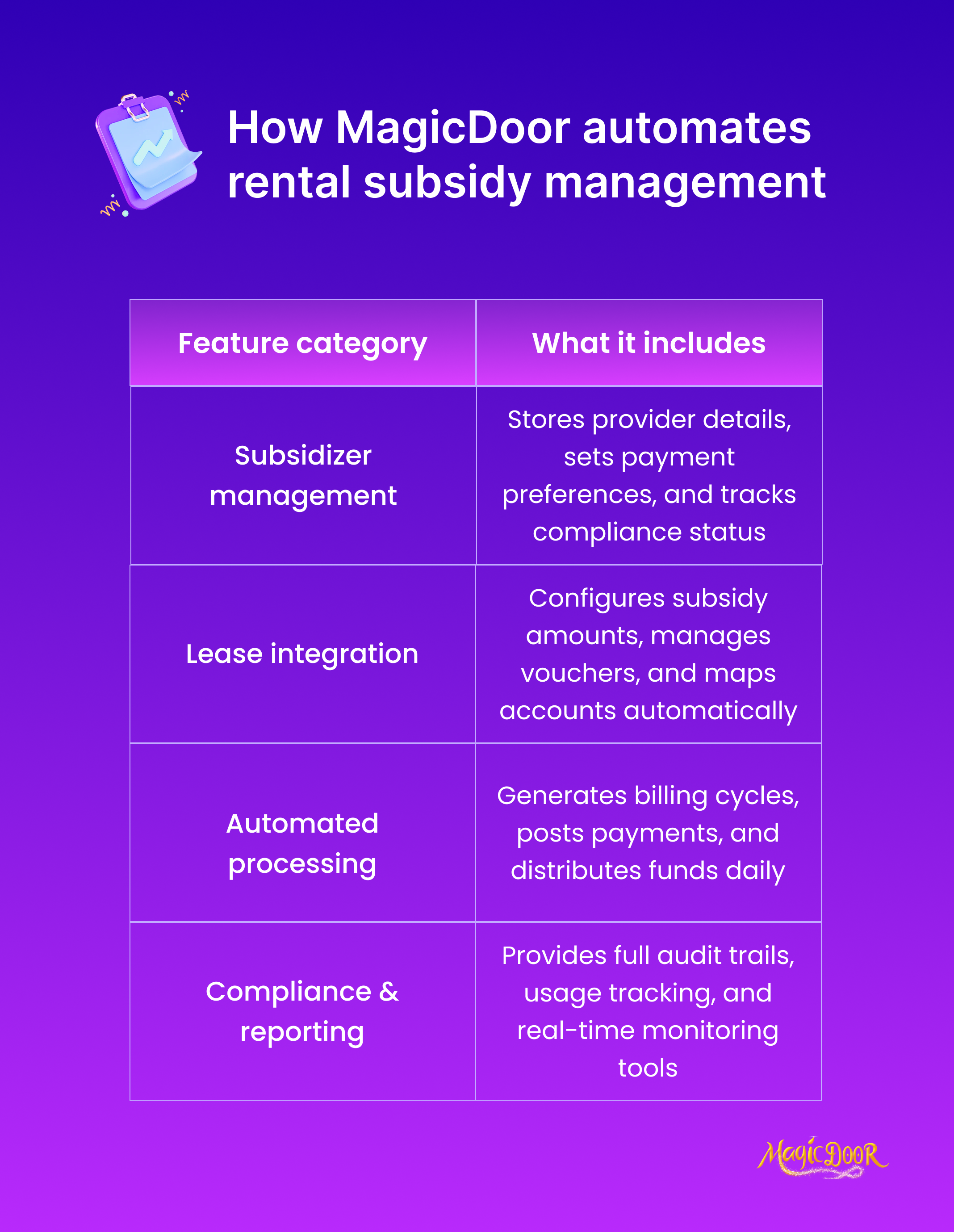

MagicDoor is a property management platform designed to automate the full rental subsidy lifecycle, from setup to compliance. Landlords can manage government, state, nonprofit, or employer-based subsidies in one system without relying on manual spreadsheets.

Features for subsidy management:

- Store provider details (name, type, contact, tax ID)

- Configure payment methods, bank details, and disbursement rules

- Link subsidies directly to leases with amounts, dates, and frequency

- Automate billing, generate subsidy periods, and post payments daily

- Distribute funds to owners with no manual oversight

- Track voucher status (active, paused, ended) in real time

- Access full transaction history and audit trails

- Use dashboards for program monitoring and compliance reporting

Best for: Small to midsize landlords managing Section 8, state/local rental assistance, or nonprofit/employer housing support.

2. Buildium

Buildium is a widely used property management software that supports landlords working with public housing agencies. While broader in scope, it includes tools to simplify subsidy workflows.

Features for subsidy management:

- Track Housing Choice Voucher payments

- Reconcile subsidy income within accounting tools

- Generate financial reports for audits and compliance

Best for: Mid-sized property managers handling a mix of market-rate and subsidized housing units.

3. AppFolio

AppFolio offers an all-in-one real estate management platform with features for landlords managing affordable housing programs. Its automation helps reduce administrative load.

Features for subsidy management:

- Track partial payments from vouchers and tenants

- Centralize lease and compliance documentation

- Use reporting tools to stay audit-ready

Best for: Larger landlords or property management companies balancing affordable housing programs with conventional rentals.

4. Propertyware

Propertyware focuses on single-family portfolios but includes subsidy support for landlords in affordable rental housing. It emphasizes accounting integration and compliance.

Features for subsidy management:

- Record subsidy payments alongside tenant portions

- Automate recurring billing cycles

- Generate custom financial reports for housing assistance programs

Best for: Landlords with single-family or scattered-site properties that require subsidy tracking integrated into property accounting.

5. Yardi Voyager

Yardi Voyager is an enterprise-level property management software used by large housing providers and public housing agencies. It includes strong compliance and reporting tools for affordable housing portfolios.

Features for subsidy management:

- Track Housing Choice Voucher payments alongside tenant rent

- Automate compliance with HUD and LIHTC requirements

- Generate detailed financial and occupancy reports

Best for: Large property management companies or housing authorities managing thousands of subsidized units.

6. ResMan

ResMan is designed for multifamily operators, with built-in support for affordable housing programs. It helps landlords streamline rent collection and compliance.

Features for subsidy management:

- Manage subsidy and tenant portions of rent separately

- Track compliance for programs like Section 8 and LIHTC

- Automate reporting for housing agencies

Best for: Multifamily landlords balancing conventional apartments with subsidized housing programs.

7. RealPage

RealPage offers a suite of property management solutions, including tools focused on compliance for affordable rental housing. It’s widely used by institutional operators.

Features for subsidy management:

- Automate rent splits between agencies and tenants

- Maintain program compliance through built-in reporting

- Track subsidy income and expenses in real time

Best for: Institutional landlords and real estate firms managing large affordable housing portfolios.

8. MRI

MRI Software offers flexible property management solutions with support for affordable and public housing programs. It is widely adopted by housing authorities and large landlords who require strict compliance features.

Features for subsidy management:

- Manage HUD, Section 8, and LIHTC compliance workflows

- Track subsidy rent portions and tenant contributions

- Generate detailed subsidy and audit reports

Best for: Housing agencies and landlords handling complex compliance requirements with multiple subsidy programs in play.

How MagicDoor Helps Manage Rental Subsidies Automatically

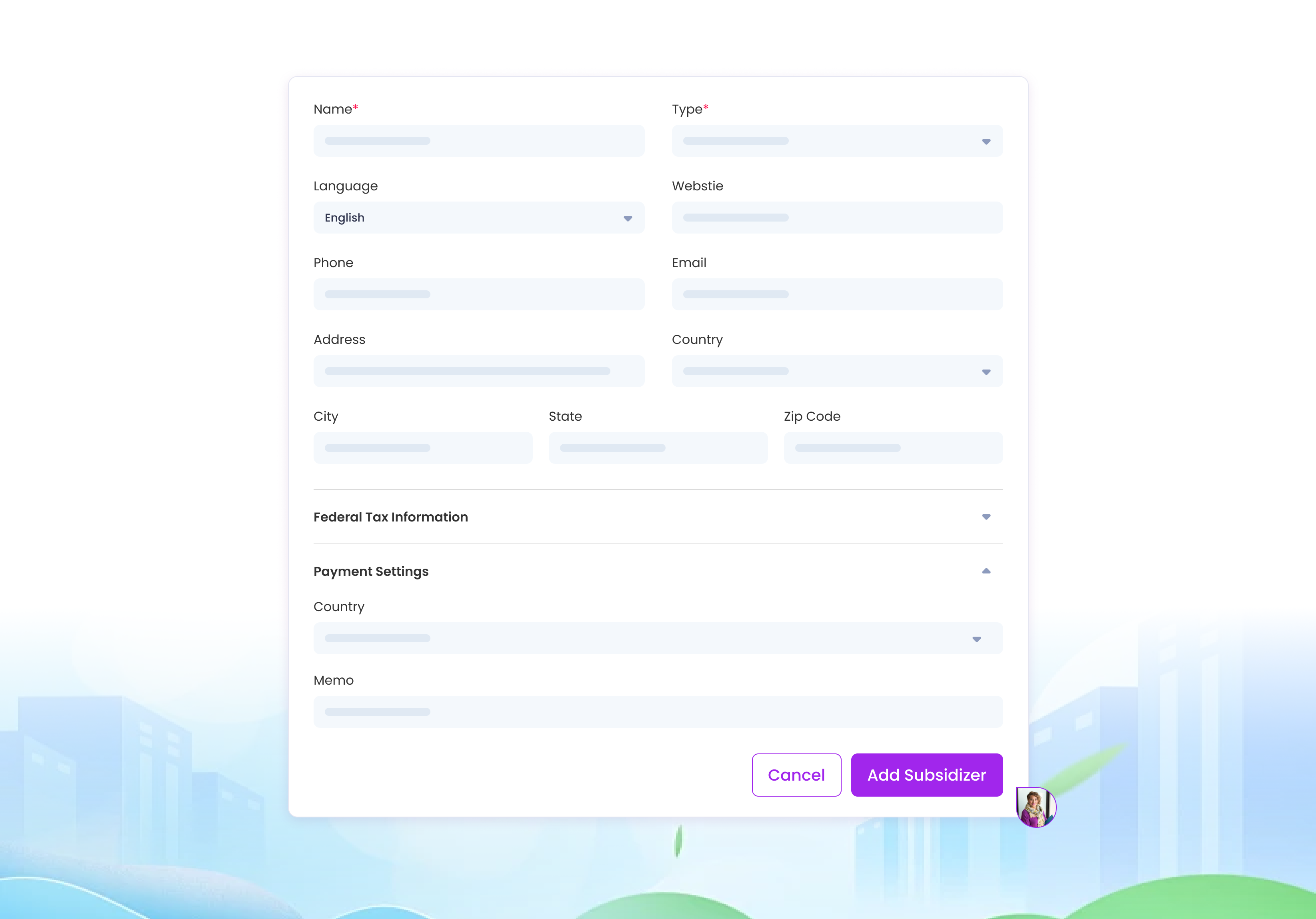

Track Subsidy Providers & Payment Preferences With Subsidizer Management

MagicDoor centralizes every subsidy source landlords work with, whether a federal Housing Choice Voucher, a state program, or a nonprofit provider. The platform keeps provider information organized, including name, contact details, type, and tax ID, so nothing gets lost in spreadsheets.

Beyond basic storage, landlords can:

- Configure payment methods, add bank details, and define disbursement rules

- Track compliance status for each agency or funding source

- Monitor approvals and renewal requirements to avoid interruptions

This makes subsidy management less about chasing paperwork and more about maintaining an accurate, auditable system that ensures rent is paid on time.

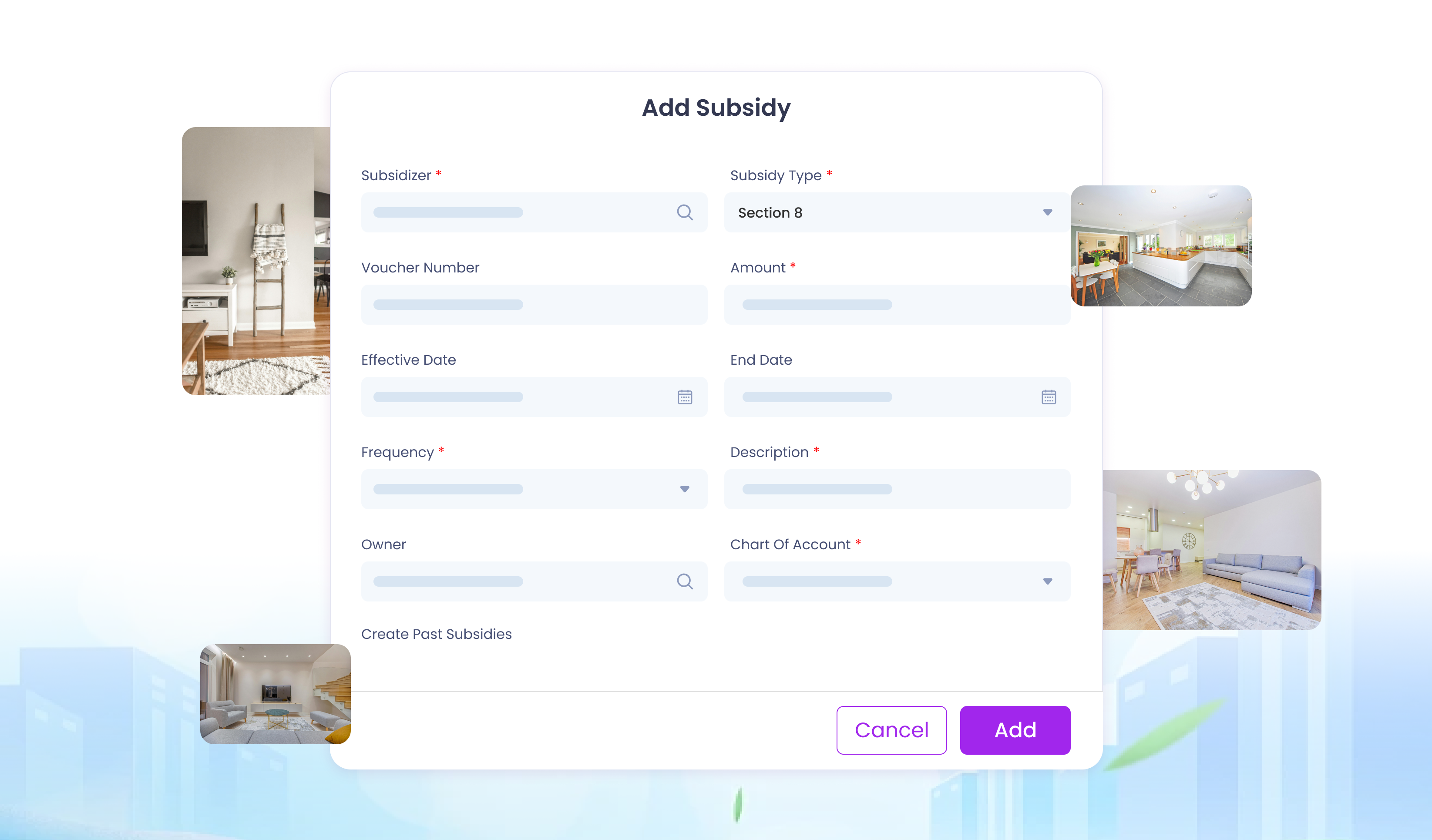

Connect Subsidies Directly to Leases With Full Integration

Managing subsidies separately from lease agreements often creates errors with property management automation.

MagicDoor removes that risk by linking subsidy details directly to each lease. Landlords set subsidy amounts, effective dates, and payment frequency once, and the system automatically tracks everything thereafter.

Integrated features include:

- Voucher tracking with updates when eligibility or amounts change

- Automated chart-of-accounts mapping for accurate property accounting

- Status transitions, active, paused, or ended, applied in real time

With lease integration, landlords don’t have to adjust rent rolls or reconcile mismatched payments manually. MagicDoor ensures subsidy data flows into leases, accounting, and reporting tools, creating a single reliable source of truth.

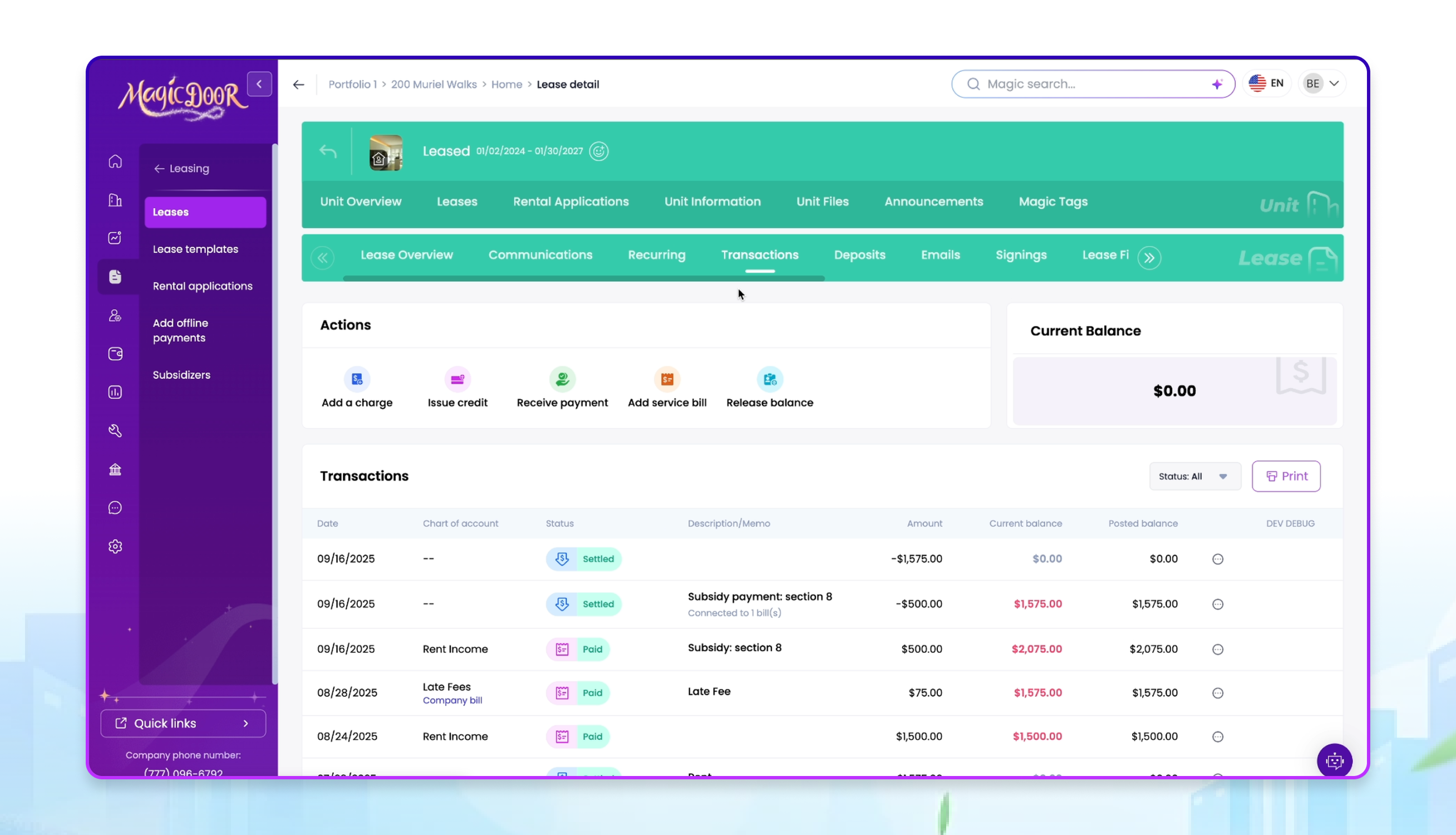

Automate Billing & Payments On the Full Subsidy Lifecycle

MagicDoor eliminates repetitive accounting tasks by turning subsidy management into a hands-off process. Once subsidy periods are set, the system generates bills automatically, posts payments as transactions, and distributes funds to owners without requiring manual entry.

What makes it powerful is the cadence: the workflow runs daily in the background.

Landlords don’t need to chase housing agencies, double-check ledgers, or update spreadsheets. Subsidy payments flow directly into property accounts with consistent accuracy.

Monitor Program Compliance With Built-In Reporting Tools

Compliance is usually the toughest part of working with subsidized housing programs.

MagicDoor simplifies it by giving landlords a complete transaction history for every subsidy, creating an audit trail ready for review at any time.

The reporting suite provides:

- Real-time dashboards that highlight active subsidies and balances

- Usage and payment history broken down by program and tenant, with tenant portal software

- Built-in monitoring tools that make it easier to ensure compliance with housing agency requirements

For landlords, this means fewer surprises during inspections, clearer records for tax reporting, and confidence that every subsidy program is managed according to the rules.

Conclusion

Subsidies can initially feel complicated, yet they’re also one of the most reliable payment sources landlords can accept.

Compliance checks and reporting can become burdensome when handled manually. Automated systems, however, reduce errors and keep everything on track.

- Payments reach landlords faster

- Compliance stays up to date

- Communication with tenants improves

MagicDoor was built to handle this workload. From lease setup to owner payouts, it automates subsidy management so you can focus on running your rentals.